Date: Tue, Dec 23, 2025 | 03:46 PM GMT

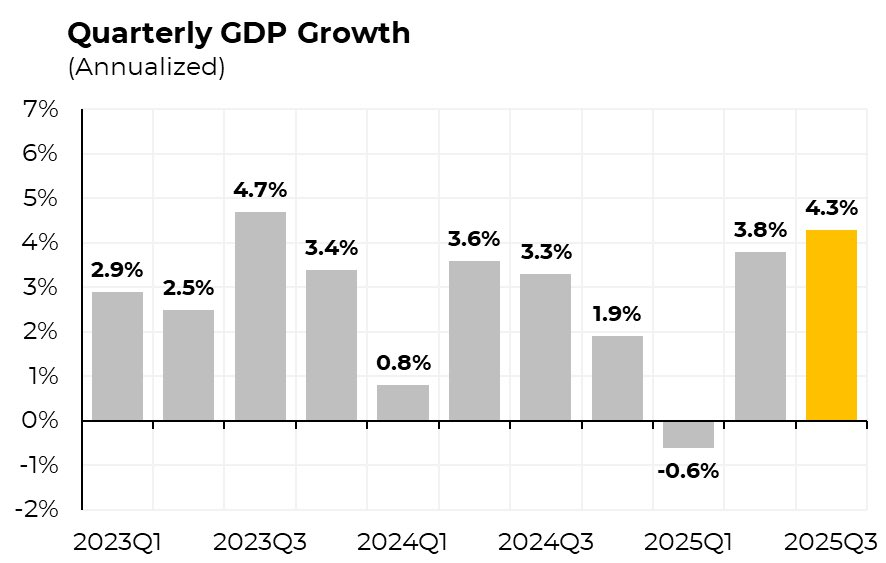

The US economy delivered a strong upside surprise in the third quarter. On December 23, 2025, the Bureau of Economic Analysis released its initial estimate for Q3 GDP, reporting an annualized growth rate of 4.3%, significantly above market expectations of approximately 3.3% and marking the fastest pace of expansion in nearly two years.

US Q3 GDP/Credits: @Geiger_Capital (X)

US Q3 GDP/Credits: @Geiger_Capital (X) The strength was broad-based. Consumer spending accelerated, exports increased sharply, and overall economic activity demonstrated notable resilience despite elevated interest rates. The data eases lingering recession concerns and underscores an economy that continues to perform well under tighter financial conditions.

Short-Term Implications for Bitcoin: A Familiar Volatility Pattern

Historically, stronger-than-expected GDP data has tended to introduce short-term volatility in risk assets, including Bitcoin. Robust growth often revives concerns that the Federal Reserve may maintain restrictive monetary policy for longer to mitigate inflation risks, creating near-term pressure on speculative assets.

Market history reflects this pattern clearly. Previous GDP upside surprises have frequently coincided with brief Bitcoin pullbacks in the 4%–6% range. However, these declines have typically been short-lived, with buyers stepping in quickly and price action ultimately resolving higher.

BTC Chart/Credits: @BullTheoryio (X)

BTC Chart/Credits: @BullTheoryio (X) Following the Q3 GDP release, Bitcoin is trading near $87,000, modestly lower than earlier highs around $89,000. If historical behavior holds, near-term consolidation or a mild correction may occur, but such moves have often served as entry opportunities rather than trend reversals.

Medium- to Long-Term Outlook: Constructive for Crypto Markets

From a broader perspective, sustained economic strength is generally supportive of risk assets, including digital assets. A resilient economy bolsters investor confidence, encourages capital deployment, and supports liquidity conditions that tend to favor higher-beta segments of the market.

One important indicator to monitor is the ISM Manufacturing PMI, which currently remains in contractionary territory near 48. Continued strong GDP growth could help lift manufacturing activity back into expansion above 50, and ideally toward the 55+ range. Historically, periods of manufacturing expansion have aligned with some of the most powerful crypto market cycles, including the major altcoin rallies of 2017 and 2021.

Improving macroeconomic momentum typically translates into greater risk tolerance across financial markets, benefiting equities and digital assets alike.

Bottom Line

The unexpected 4.3% GDP growth reading represents a meaningful positive signal for the US economy heading into 2026. For Bitcoin and crypto investors, the immediate response may involve short-term volatility or consolidation. However, if economic momentum persists and manufacturing activity strengthens, the medium- to long-term outlook remains constructive.

In an environment of durable growth and improving confidence, risk assets — including cryptocurrencies — have historically performed well. While close attention to macro data remains essential, the broader backdrop increasingly resembles one that can support the next phase of market expansion.