Don't be fooled by the rebound! Bitcoin could retest the lows at any time | Special Analysis

Market analyst Conaldo holds a Master's degree in Financial Statistics from Columbia University, USA. Since his university years, he has focused on quantitative trading in US stocks and gradually expanded into digital assets such as bitcoin. Through practical experience, he has built a systematic quantitative trading model and risk control system; he possesses keen data insight into market volatility and is committed to deepening his expertise in professional trading, pursuing steady returns. Every week, he will delve into changes in BTC technology, macro, and capital flows, review and showcase practical strategies, and preview major upcoming events worth attention for reference.

Core Summary of the Weekly Trading Report: Last week's trades were executed strictly according to the established strategy, successfully completing two short-term trades and achieving a cumulative return of 6.93%. The following will review in detail the market forecast, strategy execution, and specific trading process.

I. Review of Bitcoin Market Last Week (12.01~12.07)

1. Review of last week's core views and trading strategies:

In last week's journal, I clearly stated: using $89,000 as the dividing line between bullish and bearish, and formulated corresponding trading strategies accordingly. The specific content is reviewed as follows:

①, Review of market trend prediction: $89,000 was regarded as a short-term key watershed. If it could be effectively supported, the price was expected to rebound upwards; if it was effectively broken, a downward bottom-seeking trend would begin.

Core resistance levels:

- First resistance zone: $94,000~$96,500

- Second resistance zone: $98,500~$100,000

Core support levels:

- First support: around $89,000

- Second support: $85,500~$88,000 area

- Important support: around $80,500

②, Review of trading strategies:

- Medium-term strategy: Maintain about 65% of medium-term short positions.

- Short-term strategy: All short-term trades use the $89,000 level as the final decision basis, with two contingency plans:

- Plan A: If $89,000 support is effective, when the price rebounds to the $94,000-96,500 range and shows resistance signals, establish an initial 10% short position, with a stop loss above $100,000. If the rebound continues to around $98,500 and encounters resistance again, add another 20% short position, with a unified stop loss above $100,000.

- Plan B: If the price effectively breaks below $89,000, directly establish a 20% short position, with a stop loss around $92,000.

- Unified closing rule: When the price moves to the aforementioned important support levels and shows bottom resistance signals, partially or fully take profits on short-term positions as appropriate.

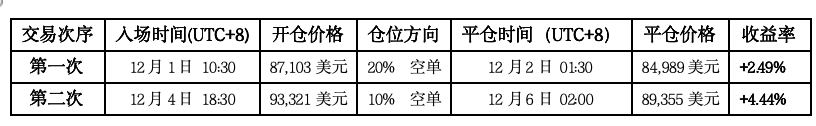

2. Last week, two short-term trades were successfully completed as planned (Figure 1), with a cumulative return of 6.93%. Detailed trading records and review are as follows:

Bitcoin 30-minute K-line chart: (Momentum Quantitative Model + Spread Trading Model)

Figure 1

①, Summary of trading details:

②, First trade (profit 2.14%): This operation was a classic execution of Plan B. After the bitcoin price effectively broke below the key $89,000 level, a decisive 20% short position was established at $87,103, and finally took profit near the second support area at $84,989. This operation perfectly embodied the trading discipline of “follow the break”.

③, Second trade (profit 4.44%): This operation was a precise implementation of Plan A. After the price found support at $89,000 and rebounded, patiently waited for it to enter the first resistance zone ($94,000~96,500). When a signal appeared at $93,321, a planned 10% short position was established, successfully capturing the subsequent pullback wave and taking profit near $89,355.

④, Profit summary: The strategy execution last week matched the market well. Both trades strictly followed the preset entry, stop loss, and closing rules, successfully converting market volatility into actual profits, with a total gain of 6.93%, validating the effectiveness of the previous strategy framework.

3. Review of last week's core bitcoin data:

- Opening price: $90,369

- Lowest price: $83,814 (Monday)

- Highest price: $94,172 (Wednesday)

- Closing price: $90,405

- Change: Weekly increase of 0.03%, maximum amplitude 12.36%

- Turnover: $13.429 billions

- Trend: Wide-range oscillation, weekly K-line closed as a “doji” with upper and lower shadows

4. Review of last week's actual market performance:

Last week, bitcoin showed a typical pattern of “violent wide-range oscillation” with several twists and turns. The week ended with a 0.03% gain, forming a “doji” bullish K-line with upper and lower shadows. Specifically, after the opening on Monday, the price plunged quickly, effectively breaking through the key $89,000 support, bottoming at $83,814 before stabilizing and rebounding, with a daily drop of 4.53%. In the following two days, the market staged a “V-shaped” reversal, with prices continuously rising, not only recovering all of Monday's losses but even reaching the weekly high of $94,172, with a cumulative two-day increase of 8.18%. After midweek, the market weakened again, with the price falling a cumulative 4.45% over two consecutive days before entering a narrow oscillation until the weekend. Notably, the midweek high of $94,172 closely matched the lower limit of the first resistance zone ($94,000~96,500) predicted last week, with a difference of only $172. This once again validates the accuracy of the previous key resistance level judgment.

II. Systematic Technical Analysis: Comprehensive Assessment Based on Multiple Models and Dimensions

Based on last week's market performance, I will comprehensively use multi-dimensional analysis models to deeply analyze the evolution of bitcoin's internal structure.

Weekly level:

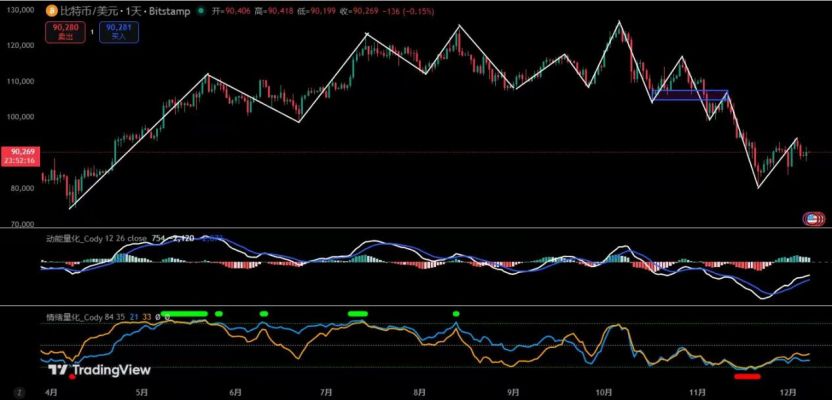

Figure 2

1. As shown in (Figure 2), from the weekly chart analysis:

- Momentum Quantitative Model: After last week's trend, both momentum lines continued to move downward. The white momentum line has been below the zero axis for three weeks, and the blue momentum line is about to cross below the zero axis. After two consecutive weeks of oversold rebound, the negative energy bars have started to shorten compared to previous weeks. At this point, the bulls must organize a strong counterattack to pull both momentum lines back above the zero axis, otherwise the bears will release greater selling pressure.

Momentum Quantitative Model indicates: Price decline index: High

- Sentiment Quantitative Model: Blue sentiment line value is 52.08, strength is zero; yellow sentiment line value is 33.53, strength is zero, peak value is 0.

Sentiment Quantitative Model indicates: Price pressure and support index: Neutral

- Digital Monitoring Model: No digital signals currently displayed.

The above data indicate: Bitcoin is in a downward trend and the weekly level is about to enter a bear market.

Daily level:

Figure 3

2. As shown in (Figure 3), from the daily chart analysis:

- Momentum Quantitative Model: After a week of rebound, both momentum lines continue to move upward below the zero axis and are gradually approaching the zero axis, but the energy bars are gradually shortening compared to previous days.

Momentum Quantitative Model indicates: Bullish rebound momentum is gradually weakening.

- Sentiment Quantitative Model: Blue sentiment line value is 21, strength is zero; yellow sentiment line value is 32, strength is zero.

Sentiment Quantitative Model indicates: Pressure and support index: Neutral

The above data suggest: The daily level is in a bear market, with an ongoing oversold rebound, but signs of weakening are emerging.

III. Market Forecast for This Week (12.08~12.14)

1. It is expected that the price will most likely remain in a range-bound oscillation this week. I divide the market into three zones: $94,200~$91,000~$87,500~$83,500. Currently, it is oscillating narrowly within the $91,000~$87,000 range, and the market will choose a direction next.

2. Resistance levels: First resistance at $91,000, second resistance at $94,000~$96,500, important resistance at $98,500~$100,000.

3. Support levels: First support at $85,500~$87,500, second support at $83,500, important support near $80,000.

IV. Trading Strategies for This Week (Excluding Impact of Unexpected News)

1. Medium-term strategy: Maintain about 65% of medium-term positions (short).

2. Short-term strategy: Use 30% of positions, set stop-loss points, and look for “spread” opportunities based on support and resistance levels. (Use 60-minute/240-minute cycles as the trading period.)

3. Based on the high probability of range-bound oscillation this week, I have formulated the following two short-term plans to cope with market trends.

Plan A: If the market oscillates upward at the beginning of the week (Sell on rebound)

- Open position: If the price rebounds to the $91,000~$94,200 area and encounters resistance, establish a 15% short position.

- Add position: If the price continues to rebound to around $98,500 and encounters resistance again, add another 15% short position.

- Risk control: All short positions have stop-losses set above $100,000.

- Reduce position: After the rebound ends and the price moves downward, if resistance appears near the first support level, close 50% of the position.

- Close position: If the price continues to fall to the second support area and shows resistance, close all remaining positions to complete the trade.

Plan B: If the price effectively breaks below the $87,500 support at the beginning of the week (Deep drop for rebound)

- Open position: If the price falls to the $83,500~$80,000 area and shows a top signal, establish a 15% long position.

- Risk control: Set stop-loss below $80,000.

- Close position: If the price rebounds to the $87,500~$88,000 area and encounters resistance, close all positions and take profit.

V. Special Reminders:

1. When opening a position: Immediately set the initial stop-loss level.

2. When profit reaches 1%: Move the stop-loss to the entry price (break-even point) to ensure capital safety.

3. When profit reaches 2%: Move the stop-loss to the 1% profit level.

4. Continuous tracking: For every additional 1% profit, move the stop-loss by 1% accordingly, dynamically protecting and locking in existing profits.

(Note: The above 1% profit trigger threshold can be flexibly adjusted by investors according to their own risk preferences and the volatility of the underlying asset.)

VI. Macro and Capital Analysis (12.8~12.14):

This week marks the most critical “Super Central Bank Week” for global financial markets before year-end, with the core focus on the December Federal Reserve rate decision, dot plot update, and Powell's speech. Although the market almost unanimously expects a rate cut at this meeting, what truly determines risk assets (including bitcoin) is not the rate cut itself, but the Fed's guidance on the rate cut path for 2025. Therefore, this week's macro and capital structure will revolve around “expectation deviation”, and asset price volatility is expected to increase significantly.

From a macro perspective, this week is packed with key data: Tuesday's US JOLTs job openings will reveal the extent of labor market cooling; if it continues to weaken, it will reinforce the logic of an early rate cut. Wednesday's China CPI and social financing will determine the direction of Asian demand and liquidity; Friday's UK GDP and European CPI will affect global synchronized easing expectations. However, the importance of these data is clearly lower than the Fed meeting, and the market as a whole is in a “waiting for the Fed's answer” mode.

The tone of this Fed meeting is almost locked in as a “December rate cut”, but the dot plot will determine the market direction for the next 3–6 months. If the dot plot is hawkish and only hints at 0–1 rate cuts in 2025, the market will quickly correct its current easing expectations, causing US Treasury yields to rise, the dollar to strengthen, and risk assets to come under short-term pressure. BTC may even retest the $85,000 area. If the dot plot is dovish and suggests at least two rate cuts in 2025, it means the easing cycle may accelerate, risk assets will rebound quickly, and BTC may challenge above $90,000 again. Powell's speech will further influence sentiment; any emphasis on “sticky inflation” or “policy still needs to remain restrictive” will amplify short-term volatility.

From a capital perspective, the current market is in a compressed state with no clear direction. BTC failed to effectively reclaim $90,000 over the weekend, but trading volume dropped significantly, indicating slower turnover and stable retail sentiment without panic selling. Institutional funds generally chose to reduce risk exposure before “Super Central Bank Week”, so there were no significant increases or withdrawals last week, which is typical of a “pre-FOMC window period”. The macro environment itself has no new negative factors; US employment and inflation data continue to weaken, which actually increases the probability of entering an easing cycle in the medium term. This is also an important reason why BTC can maintain strong oscillation at high levels.

Overall, the core variable for BTC this week is not sentiment or liquidity, but whether the Fed will provide a rate cut path consistent with market expectations. Bullish factors include: a very high probability of a December rate cut, continued cooling of employment and inflation, and a high likelihood of a dovish new Fed chair—all supporting further easing in 2025. Risks mainly lie in a hawkish dot plot, hawkish Powell remarks, and a decline in January rate cut expectations weakening short-term sentiment.

In summary, this week is an important time window that will determine the trend of risk assets in 2025. The Fed's dot plot and stance will directly affect BTC's medium-term trend. If the guidance is dovish, the market may see a year-end rally; if hawkish, there may be a short-term pullback, but it will not change the medium-term bullish structure. For BTC, this week's volatility is not just about short-term price changes, but a repricing of future trends.