If history is any guide, the crypto market may be staring at a major bearish catalyst. The Bank of Japan (BOJ) has officially hiked interest rates by 75 bps, making it its largest increase in over 30 years.

As AMBCrypto noted, BOJ rate hikes have historically led to double-digit drawdowns in Bitcoin [BTC], as rising leverage costs push foreign investors to de-risk and unwind BTC positions, fueling short-term FUD.

So far, this cycle is playing out similarly. An analyst flagged a major BTC dump ahead of the BOJ meeting. Notably, the selling came from large players, totaling 24k BTC. That’s over $2 billion in selling pressure.

The on-chain data reflects it too.

Notably, Bitcoin’s key metrics are still in the red, showing real-time losses being realized. In particular, STHs with a cost basis near $101k are now roughly 16% underwater, reinforcing ongoing capitulation pressure.

Against this setup, the recent BOJ rate hike stacks a major macro headwind.

In this context, both historical patterns and on-chain signals suggest that investors are actively reshuffling, anticipating a potential repeat flush. Naturally, the question arises: Is Bitcoin’s break below $80k imminent?

Bitcoin liquidation frenzy flips into structural support

Q4 is shaping up as a cycle defined by mass crypto manipulation.

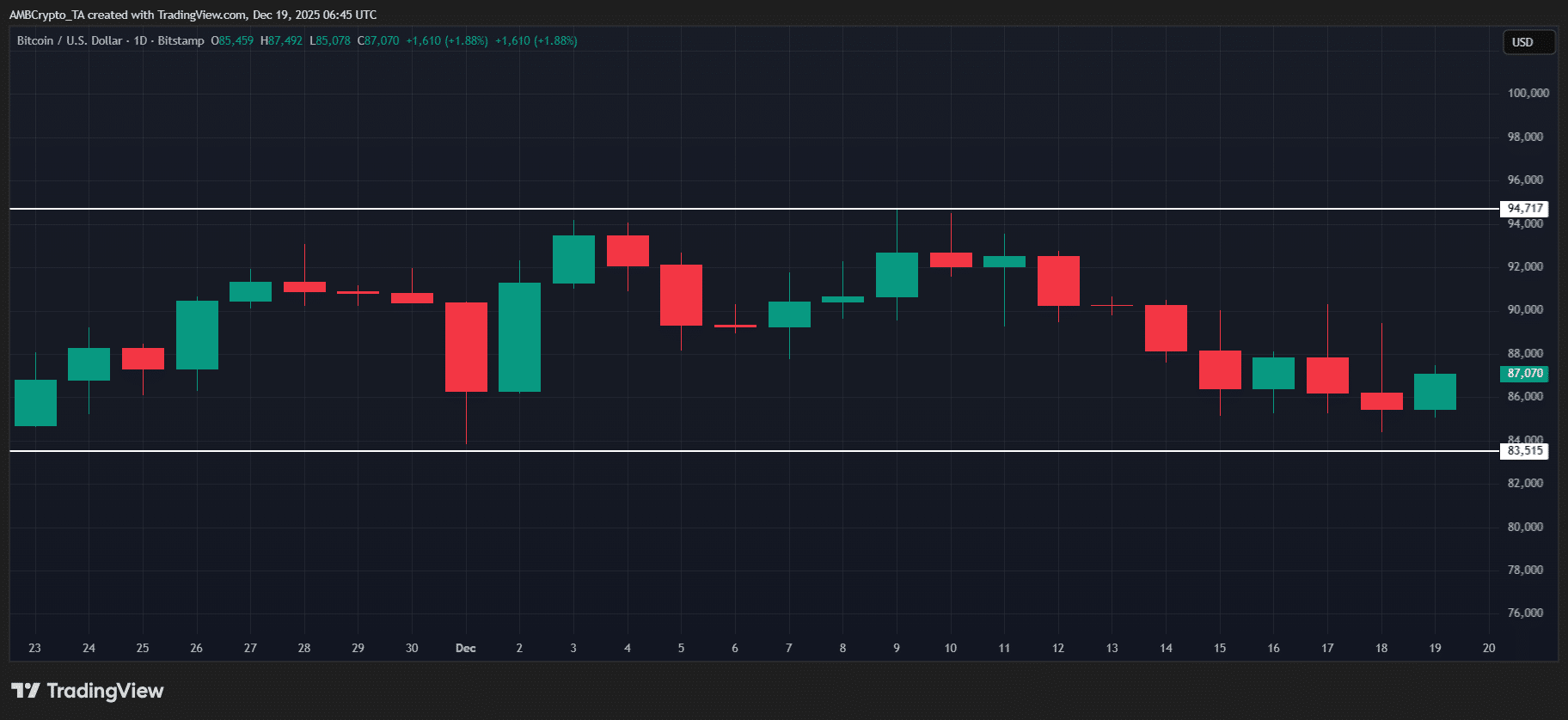

On shorter timeframes, Bitcoin has been extremely volatile, largely due to whale-driven liquidations. For instance, on the 30-minute chart on the 18th of December, BTC fell by $3k, wiping out about $140 million in longs.

The same trend shows up on the macro level. Long liquidations are running 2–3x higher than shorts, trapping BTC in a loop around $90k. In short, whales are “deliberately” preventing the market from running too hot.

This shows up clearly in the data.

At press time, Bitcoin’s Open Interest (OI) is still about 30% below the highly leveraged levels seen before the October crash, indicating that traders are staying cautious rather than chasing risky, short-term gains.

With that in mind, a similar breakdown (despite BOJ-related FUD) looks less likely. Once the fear fades and investors rebalance, the $85k level could instead act as a strong base for Bitcoin’s next move.

Final Thoughts

- BOJ’s 75 bps rate hike triggers Bitcoin deleveraging, reviving fears of a sub-$80k flush.

- Despite liquidation volatility, low leverage, and falling OI suggest $85k could form a strong BTC base.