Tether Set to Eclipse OpenAI’s Valuation? World’s Top Stablecoin Targets Unprecedented Growth

September 2025 marks a remarkable period for Tether, the world’s most influential stablecoin provider. Fresh off a major leadership shakeup and a bold business expansion strategy, Tether now stands on the verge of a historic fundraising round that could push its valuation to $500 billion—potentially surpassing AI powerhouse OpenAI.

In this article, you’ll discover exclusive insights on Tether’s current financial status, the dramatic expansion of its business into new sectors like AI and energy, details on its leadership reorganization—including connections to the White House

Who is Tether? Leading the Stablecoin Industry in 2025

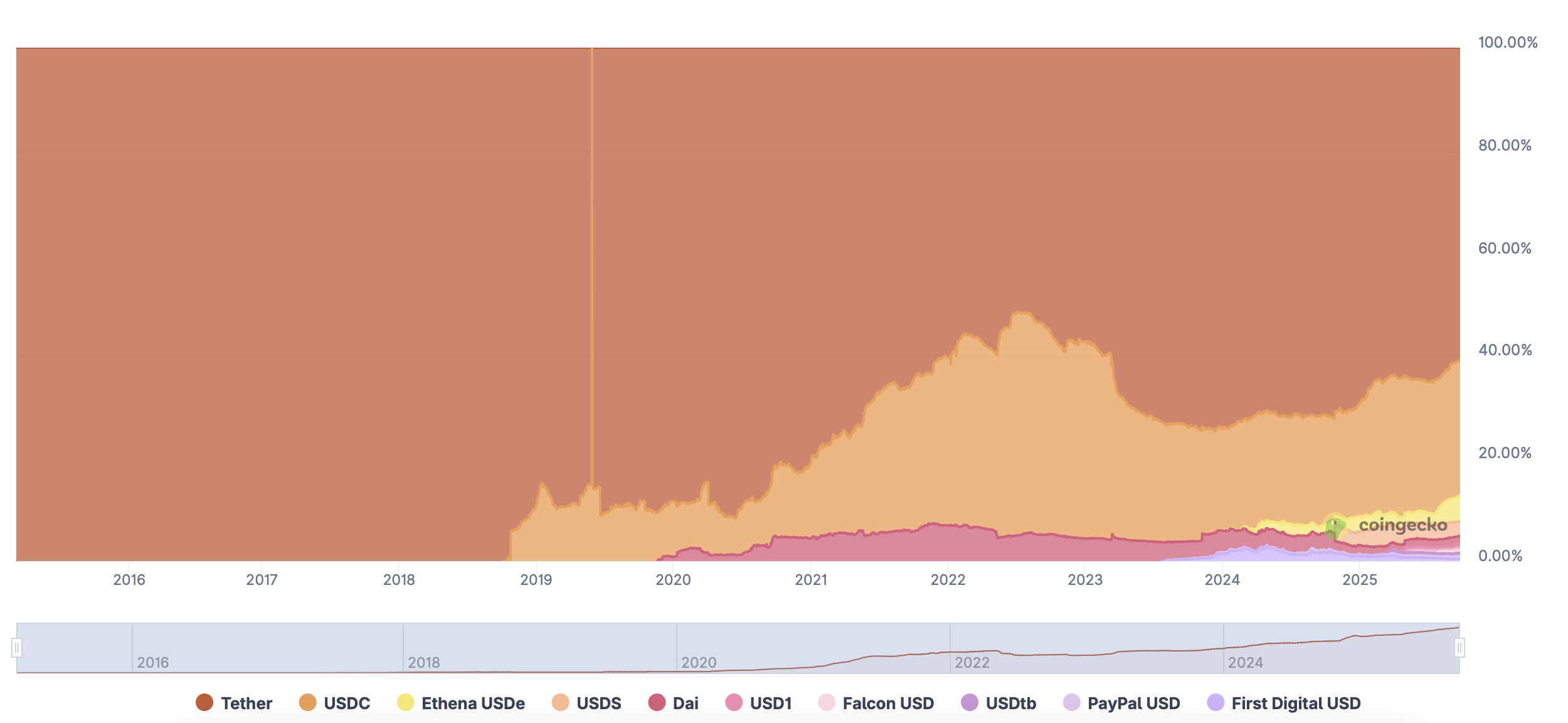

Tether, established in 2014, is now synonymous with the concept of a stablecoin. As the issuer of USDT, Tether dominates the stablecoin sector with a market capitalization that, as of September 2025, exceeds $110 billion. This represents over 70% market share among global stablecoins, and USDT remains the top choice for crypto traders seeking a reliable bridge between digital assets and fiat currencies.

Tether’s core appeal lies in its consistency and vast liquidity, making it the central stablecoin for exchanges, traders, and institutional investors alike. As stablecoins like USDT anchor trading pairs and support decentralized finance (DeFi) protocols, Tether’s influence grows ever stronger.

Tether’s Surging Value and Financial Health

Tether’s financial transformation stands out in the stablecoin ecosystem. Recent financial statements reveal Tether’s assets now total $97 billion, contrasted against $91.6 billion in liabilities, providing a sizable net surplus. This strong financial performance is driven by Tether’s prudent reserve management, which includes large holdings in U.S. Treasury bills, short-term government notes, and precious metals.

Most notable in 2025 is Tether’s private placement fundraising plan, seeking between $15 billion and $20 billion in investment. This move could boost Tether’s company value to as high as $500 billion—a forty-fold increase compared to several years ago, putting Tether on par with tech giants like OpenAI. This extraordinary leap underscores Tether’s transformation from a stablecoin provider to a diversified technology conglomerate.

Business Expansion: Beyond Just a Stablecoin Provider

Tether’s ambitions extend far beyond simply issuing USDT. In 2025, the company accelerates investment across multiple industries:

-

AI and Technology: Tether now invests heavily in artificial intelligence, notably acquiring a controlling stake in Blackrock Neurotech for $200 million. This move is part of a strategic effort to position Tether at the intersection of stablecoin innovation and cutting-edge technology.

-

Energy and Infrastructure: Diversification includes investments in power generation and telecommunications, sectors that promise strong synergies with blockchain adoption and global financial services.

-

Digital Content: Tether’s portfolio now features investments supporting the broader digital transformation, further cementing its future beyond being known solely as a stablecoin company.

Tether’s approach to reserves also continues to evolve. In addition to US dollar assets, Tether’s stablecoin reserves now include over $3.6 billion in gold, plus holdings in Bitcoin, further enhancing its resilience and appeal in the face of volatile markets.

Towards Compliance: Leadership Changes and Strategic Partnerships

Recognizing the importance of full regulatory compliance, Tether has made significant leadership changes in 2025:

-

New C-Suite Talent: Benjamin Habbel, with a background at Google and Limestone, steps in as Chief Business Officer, charged with driving Tether’s global expansion and multi-sector strategy.

-

Strategic Advisor on Crypto Policy: Bo Hines, formerly a White House crypto policy executive, has joined as a special advisor. His experience with U.S. regulatory frameworks signifies Tether’s commitment to closer alignment with American authorities.

-

Board Expansion: Tether’s refreshed board brings together industry experts in law, technology, and finance, supporting the company’s efforts to remain the world’s leading stablecoin issuer while enhancing its regulatory posture in key markets, especially the United States.

Tether’s US-oriented stablecoin, “USAT,” is also in development, targeting the evolving U.S. market with a product designed for rigorous compliance and transparency.

Conclusion: The Future of Tether and the Stablecoin Sector

As the stablecoin market matures in 2025, Tether continues to chart a course that redefines its role in both crypto and global finance. With new business ventures, strengthened compliance, and ongoing industry dominance, Tether remains central to the discussion for anyone interested in the stablecoin world. Its evolution signals a broader trend of convergence between regulated financial services, technology, and blockchain-driven innovation. For investors, traders, and industry observers, Tether will remain the name to watch in the fast-moving stablecoin sector.

Disclaimer: The opinions expressed in this article are for informational purposes only. This article does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. Qualified professionals should be consulted prior to making financial decisions.