Crypto ETF Weekly Report | Last week, US Bitcoin spot ETFs saw a net outflow of $497 million; US Ethereum spot ETFs saw a net outflow of $643 million

Compiled by: Jerry, ChainCatcher

Performance of Crypto Spot ETFs Last Week

US Bitcoin Spot ETFs Net Outflow of $497 Million

Last week, US Bitcoin spot ETFs had four consecutive days of net outflows, with a total net outflow of $497 million, and total net assets reached $114.87 billion.

Last week, six ETFs experienced net outflows, while inflows mainly came from BITB, IBIT, and ARKB, with inflows of $115 million, $106 million, and $100 million, respectively.

Data source: Farside Investors

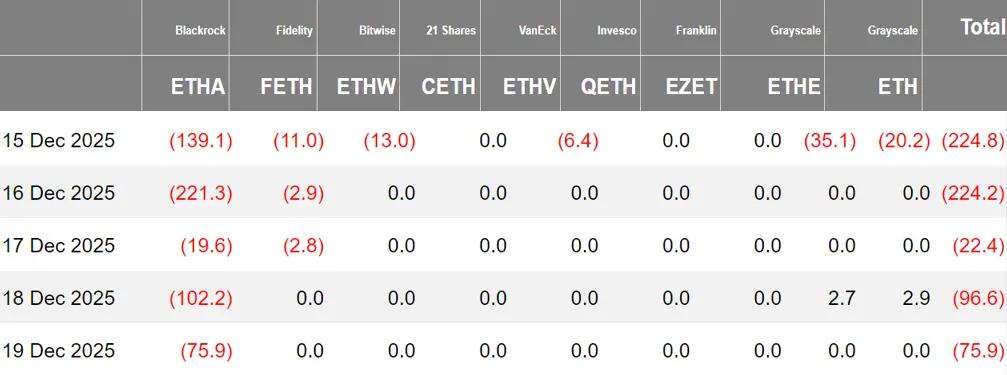

US Ethereum Spot ETFs Net Outflow of $643 Million

Last week, US Ethereum spot ETFs had three days of net inflows, with a total net outflow of $643 million,and total net assets reached $18.21 billion.

Last week's outflows mainly came from BlackRock ETHA, with a net inflow of $558 million. Six Ethereum spot ETFs were in a net outflow state.

Data source: Farside Investors

Hong Kong Bitcoin Spot ETFs Net Outflow of 8.98 Bitcoins

Last week, Hong Kong Bitcoin spot ETFs saw a net outflow of 8.98 Bitcoins, with net assets reaching $336 million. Among them, the holdings of the issuer Harvest Bitcoin dropped to 291.25 Bitcoins, while ChinaAMC increased to 2,410 Bitcoins.

Hong Kong Ethereum spot ETFs had no capital inflow, with net assets of $95.61 million.

Data source: SoSoValue

Crypto Spot ETF Options Performance

As of December 19, the notional total trading volume of US Bitcoin spot ETF options was $987 million, with a notional total long-short ratio of 1.37.

As of December 18, the notional total open interest of US Bitcoin spot ETF options reached $32.51 billion, with a notional total long-short ratio of 1.85.

In the short term, trading activity for Bitcoin spot ETF options has declined, but overall sentiment remains bullish.

Additionally, implied volatility is at 47.28%.

Data source: SoSoValue

Overview of Crypto ETF Developments Last Week

VanEck Submits Amended Filing for AVAX Spot ETF to US SEC

According to Cryptopolitan,VanEck has submitted an amended filing for a spot AVAX (Avalanche) ETF to the US Securities and Exchange Commission (SEC). The ETF plans to trade under the ticker VAVX.

Bitwise Has Submitted Sui ETF Registration Documents

According to disclosure documents from the US Securities and Exchange Commission (SEC), Bitwise Asset Management's Bitwise Sui ETF has officially submitted a Form S-1 registration statement, file number 0001213900-25-123107, and was received by the SEC on the same day.

The S-1 was submitted by Bitwise Sui ETF as the declarant and includes the registration statement, trust agreement, trust certificate, and 16 other related documents. The declarant is registered in Delaware, with offices in San Francisco, USA. This submission marks the official start of Bitwise's compliance registration process for the Sui-related ETF, and further approval from the SEC is still pending.

Canary Capital Submits Amended S-1 Filing for Staked INJ ETF to US SEC

According to CoinGape, Canary Capital has submitted an amended S-1 filing for a staked INJ exchange-traded fund (ETF) to the US Securities and Exchange Commission (SEC).

The trust fund plans to list on the Cboe exchange, providing investors with spot price exposure to Injective as well as additional returns from staking programs. According to the application, U.S. Bancorp Fund Services will serve as transfer agent and cash custodian, while BitGo Trust Company has been selected as the custodian.

The Hong Kong Securities and Futures Commission (SFC) released its Q3 2025 report, which disclosed that the total market cap of virtual asset spot ETFs in Q3 reached $920 million, up 217% since launch. The AUM of five tokenized money market funds reached HKD 5.387 billion (about $692 million), a 391% increase from the previous quarter.

Additionally, the Hong Kong SFC stated it has confirmed that the stamp duty exemption for ETF transfers applies to tokenized ETFs, aiming to promote secondary market trading of tokenized ETFs and further expand market access for tokenized fixed income and money products. The SFC has issued licenses to 11 virtual asset trading platforms and is reviewing license applications from 8 other virtual asset trading platform applicants.

According to businesswire, the New York Stock Exchange released its 2025 business highlights, revealing that it hosted seven of the year's top ten IPOs and pioneered access to the cryptocurrency market.

This year, the NYSE listed Circle Internet Group, Inc. (NYSE: CRCL), Bullish (NYSE: BLSH), and Twenty One Capital, Inc. (NYSE: XXI), as well as 25 digital asset ETFs, including: Grayscale CoinDesk Crypto 5 ETF (NYSE Arca: GDLC), Bitwise Solana Staking ETF (NYSE Arca: BSOL), Franklin XRP ETF (NYSE Arca: XRPZ), and others. It has now become the preferred platform for US crypto ETF trading.

In addition, the first closed-end crypto fund listed on a US exchange, the C1 Fund, also chose the NYSE.

Bitwise Submits Amended Filing for Its Hyperliquid ETF, May Be Listed Soon

Bloomberg ETF analyst Eric Balchunas posted on social media that Bitwise has just submitted an amended filing for its Hyperliquid ETF, adding Section 8(a), a fee rate (0.67%), and the stock ticker (BHYP).

Typically, this signals that the product is about to be listed.

Views and Analysis on Crypto ETFs

Bitwise CIO: Crypto ETF Inflows Expected to Hit Record High Next Year

According to Decrypt, Bitwise Chief Investment Officer Matt Hougan said the development trajectory of crypto ETFs is "extremely optimistic," with some large brokerages entering the market. He expects 2026 to be a record year for crypto ETF inflows.

In addition, the recent crypto market downturn is mainly due to "investors anticipating the arrival of the four-year cycle and choosing to sell" and the impact of the "1011 market crash." Once these negative factors dissipate, the market is expected to rebound. As tokenization and institutional adoption become the main drivers of price, the crypto market will gradually mature based on its own fundamentals.

Opinion: Hundreds of Crypto ETFs to Be Listed, 85% of Assets Custodied by Coinbase Raises Concerns

According to Cryptoslate, the US SEC approved general listing standards for crypto ETPs in September last year, shortening the product launch time to 75 days. Bitwise predicts that over 100 crypto ETFs will be launched in 2026, but Bloomberg senior analyst James Seyffart warns that a wave of liquidations is likely.

The biggest risk lies in highly concentrated custody: Coinbase holds the vast majority of crypto ETF assets, claiming an 85% share of global Bitcoin ETF assets, posing a single point of failure risk. In addition, authorized participants (APs) rely on a few platforms for pricing and borrowing, and altcoins are difficult to hedge due to a lack of derivatives depth.

Mainstream ETFs for Bitcoin, Ethereum, Solana, and other major coins will strengthen their dominance, but small funds face pressures such as liquidity shortages, persistent premiums/discounts, and fee wars. Analysts predict the first wave of liquidations will occur from late 2026 to early 2027, with high-fee, homogeneous products and niche index funds with assets under $50 million being the most vulnerable. The general standards solve the approval timeliness issue but do not address the liquidity dilemma.

Bitwise CEO: Number of Bitcoins to Be Purchased by Bitcoin ETFs May Exceed Annual Mining Supply

Crypto KOL Pete Rizzo posted that Bitwise CEO Matt Hougan said in an interview video that the number of Bitcoins to be purchased by Bitcoin ETFs, which have a scale of $15 billion, will soon exceed the annual mining supply.