Bitcoin Tumbles on Report of SEC Saying Spot BTC ETF Filings Inadequate

Spot bitcoin ETF applications from BlackRock and Fidelity, among others, had helped drive bitcoin higher over the past two weeks.

The U.S. Securities and Exchange Commission (ETF) said recent filings to launch a spot bitcoin ETF are inadequate, Friday morning, citing sources close to the matter.

The news sent the price of bitcoin () plunging by $1,000, or more than 3%, in the space of a few minutes. At press time, bitcoin was trading just above $30,000.

According to the story, the SEC has informed Nasdaq and CBOE – the exchanges that filed the spot ETF paperwork for several of the asset managers, including BlackRock (BLK) and Fidelity – that the applications aren’t sufficiently clear and comprehensive.

At issue, the story continued, is that the filings didn't have enough detail with respect to the “surveillance-sharing agreements," including which spot bitcoin exchange would be used. The asset managers can update their applications and refile, and the CBOE indicated to the WSJ and to CoinDesk that it plans to do so.

The SEC said in that the sponsor of a bitcoin trust would have to enter a surveillance-sharing agreement with a regulated market of significant size.

A market of significant size is one where anyone trying to manipulate the price of an exchange-traded product has to trade on the same market the exchange-traded product (ETP) is based on, meaning the agreement would let the sponsor and the trading platform identify any wannabe market manipulators.

At present, no federal regulator has oversight of spot bitcoin markets, a state of affairs the Commodity Futures Trading Commission has lobbied to change for years.

"We would decline to comment on the possibility of individual filings," an SEC spokesperson told CoinDesk.

BlackRock's spot ETF filing in mid-June for a strong run higher in the price of bitcoin since, sending the crypto from below $26,000 to one-year highs above $31,000. The BlackRock application also set off a host of filings from several other asset managers, including fellow asset management giants Invesco (IVZ) and Fidelity, both of which refiled for approval of their previously rejected spot bitcoin ETFs.

BlackRock, Fidelity, and Galaxy (who filed in conjunction with Invesco) spokespeople all declined to comment to CoinDesk.

Updated (15:02 UTC, June 30, 2023): Adds additional context.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin price prediction as ETFs see $175m in outflows: Will BTC crash to $80k?

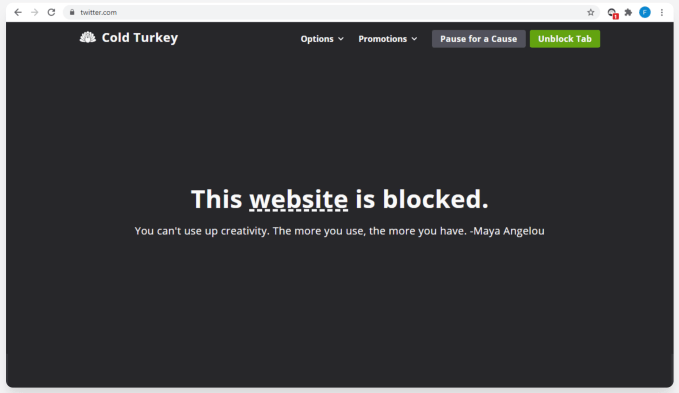

The best distraction blockers to jumpstart your focus in the new year