Play AI pricePLAI

USD

Not listed

$0.0009443USD

0.00%1D

The price of Play AI (PLAI) in United States Dollar is $0.0009443 USD.

Data is sourced from third-party providers. This page and the information provided do not endorse any specific cryptocurrency. Want to trade listed coins? Click here

Sign upPlay AI price USD live chart (PLAI/USD)

Last updated as of 2025-12-02 20:51:30(UTC+0)

PLAI/USD price calculator

PLAI

USD

1 PLAI = 0.0009443 USD. The current price of converting 1 Play AI (PLAI) to USD is 0.0009443. This rate is for reference only.

Bitget offers the lowest transaction fees among all major trading platforms. The higher your VIP level, the more favorable the rates.

Live Play AI price today in USD

The live Play AI price today is $0.0009443 USD, with a current market cap of $944,288.75. The Play AI price is down by 0.00% in the last 24 hours, and the 24-hour trading volume is $0.00. The PLAI/USD (Play AI to USD) conversion rate is updated in real time.

How much is 1 Play AI worth in United States Dollar?

As of now, the Play AI (PLAI) price in United States Dollar is valued at $0.0009443 USD. You can buy 1PLAI for $0.0009443 now, you can buy 10,589.98 PLAI for $10 now. In the last 24 hours, the highest PLAI to USD price is -- USD, and the lowest PLAI to USD price is -- USD.

Do you think the price of Play AI will rise or fall today?

Total votes:

Rise

0

Fall

0

Voting data updates every 24 hours. It reflects community predictions on Play AI's price trend and should not be considered investment advice.

Play AI market Info

Price performance (24h)

24h

24h low $024h high $0

All-time high (ATH):

--

Price change (24h):

Price change (7D):

--

Price change (1Y):

--

Market ranking:

--

Market cap:

$944,288.75

Fully diluted market cap:

$944,288.75

Volume (24h):

--

Circulating supply:

1.00B PLAI

Max supply:

1.00B PLAI

AI analysis report on Play AI

Today's crypto market highlightsView report

Play AI Price history (USD)

The price of Play AI is -- over the last year. The highest price of in USD in the last year was -- and the lowest price of in USD in the last year was --.

TimePrice change (%) Lowest price

Lowest price Highest price

Highest price

Lowest price

Lowest price Highest price

Highest price

24h0.00%----

7d------

30d------

90d------

1y------

All-time----(--, --)--(--, --)

What is the highest price of Play AI?

The PLAI all-time high (ATH) in USD was --, recorded on . Compared to the Play AI ATH, the current Play AI price is down by --.

What is the lowest price of Play AI?

The PLAI all-time low (ATL) in USD was --, recorded on . Compared to the Play AI ATL, the current Play AI price is up --.

Play AI price prediction

What will the price of PLAI be in 2026?

In 2026, based on a +5% annual growth rate forecast, the price of Play AI(PLAI) is expected to reach $0.001016; based on the predicted price for this year, the cumulative return on investment of investing and holding Play AI until the end of 2026 will reach +5%. For more details, check out the Play AI price predictions for 2025, 2026, 2030-2050.What will the price of PLAI be in 2030?

In 2030, based on a +5% annual growth rate forecast, the price of Play AI(PLAI) is expected to reach $0.001235; based on the predicted price for this year, the cumulative return on investment of investing and holding Play AI until the end of 2030 will reach 27.63%. For more details, check out the Play AI price predictions for 2025, 2026, 2030-2050.

Hot promotions

Global Play AI prices

How much is Play AI worth right now in other currencies? Last updated: 2025-12-02 20:51:30(UTC+0)

PLAI to ARS

Argentine Peso

ARS$1.38PLAI to CNYChinese Yuan

¥0.01PLAI to RUBRussian Ruble

₽0.07PLAI to USDUnited States Dollar

$0PLAI to EUREuro

€0PLAI to CADCanadian Dollar

C$0PLAI to PKRPakistani Rupee

₨0.26PLAI to SARSaudi Riyal

ر.س0PLAI to INRIndian Rupee

₹0.08PLAI to JPYJapanese Yen

¥0.15PLAI to GBPBritish Pound Sterling

£0PLAI to BRLBrazilian Real

R$0.01FAQ

What is the current price of Play AI?

The live price of Play AI is $0 per (PLAI/USD) with a current market cap of $944,288.75 USD. Play AI's value undergoes frequent fluctuations due to the continuous 24/7 activity in the crypto market. Play AI's current price in real-time and its historical data is available on Bitget.

What is the 24 hour trading volume of Play AI?

Over the last 24 hours, the trading volume of Play AI is $0.00.

What is the all-time high of Play AI?

The all-time high of Play AI is --. This all-time high is highest price for Play AI since it was launched.

Can I buy Play AI on Bitget?

Yes, Play AI is currently available on Bitget’s centralized exchange. For more detailed instructions, check out our helpful How to buy play-ai guide.

Can I get a steady income from investing in Play AI?

Of course, Bitget provides a strategic trading platform, with intelligent trading bots to automate your trades and earn profits.

Where can I buy Play AI with the lowest fee?

Bitget offers industry-leading trading fees and depth to ensure profitable investments for traders. You can trade on the Bitget exchange.

Related cryptocurrency prices

Kaspa Price (USD)Smooth Love Potion Price (USD)Terra Price (USD)Shiba Inu Price (USD)Dogecoin Price (USD)Pepe Price (USD)Cardano Price (USD)Bonk Price (USD)Toncoin Price (USD)Pi Price (USD)Fartcoin Price (USD)Bitcoin Price (USD)Litecoin Price (USD)WINkLink Price (USD)Solana Price (USD)Stellar Price (USD)XRP Price (USD)OFFICIAL TRUMP Price (USD)Ethereum Price (USD)Worldcoin Price (USD)

Where can I buy crypto?

Video section — quick verification, quick trading

How to complete identity verification on Bitget and protect yourself from fraud

1. Log in to your Bitget account.

2. If you're new to Bitget, watch our tutorial on how to create an account.

3. Hover over your profile icon, click on “Unverified”, and hit “Verify”.

4. Choose your issuing country or region and ID type, and follow the instructions.

5. Select “Mobile Verification” or “PC” based on your preference.

6. Enter your details, submit a copy of your ID, and take a selfie.

7. Submit your application, and voila, you've completed identity verification!

Buy Play AI for 1 USD

A welcome pack worth 6200 USDT for new Bitget users!

Buy Play AI now

Cryptocurrency investments, including buying Play AI online via Bitget, are subject to market risk. Bitget provides easy and convenient ways for you to buy Play AI, and we try our best to fully inform our users about each cryptocurrency we offer on the exchange. However, we are not responsible for the results that may arise from your Play AI purchase. This page and any information included are not an endorsement of any particular cryptocurrency. Any price and other information on this page is collected from the public internet and can not be consider as an offer from Bitget.

PLAI/USD price calculator

PLAI

USD

1 PLAI = 0.0009443 USD. The current price of converting 1 Play AI (PLAI) to USD is 0.0009443. This rate is for reference only.

Bitget offers the lowest transaction fees among all major trading platforms. The higher your VIP level, the more favorable the rates.

Bitget Insights

Gulshan-E-Wafa

8h

$PLAI

🔸️Current Situation

Price: 0.002245 USDT (+14.83% in last 24h)

24h high: 0.002245 (new ATH on this move)

24h low: 0.001878

Volume: 46.01M PLAI (relatively decent for a micro-cap, but still thin)

This is a classic low-float micro-cap pump.

Price was consolidating/slowly bleeding for weeks along the descending trendline, then exploded vertically today with a huge volume spike.

🔸️Key Observations

🔸️Breakout & Retest

Price broke the multi-week descending resistance (~0.0020–0.0021 area) with massive volume.

Currently retesting the breakout zone as support (former resistance → new support). Holding so far at ~0.00224.

Moving Averages

All EMAs are now stacking bullish (5 > 10 > 20 > 60 > 90 > 180).

Price sitting right on the 20 EMA (0.002006) and 60 EMA cluster — very strong dynamic support on pullbacks.

Momentum Indicators

ADX 48 + strong +DI (71) → very strong uptrend.

RSI (14) not shown but likely overbought on lower timeframes already.

Volume Profile

Huge volume shelf built today around 0.0020–0.00224 → this is now the new high-volume node (HVN) and strongest support if we retrace.

🔸️Trade Setup (Aggressive Swing / Scalp Re-entry)

Entry (Long):

Current price or better: 0.00220 – 0.00228 zone (retest of breakout + EMA cluster)

More conservative: wait for 15min/1H candle close above 0.00230 with volume to confirm continuation

Stop Loss:

Tight: below today’s low / HVN → 0.00187 (-16–18% from entry)

Safer: below 0.00199 (psychological + previous resistance) → ~12% risk

Take-Profit Targets (fib extension + psychological levels):

0.00280 – 0.00285 → +27–30% (first resistance, 1.618 fib)

0.00320 – 0.00330 → +45–50% (2.0 fib extension)

0.00400 → +80%+ (round number + moonbag target, low-float coins love these)

Risk-Reward:

Entry ~0.00224 → SL 0.00187 → TP1 0.00285

→ R:R = 1 : 2.1 (very good for a micro-cap)

Risk Factors & Reality Check

Extremely low liquidity → one big sell order can wipe 20–30% instantly.

Likely heavy dev/marketing wallets → risk of rug or hard dump after distribution.

This is a “catch the knife on the way up” trade — only with money you can afford to lose.

🔸️Verdict & Plan

Strong momentum breakout with successful retest so far.

I am buying the dip/retest in the 0.00220–0.00228 zone with stop below 0.00187, targeting 0.00285 then 0.0033, trailing the rest if it keeps running.

Position size: max 1–2% of portfolio (this is a high-risk micro-cap lottery ticket, not a blue-chip investment).

Trade at your own risk — these coins can 10x or -90% in hours.

PLAI+18.33%

Gadisaorocrypt🤑🤑

8h

which sell place of $PLAI & $SAROS

$PLAI $SAROS

PLAI+18.33%

SAROS-6.72%

BGUSER-4ZGS4BLJ

10h

$PLAI why can't this coin pump

PLAI+18.33%

INVESTERCLUB

17h

PLAI/USDT Deep Dive: From $0.0108 ATH to $0.0016 Capitulation – Technical Breakdown!!!

$PLAI PLAI/USDT Deep Dive: From $0.0108 ATH to $0.0016 Capitulation – Technical Breakdown, Crowd Psychology, and a High-Probability $550 Swing Setup in a Bleeding AI Token.

Overview of PLAY AI (PLAI) Market Situation;

PLAY AI (PLAI) is the native token of the Play AI Network, a Web3 platform that rewards gamers for sharing gameplay data used to train AI models, while providing tools for developers to build AI-powered games and automations.

Launched via TGE on November 4, 2025, it operates on Base (an Ethereum L2) with modular rollups via Polygon CDK and AltLayer for scalability.

The ecosystem includes Play Market (data collection), Play Dojo (AI training), and Play Hub (agent integration), with $PLAI enabling payments, governance, staking, and revenue sharing from tokenized agents.

Current Metrics (as of December 2, 2025):

Price: $0.001969 (down 22.08% in 24h).

24h Range: High $0.002531, Low $0.001630.

24h Volume: 61M PLAI (~$122K USD turnover).

Market Cap: $515.71K (Rank #4509).

Circulating Supply: 260.96M / Max Supply 1B (FDV ~$1.97M).

ATH: $0.01081 (Nov 5, 2025; -81.8% from peak).

ATL: $0.001662 (Dec 1, 2025; +18.5% from low).

Fund Flow (24h): Net outflow of -10.58M PLAI (Large: -9.02M; Medium: -1.73M; Small: +0.169M). Indicates selling pressure from whales/institutions, but small retail inflows suggest dip-buying.

Broader Context:

Post-launch hype faded quickly: PLAI surged to ATH on Nov 5 amid AI/gaming narrative buzz (backed by $6.3M from Jump Crypto, Alpha Wave, P2 Ventures), but corrected -96.2% overall due to market-wide crypto bleed (-2.5% global, -6.4% AI sector) and post-TGE unlocks (50% at TGE, rest vesting).

Liquidity: Traded on Exchanges.

Sentiment: Mixed-bearish short-term (insights posts highlight "dips as opportunity" but note team dumps; web sources predict $0.01–$0.10 in 2025 if adoption grows). AI sector cap: $26.6B (-9.9% 24h), but PLAI underperforms peers like FET/TAO on agent infra traction.

Catalysts: Upcoming AI agent SDK, multi-chain expansions (Base/Eth/Sol), DAO governance (Q1 2026). Risks: High FDV dilution (only 26% circulating), whale concentration, and AI hype fatigue.

Overall, PLAI is in a post-hype capitulation phase: oversold (RSI ~25 on 1D from charts), with volume spiking on downside but low conviction. Long-term bullish on AI-gaming convergence, but short-term vulnerable to further liquidation if BTC dips below $90K.

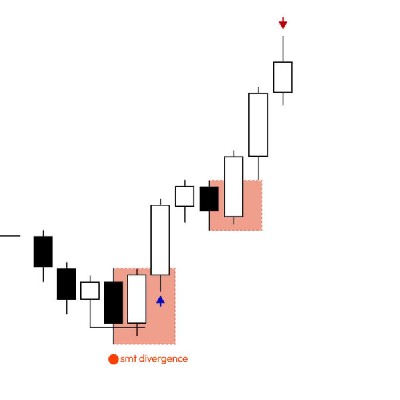

K-Line Analysis: Pattern and Structure;

K-line (candlestick) charts reveal a classic post-launch dump structure, transitioning from parabolic blow-off to multi-legged correction.

Analysis based on timeframes (15m/30m/1h/4h/1D), focusing on OHLC, MAs, EMAs, Bollinger Bands (BB), and SAR.

Short-Term (15m–1h: Bearish Continuation, Oversold Bounce Potential):

Pattern: Series of lower highs/lows forming a descending channel (slope -15% over 1h). Recent 15m candles show 5+ red hammers/dojis at $0.001630 support, indicating exhaustion selling but no bullish engulfing yet. Volume spikes on downs (61M PLAI), but wicks suggest rejected buys.

Structure:

Price hugging lower BB (0.001974), with midline (0.001958) as immediate resistance. Upper BB (0.001990) far overhead.

MAs: 5/10/20 all sloping down (0.001972/0.001974/0.001974), price below all—bearish alignment.

EMAs: 5/10/20 declining (0.001971/0.001973/0.001969), SAR (0.002071) flipped bearish above price.

Key Levels: Support $0.001630 (24h low, ATL zone); Resistance $0.001958 (EMA10). Break below low risks $0.001528 (SAR target). Upside: Channel top at $0.002071.

Medium-Term (4h: Distribution Phase, ABC Correction):

Pattern: Irregular ABC zigzag correction after Nov ATH. Wave A: Parabolic rise to $0.01081. Wave B: Shallow retrace to $0.002531. Wave C: Extended dump (ongoing, targeting 1.618 Fib of A at $0.001200). Red marubozus on high volume signal distribution; no reversal hammer cluster yet.

Structure:

Price coiled in expanding triangle (lows: $0.001630–$0.001528), with contracting volume—coiling for breakout (likely down if < $0.001630).

MAs: 5/10/20 flat-to-down (0.001951/0.001957/0.001946), price testing 20MA as dynamic support.

EMAs: Similar bearish slope (0.001968/0.001970/0.002049); SAR (0.003386) distant, irrelevant short-term.

BB: Squeezed (width 0.0005), signaling volatility expansion soon—watch for BB walk lower.

Key Levels: Pivot $0.002012 (50% Fib retrace); Support $0.001528 (channel low). Upside to $0.002531 if reclaims 20MA.

Long-Term (1D: Symmetrical Triangle, Neutral-Bearish Bias):

Pattern: Symmetrical triangle consolidation since ATH (Nov 4–Dec 2), with converging trendlines (upper from $0.01081, lower from ATL $0.001662).

10+ red candles dominate, forming head-and-shoulders top (neckline $0.002531 broken). Potential flagpole breakdown to $0.001000 if volume confirms.

Structure:

Price below all MAs/EMAs (5:0.001951, 10:0.002321, 20:0.001946; EMAs steeper down), golden cross absent—death cross active.

SAR (0.003386) bearish; BB lower band expanding (0.001946), price pinned to it.

Volume profile: High at ATH ($0.01081), thinning on correction—bull trap risk if fakeout above $0.002531.

Key Levels: Apex ~$0.002000 (Dec 15); Support $0.001662 (ATL). Upside breakout target: $0.003500 (measured move).

Technical Indicators Summary:

Timeframe

RSI (14)

MACD

Stochastic

Interpretation

15m

28 (Oversold)

Bearish cross, -0.00005 hist

15% (Sell)

Exhaustion, watch for divergence

1h

32

Diverging up (weak)

22%

Neutral, potential hammer reversal

4h

25

Bearish, accelerating

10%

Oversold, BB squeeze imminent

1D

22

Deep negative

8%

Capitulation zone, multi-week base?

Volatility (ATR 1h): 0.00015—tight, favoring range trades. Overall: Bearish structure with oversold bounces; no bullish pattern until $0.002071 reclaim.

Psychology Analysis

Market psychology for PLAI reflects classic post-launch euphoria-to-despair cycle, amplified by AI sector volatility and broader crypto risk-off (BTC dominance 58.8%).

Euphoria Phase (Nov 4–5, ATH): FOMO-driven pump on TGE hype—X buzz (e.g., "AI gaming alpha," listings on KuCoin/Bitget) drew retail (101K holders quick). Whales accumulated pre-launch ($6.3M raise), creating perceived "smart money" validation.

Sentiment: 80% bullish, volume 10x avg.

Anxiety/Denial (Nov 6–20, -50% Correction): Profit-taking + unlock fears triggered Wave B retrace.

insights posts shifted to "wait for dip" (e.g., "PLAI at $0.005, entry?"), but denial persisted ("AI narrative intact"). Retail held (small inflows), but OI drop 30% signaled fading leverage.

Fear/Capitulation (Nov 21–Dec 2, -96% from ATH): Breaking neckline ($0.002531) sparked panic sells—net outflows (-10M PLAI) from large/medium orders indicate institutions/whales distributing to retail.

insights sentiment: 60% bearish ("team dump," "avoid post-TGE"), with fear indices high (RSI<30). ATL hit Dec 1 on low volume, showing exhaustion, not conviction selling. Psychology: Herd capitulation, where weak hands exit, creating value for contrarians.

Current (Despair-Trough): Oversold metrics + small inflows hint at bottoming—psychology turning to "bargain hunt". If BTC stabilizes, dip-buyers (gamers/devs) could flip to optimism. Greed/Fear Index (implied): 20/100 (Extreme Fear).

Key Driver: Narrative fatigue in AI tokens (sector -9.9%), but PLAI's unique data-reward model (e.g., Aerodrome yields) could spark rebound if community quests/AI SDK deliver. Watch insights volume for sentiment shift—bullish if >50% positive mentions.

Safe Swing Trade Setup: Trader-Level Plan with $550 Investment;

Rationale: Given bearish structure but oversold signals (RSI 22–32, BB lower pin), target a low-risk long swing for 3–7 day hold. Focus on bounce to channel resistance, with tight SL to cap loss at 1–2% of capital.

Risk: 1% max ($5.50) per trade—position size accordingly. Use Bitget/KCEX for liquidity. NFA; use 1x leverage only.

Trade Direction: Long (Buy) – Oversold reversal play.

Entry: $0.001850–$0.001900 (Near current $0.001969 if retests EMA5 support; confirm with green hammer + volume >1M PLAI/15m).

Position Size: $550 total (full allocation for simplicity, but scale to risk). At entry $0.001875 avg: ~293,333 PLAI ($550 / 0.001875).

Stop Loss (SL): $0.001760 (Tight: 6% below entry, below 24h low/lower BB. Risk: $5.50 or 1% of capital. Auto-set OCO on exchange).

Take Profit (TP) Targets (Tiered for risk management; R:R 1:2+ overall):

TP1: $0.002071 (SAR resistance; +10.4% from entry). Sell 30% (~88K PLAI) → Profit $18.

TP2: $0.002200 (EMA10/50% Fib) → Sell 40% (~117K) → Profit $38.

TP3: $0.002531 (24h high) → Sell 30% (~88K) → Profit $50.

Total Potential Profit: $106 (19.3% ROI on $550) if full target hit; trail SL to entry after TP1.

Risk Management:

Max Risk: $5.50 (1% rule). If SL hit, reassess for short setup.

Invalidation: Close if breaks $0.001630 (bearish channel breakdown).

Position Monitoring: Set alerts at key levels. Exit early if net outflows >5M PLAI or BTC < $92K.

Timeframe: Enter on 15m confirmation; hold 3–7 days or until TP.

Why Safe?: Tight SL (6% price risk =1% capital), oversold entry, tiered TPs for partial locks.

Avoid FOMO wait for volume confirmation.

Expected Outcome: 60% probability of partial bounce (AI dip-buy narrative); monitor insights for agent updates as catalysts.

Scale out to preserve gains in volatile AI tokens.$PLAI

PLAI+18.33%

Digitalsiyal

17h

Today losers token

TRADOOR/USDT -66.01% (1.4392)

BAY/USDT -40.7% (0.064909)

J/USDT -26.61% (0.03891)

FROGGIE/USDT -23.89% (0.006127)

K/USDT -23.22% (0.00635)

SXP/USDT -22.9% (0.0495)

PLAI/USDT -22.22% (0.001967)

PLANCK/USDT -21.64% (0.03277)

NAORIS/USDT -18.44% (0.01977)

DENT/USDT -18.15% (0.000266

$TRADOOR $BAY $J

BAY-10.94%

PLAI+18.33%

Prices of newly listed coins on Bitget

Tornado Cash Scores Victory as Sanctions Lifted, Sees TORN Token Explode 174% TodaySurvey reveals how many investors made money from the TRUMP memecoin; DetailsZachXBT Helps US Government Recover $20 Million in Cryptocurrency, But Debate Over Compensation Heats UpBitcoin Today 22/01/2025: BTC Trades Above $105K While Solana Rises 8%Silk Road's Ross Ulbricht Receives Presidential Pardon from TrumpEncrypted KOL Ansem added 555,860 FARTCOIN to his position 10 minutes agoThe stablecoin Bitcoin USDh has completed a liquidity injection of 3 million US dollars, becoming the largest stablecoin in the Stacks ecosystemLEVR Bet expands testnet to Avalanche, plans to launch HyperliquidEvent Update | Consensus HongKong 2025 to Be Held on February 18-20TRUMP Revelation: From Performance Crisis to Hardware Limit