$Recall – Redefining AI, Agency, and Decentralized Memory

Somewhere between the relentless hype of “AI tokens” and tired DeFi copycats, $Recall lands with a vision that actually makes you pause. What if crypto could finally give ownership not just to coins, but also to wisdom, skills, memory, and digital agency? What if you could mint, curate, and trade access not to static content, but to networks of human and machine intelligence?

As someone who’s fielded a thousand pitches about “decentralized AI marketplaces,” I’ll say: $Recall is the first one where the architecture matches the ambition.

### What $Recall Gets Right About the AI Wave

Most AI projects in Web3 slap on an LLM, sprinkle some staking, and call it “blockchain AI.” $Recall actually thinks deeply about where crypto shines: community curation, economic signals, verifiable public memory, and reward flows that don’t depend on Big Tech.

In the $Recall world, anyone can create or curate “skill markets.” Don’t imagine another OpenAI plugin directory—imagine a living, fluid marketplace where agents, bots, or even human contributors compete in reputation and utility. Backers can stake RECALL on the best performers, curators get incentivized to identify (not just spam) the winners, and the best talent rises thanks to real usage, not paid advertising.

For anyone who dreams of the “agentic web”—a place where your preferences, data, and digital agents serve you, not opaque algorithms—this protocol feels like the blueprint for how we get there without repeating Web2’s mistakes.

### Curation-Led, Not Marketer-Driven

I’ve worked in technical analysis, run Discords, and seen how quickly spam can choke any open community. $Recall’s anti-sybil architecture and human passport verification mean reputation and rewards link to real action, not just volume or vanity metrics.

The evaluation and synthesis of agents are public, open, and procedurally fair. You can launch a new skill market (“Best Sentiment Bot for Crypto Twitter,” “Most Accurate ETH Price Forecaster,” and so on) and anyone, not just insiders, can compete.

Curators (real people, not just whales) stake their own tokens—putting skin in the game—and are rewarded only when their picks hold up to scrutiny and actual use. For the first time, crypto turns knowledge curation into a real on-chain economy, not an afterthought.

### Tokenomics for Anti-Manipulation

Having seen more launches than I can count, the first red flag for me is always instant/unvested supply and silent whale allocations. $Recall chose the hard road: slow, community-weighted vesting (20% circulating at TGE, long schedules for the rest), Sybil-resistant airdrops, tiered access, and ongoing rewards for actual ecosystem contribution.

Supply isn’t weaponized. Builders, contributors, and early adopters get their fair share—but only if they do the work. When a project puts this much weight on transparency and defense against gaming, it’s a green flag for everyone—from retail to institutional DAOs.

### What Makes $Recall’s Marketplace Special?

This isn’t a static NFT drop or a passive staking platform. $Recall’s true genius is in the cyclical, live interplay between markets, participants, and agents. You can propose a new category, stake on it, help open-source the best performer, and earn steady rewards as long as your insight or creation delivers value.

This changes the game for AI developers who don’t want to live and die by the OpenAI or Google algorithm winds. Suddenly, there’s a venue for open-source growth—better models, smarter bots, helpful knowledge networks—and nobody can take away your access, block your bot, or rug your community.

The tech stack is robust—ERC-20/tokenized on Base, with bridges for EVM and plans for cross-chain expansion. The roadmap isn’t vapor: more integrations with data protocols, ceramic identity, and maker DAO-style autonomy.

### Use Cases That Will Actually Matter

The most exciting use cases for $Recall won’t show up in mainstream headlines first—but they’re critical. Think:

- Automated governance intelligence for DAOs and treasuries—self-updating, fully-audited histories and signals.

- Curation and monetization of crypto trading bots, sentiment aggregators, and prediction agents—a second economy for builders who don’t want to sell to hedge funds.

- On-chain, communal “memory” for research groups, decentralized teams, and educators—never losing knowledge as people rotate or as platforms go down.

- Dapps and consumer tools that surface the right answer, model, or method, not just the best advertiser.

- New ways for normal users to gain exposure and passive income by fueling AI growth.

The Real Test: Is $Recall for You?

Are you tired of projects where labor vanishes once the launch campaign ends? $Recall will reward you for what you know, create, and identify—for the long haul. If you want my honest, professional advice: join the skill markets early, focus on quality over quantity in both curation and creation, and don’t just chase the next airdrop. This is a marathon, not a sprint.

For forward-thinking DAOs, devs, and communities? $Recall is a chance to pool talent, align incentives, and future-proof your knowledge layer in a world where every API and every social network is up for disruption.

Mentor’s Takeaway

I’ve waited a long time for a crypto protocol to match the “promise” rhetoric of blockchain AI with functional, open, human-centric systems. $Recall is as close as the market’s come, and unlike many pretenders, it’s not just beta hype but live, growing, and community-owned.

If you want to help shape not just your own digital world, but the algorithms, bots, and agents that will shape everyone’s, this is where your journey should start.

$YB: Yield That’s Not Just Hype But Depth

You can make a killing in yield farming, but most protocols don’t tell you about the grind: like watching your principal vaporize after a single market move, or realizing the rewards are all gone once the airdrop farmers leave.

YieldBasis ($YB) is adamant about breaking that cycle. Institutionally-inspired strategy. Real delta-neutral leverage. Vaults that don’t just pump APY for a week but are actually secure and “set-and-forget” enough for treasuries and power users.

I often get asked, “Can I earn yield on my BTC or ETH, but not hand over custody to some black box?” YieldBasis says “yes” and actually delivers—a rarity. You deposit, you borrow against your own holdings using crvUSD, and you get exposure that tracks, but doesn’t leave you exposed during swings. The system handles rebalancing and risk checks without you having to babysit it.

The veYB model means if you’re long-term, you get real influence in protocol direction and bigger shares of actual fees — the kind that last, not just emission fluff. Passive holders, aggressive farmers, and DAOs alike can operate with confidence here.

If you want to move past hype cycles and get into sustainable protocol yield, $YB is almost tailor-made. It’s not just about what you “could” earn—it’s how you can keep earning, after others have already moved on.

$Recall: Powering the AI Marketplace We Actually Need

Everyone’s throwing around “AI + crypto” like it’s magic, but very few are thinking about what that actually means outside of marketing slides. Recall ($RECALL) gets to the heart of it: a decentralized skills market where actual intelligence, not just compute cycles, matters.

I’ve seen what happens when only the biggest tech platforms decide which AI models get attention. They’re closed, usually outdated, and impossible to fork or fund as an indie builder or DAO. Recall flips that whole dynamic. Anyone can start a “skill market,” anyone can back their favorite agent, and anyone who helps curate or improve them gets paid.

What’s visionary is Recall’s approach to on-chain curation signals—every user becomes a reviewer, a backer, a validator of talent. From trading bots to content creation, this marketplace gives visibility and monetization to the best, without waiting on platform algorithms or VC darlings.

The tokenomics? Thoughtfully (even brutally) anti-sybil, with long-term unlocks that keep power distributed NOT stuck with an inner circle. The airdrop and human passport checks are probably the most fair launch I’ve seen for AI credentials in the space.

For me, as a mentor who’s tired of fake volume and shallow “community,” Recall actually walks the walk: it makes it possible for value (in data, advice, predictions, code) to be surfaced by the crowd, and not dictated from the top down. If you’re in crypto to help build products and economies that actually serve the many, not just a few, diving into Recall is not just beneficial—it’s essential.

Wedge Breakout with Bullish Confirmation & RSI Strength

Quick snapshot (points)

Red Arrow → Indicates expected bullish breakout direction from the symmetrical triangle.

Symmetrical triangle/wedge forming between descending & ascending trendlines.

Major support zone: 0.30–0.33 (blue box).

Major resistance/target: 0.58–0.65 (red zone).

Fibonacci retraces: 0.382 ≈ 0.44, 0.618 ≈ 0.51.

RSI recovery zone: 39–44 → possible reversal

building.

Short-term target: 0.50, next: 0.58–0.63.

Breakout confirmation required (volume + close above trendline).

Today I’ll write about $RECALL in detail — discussing its market overview, technical setup (K-line analysis), the meaning of the red arrow and wedge structure, trading strategy for both short- and long-term traders, RSI interpretation, bullish vs bearish scenarios, market sentiment, and overall risk perspective.

What is Recall?

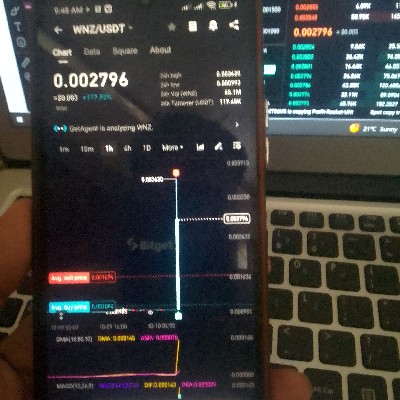

Recall is a blockchain-based project focused on AI-integrated and community-governed ecosystems. It has gained attention for its decentralized verification model. The coin trades actively on Bitget and other exchanges. As of now, Recall’s price hovers near $0.38 USDT, with a circulating market cap around $70M and moderate 24-hour volume fluctuations. Market activity has picked up recently due to increased technical interest near support levels.

K-Line / Chart Analysis (4H View)

The 4-hour chart of Recall clearly shows a symmetrical triangle pattern — formed between a descending resistance line (from prior highs) and an ascending support line (from higher lows). The red arrow drawn on the chart signifies a bullish breakout expectation from this consolidation zone.

The major support zone (0.30–0.33) has been tested multiple times, confirming buyer strength. Above, the resistance zone (0.58–0.65) remains a heavy supply area where sellers previously dominated. The Fibonacci retracement levels at 0.44 (0.382) and 0.51 (0.618) are intermediate checkpoints that can act as short-term resistances before price reaches the red zone.

The overall pattern implies price compression — as volatility tightens near the apex of the wedge, a strong directional move is imminent. The red arrow indicates that bulls might be preparing for that upward expansion.

Trading & Market Strategy

Strategy Breakdown:

Bullish Scenario (red arrow path): Wait for a clean breakout above the descending trendline, ideally a 4-hour candle close above 0.40–0.42 with strong volume. That’s your entry trigger.

Target 1: 0.50 (Fibo 0.618)

Target 2: 0.58–0.63 (red zone / prior swing highs)

Stop-loss: below the ascending support (~0.30) or the breakout retest level.

Bearish Scenario: If price rejects from the trendline and closes below 0.33, expect retest of 0.30–0.28 and possibly 0.25. Avoid early entries before confirmation; triangles often fake out both sides.

Trader Behavior:

Short-term traders should watch the triangle apex closely. Enter only on volume confirmation; fake breakouts are common in low-liquidity markets.

Long-term holders may accumulate near support zones with small increments (DCA approach) but should expect volatility.

RSI Analysis (Momentum Context)

The RSI indicator at the bottom of the chart shows a reversal zone between 39–44, where previous lows stabilized. The RSI curve is now turning upward, reflecting a potential momentum reversal from oversold conditions.

If RSI crosses above 50 while price breaks the trendline — that would confirm bullish momentum aligning perfectly with your red arrow breakout projection.

If RSI fails to rise or diverges negatively (RSI down while price up), that would signal weakness — treat any breakout with caution then.

Swing Scenarios & Price Projection

Bullish Continuation (expected): Breakout above 0.40 → push to 0.50 → momentum extension to 0.58–0.63 (red resistance box). RSI confirming above 50 adds confluence.

Bearish Rejection: Failed breakout and breakdown below support (~0.33) → quick fall toward 0.25 zone. RSI would dip below 35 again, confirming downside.

Neutral Consolidation: If price remains trapped between 0.35–0.40 → wait for a breakout candle before committing.

Market Sentiment & Comparison

Recent performance shows Recall consolidating while many altcoins are also in corrective phases. Compared to other mid-cap coins, Recall’s volatility remains relatively contained — which could fuel a sharper move once volume returns. Market sentiment appears cautiously optimistic as RSI and structure both point toward a potential upside breakout (↗️), aligning with your red arrow’s bullish projection.

Risk Management & Bias

Risks: false breakouts, liquidity traps, Bitcoin correlation, and low confirmation volume.

Bias: moderately bullish as long as price stays above ascending trendline and RSI maintains upward slope. Any 4H close below 0.33 invalidates the setup.

Trader Focus: patience — wait for a clean breakout + retest before scaling in.

Final Summary

The red arrow marks a potential bullish breakout from the symmetrical wedge, supported by an RSI reversal and higher lows. As the pattern nears completion, volatility compression signals a decisive move is near.

If breakout occurs: expect 0.44 → 0.50 → 0.58–0.63.

If breakdown happens: re-evaluate near 0.30 and 0.25.

For now, sentiment and structure both lean toward a bullish bias — but confirmation is key.

$RECALL