It’s OK to Think of Crypto as a Macro Market

If you have a long view, crypto markets are more influenced by macro forces than things like regulatory moves or on-chain activity.

markets are macro markets.

Despite this assertion, I find that many digital asset investors get lost in this nascent market’s minutia. I’m not discounting the , , or challenges unique to the new market, let alone the high volatility of the asset class and 24/7 market hours. These are essential issues to consider when committing client capital. However, many analysts appear to place more emphasis on cryptography details, TVL (“total value locked”) and on-chain activity rather than spending time studying the broader macro environment.

This bottoms-up approach may stem from the early days of crypto markets when there were limited correlations with traditional asset classes. However, with the total market capitalization of digital assets averaging above $1 trillion over the past two years, evaluating the macro backdrop is becoming unavoidable.

You're reading , CoinDesk’s weekly newsletter that unpacks digital assets for financial advisors. to get it every Thursday.

Last year’s market performance made this clear. Digital assets like bitcoin () and ether () suffered when the Federal Reserve raised interest rates in response to economic conditions.

To demonstrate the efficacy of macro signals in navigating digital asset markets, I constructed a composite basket of macro indicators. I began by selecting some typical macro market rates, specifically front-end interest rates, inflation-adjusted interest rates (“real yields”), U.S. dollar exchange rate baskets, and U.S. corporate credit spreads. It’s worth mentioning that these rates are typically used within broader indices that are widely watched.

To form a forward-looking perspective on this selected macro data, I generated moving-average trend signals, which served as the foundation for the macroeconomic view. I then assigned positive or negative values to the changes in these markets that result in the relaxing of financial conditions. Lowering nominal and real interest rates, weakening of the U.S. dollar, and tightening of corporate credit spreads were all classified as easing of financial conditions, and expected to have a positive impact on digital assets. Likewise, rising nominal/real interest rates, a strengthening dollar, and widening of corporate credit spreads were classified as tightening of financial conditions, likely leading to a negative impact.

With a newly constructed macro indicator data series in hand, I conducted a hypothetical backtest to assess the usefulness of a macro signal in dynamically allocating to cryptocurrencies. Bitcoin was chosen as a proxy for crypto assets due to its status as the oldest and consistently largest token in the market by market cap, and I used the as a glo bal price for bitcoin.

I combined the macro signal (ranging from -1 to +1) with a 50% allocation to bitcoin to create a long-only dynamic strategy, with the Bitcoin weight varying from 0 to 100%. The remainder of the simulated portfolio is placed into a short-term cash ETF.

Over the five years of the hypothetical backtest period, it’s clear that keeping an eye on macroeconomic conditions can help reduce risk and improve risk-adjusted performance versus a buy-and-hold bitcoin approach.

This is particularly pronounced during crypto bear markets (“winters”) such as 2018 and 2022, where all three components of the macro trend signal minimized crypto allocations during tightening financial conditions. Both credit and foreign exchange (FX) market signals were also able to navigate through the COVID market drawdown. In contrast, the real yields signal was more reactive to reduce crypto exposure during 2022, highlighting the benefit of a diversified combined macro signal.

While there is always some benefit of hindsight baked into any backtest, it’s apparent that digital asset investors can gain from incorporating macro insights derived from more traditional asset classes to aid in navigating a market as cyclical as cryptocurrency.

Edited by Pete Pachal.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BTC OG Insider Whale Holds $730M Long Across BTC, ETH, and SOL with $41M Unrealized Losses

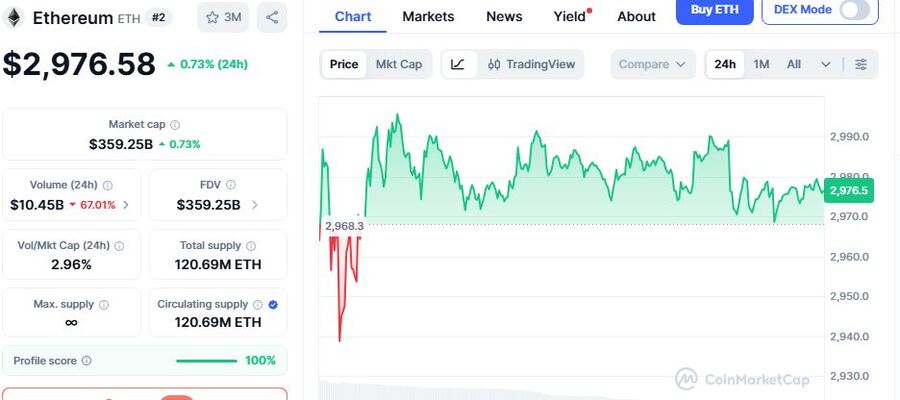

Ethereum New Wallet Addresses on Spike As ETH Consolidates at $2,977, Suggesting Looming Market Momentum

Digital Renminbi Fraud Traps: How Scammers Push Wallet Schemes and How to Protect Your Funds