Heading into 2026, the market looks to be setting up a clear divergence.

On one side, the tone is still risk-off. Bitcoin [BTC] hasn’t reclaimed levels since the October crash, dropping the share of supply in profit from 98% before the sell-off to around 63% now. That’s a real squeeze on margins.

The result? BTC’s NUPL is deep into net-loss territory. From a technical standpoint, this looks like a classic capitulation setup. However, a key market divergence suggests this phase may not be bearish after all.

Mining shutdown and LTH sales explain Bitcoin’s weakness

Bitcoin’s supply dynamics are seeing a quiet but significant shakeout.

Notably, most of the pressure is coming from China, which has once again tightened mining restrictions. Specifically, the Xinjiang crackdown has shut down roughly 1.3 GW of mining capacity, taking 400,000 rigs offline.

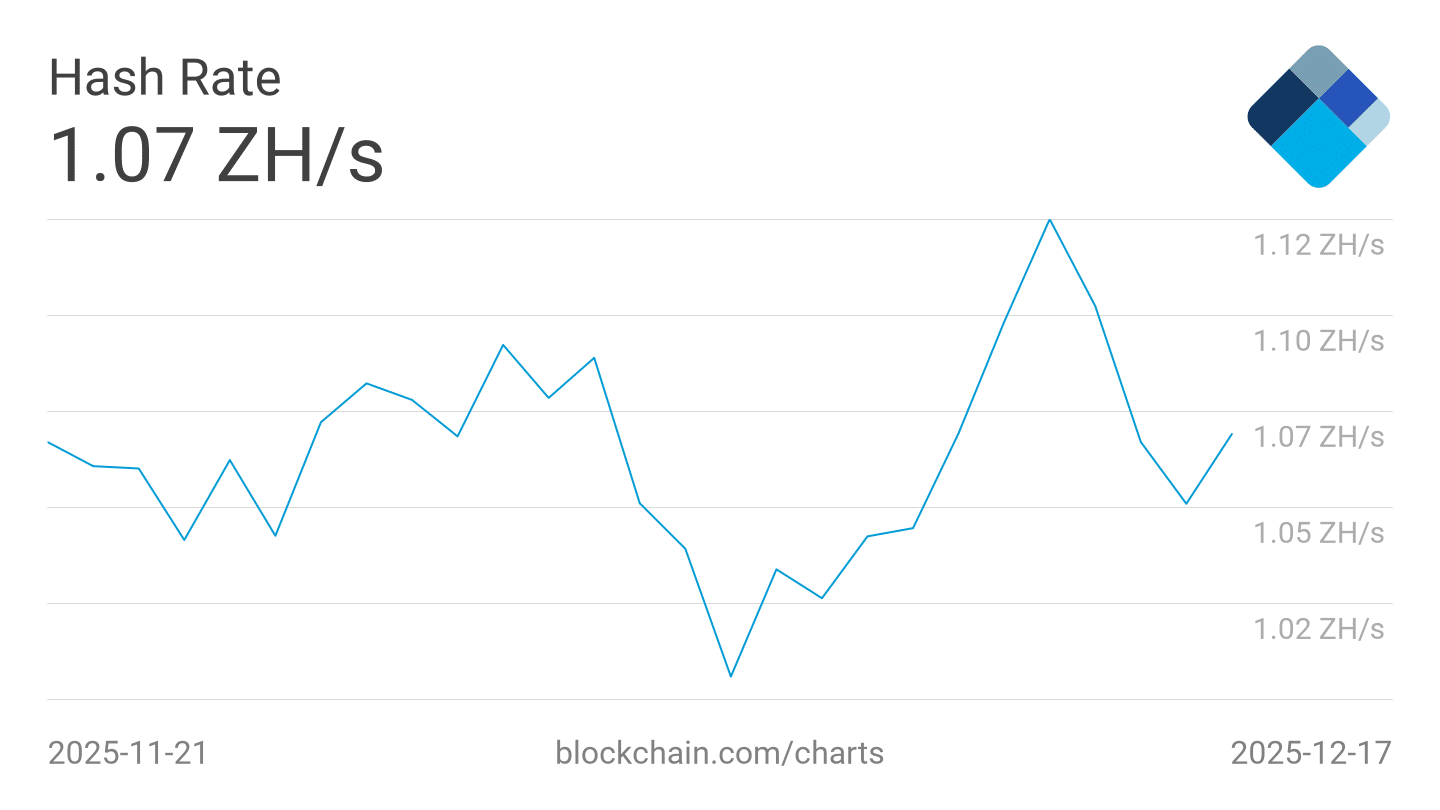

Simply put, BTC miners are at risk as a large chunk of Bitcoin mining in China has been forced offline. The result? Bitcoin’s hashrate has dropped about 8%, making the network temporarily less secure against attacks.

As the chart shows, Bitcoin’s hashrate fell from 1.12 billion TH/s to 1.07 billion TH/s in less than a week. With China controlling around 14% of total hashpower, this highlights how regional moves are adding selling pressure.

On-chain data supports this trend. Asian exchanges have shown consistent net spot selling throughout Q4. At the same time, long‑term holders (LTHs) are also reducing positions, with selling activity rising over the past month or two.

In short, Bitcoin is facing Asia‑driven pressure. Meanwhile, U.S. BTC spot ETFs just recorded their largest single-day inflow in over a month. This divergence could play a decisive role in shaping Bitcoin’s trajectory as 2026 approaches.

Forced, not panic selling, could shape BTC’s 2026 move

Bitcoin’s outlook for 2026 is being defined by a subtle shift in supply dynamics.

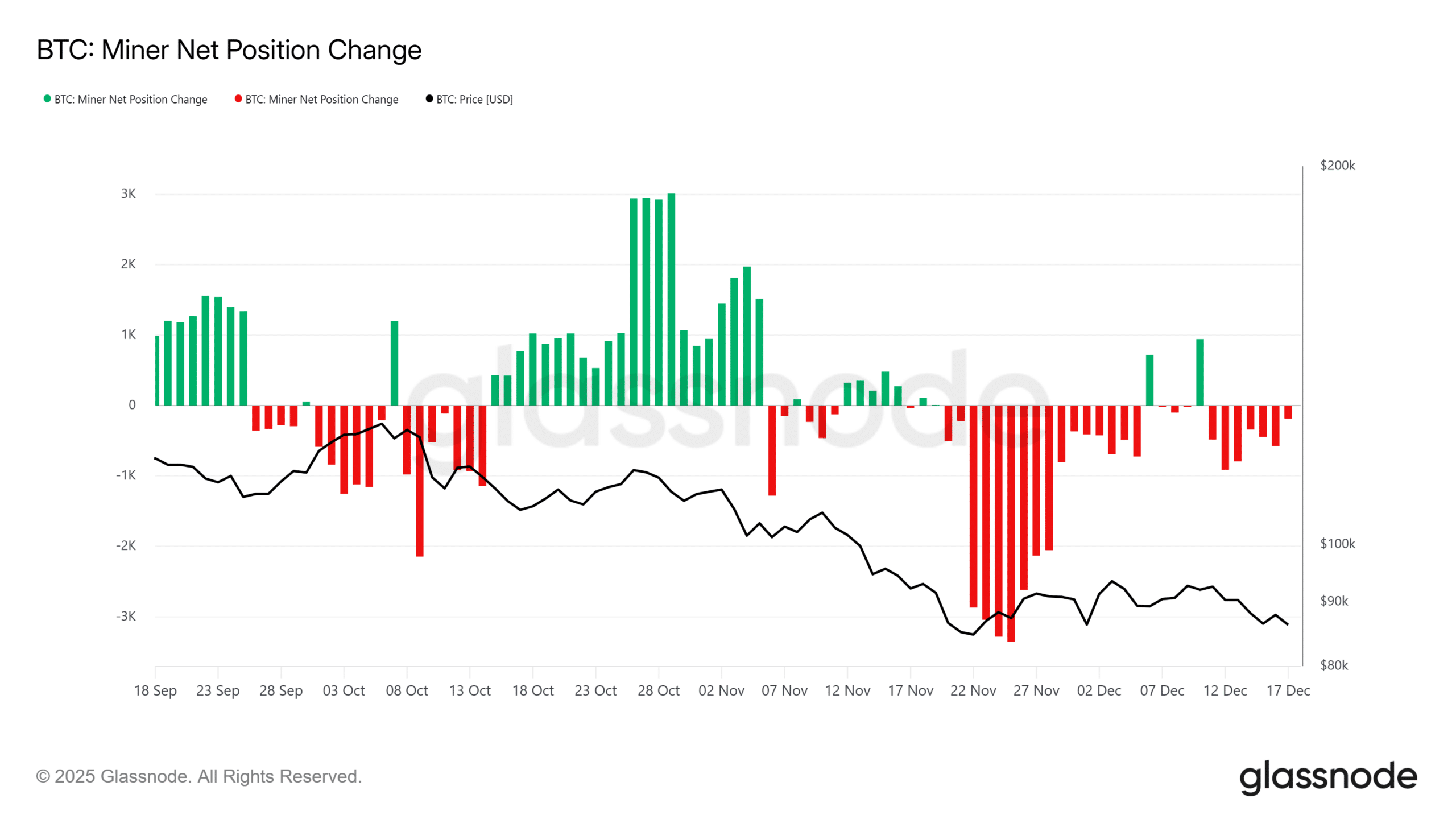

As macro volatility picks up and renewed China mining pressure builds, different BTC cohorts are being pushed into selling just to manage losses. Miners are a clear part of this, with miner net position change flipping red.

In other words, with hashrate down around 8%, miner margins are getting squeezed, making continued selling more likely. That keeps Bitcoin’s short-term momentum capped, limiting its Q4 tailwind.

That said, this looks more like forced selling than panic.

BTC ETFs just pulled in $457 million in a single day, showing institutions are still buying. Big players haven’t tapped out yet, which makes the pullback feel more like a healthy reset than a fear-driven capitulation.

Notably, this divergence could define Bitcoin’s setup heading into 2026.

Final Thoughts

- Asia-led forced selling is weighing on BTC short-term, driven by China’s mining shutdowns, falling hashrate, and long-term holder distribution.

- Institutional demand remains intact, with strong U.S. spot ETF inflows creating a divergence that could shape Bitcoin’s setup heading into 2026.