Why is Bitcoin price down today?

Bitcoin price is down today as investors expect the Federal Reserve to raise rates and crypto whales send record amounts of BTC to exchanges.

The bullish momentum that propelled Bitcoin () to a 76% year-to-date gain has all but vanished on July 24 as Bitcoin price briefly fell below $29,000.

The contraction in Bitcoin price has some analysts cautioning that BTC could still in a serious shake-up.

BTC/USD 1-day price. Source:

BTC/USD 1-day price. Source:

Let’s take a closer look at the factors impacting Bitcoin price today.

Related:

Crypto traders turned briefly bullish when the Federal Reserve decided to pause interest rate increases on June 14, but on multiple occasions, Fed chair Jerome Powell has expressed his commitment to reducing inflation by restarting rate hikes if needed.

The next Federal Open Markets Committee (FOMC) concludes on July 26 and the market seems to confidently believe that the Fed will begin increasing interest rates again. CME’s FedWatch shows the overwhelming market belief that such increases are coming at the next FOMC. As of July 24, the probability of interest rate hikes sits at 98.9%.

Target interest rate probabilities. Source: CME Group

Target interest rate probabilities. Source: CME Group

Most major banks still expect the U.S. to experience a sharp recession at some point in 2023.

According to U.S. Bank analysis which incorporates more than 1,000 data points, investor sentiment about the current state of the economy remains low.

Global economic health. Source: U.S. Bank

Global economic health. Source: U.S. Bank

According to U.S. Bank analysis,

Bitcoin’s price drop comes as BTC inflow shows large investors adding funds to centralized exchanges. On July 24, Bitcoin whale exchange inflow hit a of over 40% of total volume.

Bitcoin whale to exchange inflow. Source: Glassnode

Bitcoin whale to exchange inflow. Source: Glassnode

Exchange inflow is one way to monitor whale BTC movement but it does not capture the entire picture when accounting for Bitcoin that moves off exchanges through outflow. Once the inflow is subtracted from the outflow, data can show the total BTC exchange net flow.

Throughout June and July, the whale-to-exchange net flow metric hovered around a positive 4,000 to 6,500 BTC per day.

Bitcoin whale to exchange netflow. Source: Glassnode

Bitcoin whale to exchange netflow. Source: Glassnode

A higher positive net inflow of deposits to centralized exchanges may translate to increased selling pressure, meaning Bitcoin price could drop further.

Despite the recent wave of in Bitcoin, the actions of U.S. regulators is still seen as unknown. While the Securities and Exchange Commission has previously noted Bitcoin is not a security, some market analysts are weighing if the current increase in actions is a renewed attempt for the initiative which aims to restrict access to all digital currencies.

Despite the SEC against Ripple () through a Federal District Judge’s summary judgment ruling on July 13, the agency seems poised to . And while a of U.S. lawmakers like Rep. Richie Torres and Rep. Warren Davidson is calling on the SEC Chairman Gary Gensler to clarify his stance on crypto, Gensler than $2.4 billion to go after “noncompliance”.

Related:

Recently, the U.S. and have released digital asset drafts, but not all crypto associations are pleased with the .

The short-term uncertainty in the crypto market does not appear to have changed institutional investors' long-term outlook. Recently, despite a hostile U.S. regulatory environment, large institutions are pushing for which may spark a bull run.

Bitcoin price continues to be directly impacted by macroeconomic events, and it is also likely that further regulatory actions and interest rate hikes will continue having some effect on BTC price.

In the long term, market participants still expect the price of Bitcoin to recover, especially as more financial institutions are seemingly embracing BTC.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BTC OG Insider Whale Holds $730M Long Across BTC, ETH, and SOL with $41M Unrealized Losses

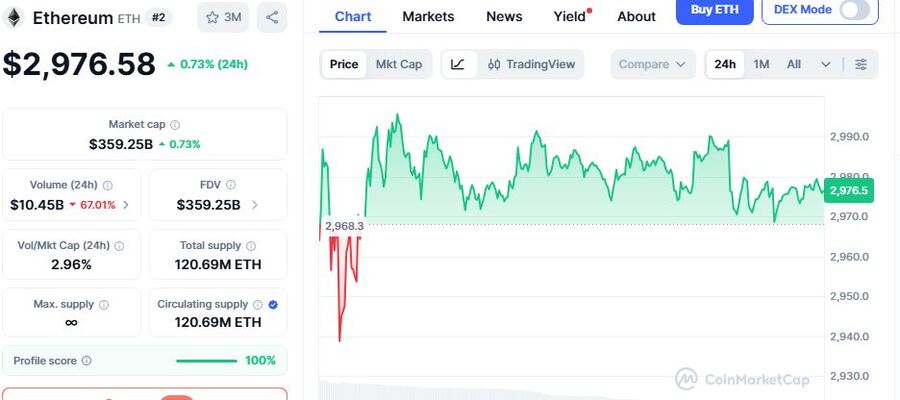

Ethereum New Wallet Addresses on Spike As ETH Consolidates at $2,977, Suggesting Looming Market Momentum

Digital Renminbi Fraud Traps: How Scammers Push Wallet Schemes and How to Protect Your Funds