Will Gold Hit $5,000 in 2026? Not as Far-Fetched as It Sounds

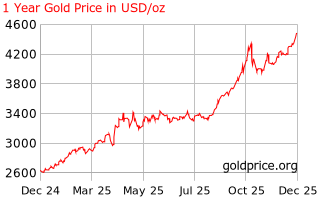

Gold’s rally over the past year has been nothing short of remarkable. By late December 2025, the precious metal was trading near $4,500 an ounce, up roughly 60 to 70 percent over the year and repeatedly setting new all-time highs. What was once viewed as a slow-moving store of value has become one of the strongest-performing major assets in global markets. Against this backdrop, a question that would have sounded implausible not long ago is now being taken seriously by investors and analysts alike: Could gold reach $5,000 in 2026?

At first glance, the idea appears extreme. A $5,000 gold price would push the metal deep into uncharted territory. Yet markets have a habit of redefining what seems unrealistic when underlying conditions shift. Just a few years ago, $2,000 gold was widely dismissed, and even at the start of 2025 few expected a decisive break above $3,000. With interest-rate cuts back on the agenda, central banks accumulating gold at record pace, geopolitical risks elevated, and concerns growing over debt and currency stability, the debate over $5,000 gold is no longer about hype. It is about understanding whether today’s economic and financial forces make such a level plausible, or whether the rally has already gone too far.

Gold Price Today: The 2025 Snapshot

Gold Price

Source: goldprice.org

As 2025 draws to a close, gold is trading in the mid to high $4,000s per ounce after briefly touching record highs above $4,500 in December. The move caps one of the strongest annual performances in modern gold market history, with prices up roughly 60 to 70 percent year to date. That rally has outpaced most major asset classes, including global equities and bonds, and has occurred despite periods of dollar strength and resilient economic data, conditions that have historically acted as headwinds for gold.

The speed of the advance is as striking as the level itself. Gold spent much of the past decade trading below $2,000, finally breaking that threshold during the pandemic in 2020. It then took less than five years to surge past $3,000 in early 2025 before accelerating sharply in the second half of the year. By comparison, it took nearly eight years for gold to rise from $1,000 to $2,000 and more than a decade to climb from $2,000 to $3,000. The current cycle has compressed what were once multi year moves into a matter of months.

Viewed through the lens of past milestones, today’s prices underscore how dramatically market perceptions have shifted. The $1,000 level was considered a ceiling before the global financial crisis. The $2,000 mark was widely debated and doubted before it was finally breached. The $3,000 threshold, crossed only this year, was once viewed as an extreme tail risk. Each of those levels ultimately became stepping stones rather than endpoints. That history does not guarantee gold will continue higher, but it explains why a discussion about $5,000, once unthinkable, is now being framed as a serious, if still uncertain, possibility rather than pure speculation.

The Bull Case: What Could Push Gold to $5,000

Several powerful forces are now supporting gold, helping explain why a move toward $5,000 is no longer dismissed outright. While none of these factors alone guarantees higher prices, their combination is historically favorable for the metal.

1. Monetary Policy and Interest Rates

Expectations of interest rate cuts are central to the bullish case. As markets look ahead to easier monetary policy in 2026, real interest rates have come under pressure. Gold, which offers no yield, typically performs well when real returns on cash and bonds decline. Even modest rate cuts, if inflation remains sticky, could push real yields lower and strengthen gold’s appeal as a store of value.

2. Inflation, Debt, and Currency Risks

Inflation concerns have eased from their peak but remain persistent, while government debt levels continue to climb. This combination has revived fears of currency debasement and long term fiscal strain. Historically, such conditions have favored gold, which is often used as a hedge against the erosion of purchasing power and the risks associated with expanding money supply.

3. Central Bank Gold Buying

Central banks have become a major source of demand, purchasing gold at record levels in recent years. Many emerging market economies are diversifying reserves away from the U.S. dollar, viewing gold as a neutral and politically insulated asset. This steady, price insensitive buying has tightened supply and provided a strong underlying support for prices.

4. Geopolitical and Systemic Risk

Geopolitical tensions and financial system concerns continue to bolster gold’s safe haven role. Ongoing conflicts, trade fragmentation, and elevated market volatility have increased demand for assets with no counterparty risk. As long as global uncertainty remains high, gold is likely to retain a premium tied to its defensive characteristics.

Together, these forces form a solid foundation for higher prices. They do not make $5,000 gold inevitable, but they help explain why such a level is now viewed as a realistic possibility rather than an extreme outlier.

The Bear Case: What Could Stop Gold Short of $5,000

While the forces supporting gold are strong, there are also clear risks that could cap prices or trigger a pullback before the metal reaches $5,000. These factors highlight why the rally, though powerful, is not guaranteed to continue uninterrupted.

1. Stronger Economic Growth and Higher Rates

If global growth remains resilient, central banks may keep interest rates higher for longer. Elevated real yields increase the opportunity cost of holding gold and tend to support the U.S. dollar, both of which can weigh on prices. A stronger economic backdrop could also draw capital back into equities and other risk assets, reducing demand for defensive holdings like gold.

2. Reduced Safe Haven Demand

Gold’s appeal often rises during periods of uncertainty. A sustained easing of geopolitical tensions or a broad improvement in investor confidence could reduce demand for safe haven assets. If markets shift decisively toward risk taking, gold may lose part of the premium it has gained from global instability.

3. Profit Taking After a Historic Rally

Gold’s rapid advance itself presents a risk. A gain of 60 to 70 percent in a single year is rare, and markets frequently consolidate after such moves. Even without a major change in fundamentals, profit taking and volatility could lead to corrections or extended periods of sideways trading, potentially keeping gold below $5,000 in 2026.

Gold’s Previous Peaks and What They Mean Now

To assess whether $5,000 gold is truly extreme, it helps to compare today’s rally with past peaks. Gold has a history of moving in long, powerful cycles driven by inflation, monetary policy, and shifts in investor confidence. While the speed of the recent advance is unusual, the scale of the move fits patterns seen during earlier periods of economic and financial stress.

Key historical reference points include:

-

Gold traded below $300 per ounce in the early 2000s before rising to around $1,000 during the global financial crisis.

-

Prices peaked near $1,900 in 2011, followed by nearly a decade of consolidation before breaking above $2,000 in 2020.

-

Gold surged past $3,000 in early 2025 and climbed above $4,500 later in the year, compressing what were once decade-long moves into just a few years.

Viewed on an inflation adjusted basis, gold’s previous real peak occurred around 1980, equivalent to roughly $2,700 to $3,000 today. That suggests gold has already exceeded its prior real highs, reflecting a broader reassessment of monetary stability and financial risk rather than inflation alone. History also shows that gold bull markets often run longer than expected and typically end only when real interest rates rise meaningfully, helping explain why $5,000, while ambitious, is no longer outside the realm of serious discussion.

Possible Scenarios for 2026

Looking ahead to 2026, gold’s trajectory is likely to depend on how monetary policy, economic growth, and global risk evolve. Rather than a single outcome, a range of scenarios helps frame what $5,000 gold could mean in practice.

Scenario 1: Bullish Breakout

In a bullish scenario, economic growth slows meaningfully and central banks respond with deeper and faster interest rate cuts. Real yields fall further, inflation concerns remain elevated, and geopolitical risks intensify. Central bank buying continues at a strong pace, while investor demand through ETFs accelerates. Under these conditions, gold could extend its rally and reach or exceed $5,000, potentially setting new record highs.

Scenario 2: Consolidation

A more moderate outcome would see gold consolidating below $5,000. Growth slows but avoids recession, and central banks cut rates gradually rather than aggressively. Gold remains well supported by lower yields and ongoing official sector demand, but gains are more measured. In this scenario, prices could trade sideways in the high $4,000s, maintaining strength without a decisive breakout.

Scenario 3: Correction

In a less favorable scenario for gold, economic growth proves resilient and interest rates stay higher for longer. Improved risk sentiment draws capital back into equities and other risk assets, while the U.S. dollar strengthens. Gold could experience a correction or an extended period of weakness, pulling prices lower but remaining structurally supported compared with past cycles.

Conclusion

Whether gold reaches $5,000 in 2026 remains uncertain, but the idea can no longer be dismissed as unrealistic. The metal’s surge over the past year reflects a rare alignment of supportive forces, including expectations of easier monetary policy, persistent inflation and debt concerns, record central bank buying, and elevated geopolitical risk. Together, these dynamics help explain why price targets that once seemed extreme are now part of mainstream market discussion.

At the same time, gold’s path forward is unlikely to be smooth. Stronger economic growth, higher real interest rates, or a sustained return to risk taking could slow or reverse the rally. For investors, that uncertainty underscores an important point. Gold is best viewed not as a prediction on a single price level, but as insurance against a range of macroeconomic and financial outcomes. In a world where those risks remain elevated, the question is no longer whether $5,000 gold sounds dramatic, but whether the conditions that made it conceivable are likely to persist.

Disclaimer: The opinions expressed in this article are for informational purposes only. This article does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. Qualified professionals should be consulted prior to making financial decisions.

- Bitcoin 2025 Recap: Guarded Optimism2025-12-25 | 20m

- Top 10 Best Crypto Staking Platforms to Use in 20262025-12-24 | 5m