News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec. 2) | Spot Bitcoin ETFs saw USD 3.5 billion in outflows in November; Massimo added BTC to its treasury reserve strategy; Benchmark says there is no need to worry about Strategy’s solvency2BTC price analysis: Bitcoin could crash another 50%3Price predictions 12/1: SPX, DXY, BTC, ETH, XRP, BNB, SOL, DOGE, ADA, BCH

Alt5 Sigma Faces Scrutiny Over Conflicting SEC Disclosures and Governance Gaps

DeFi Planet·2025/12/02 11:24

CZ-Linked YZi Labs Moves to Take Control of BNB Treasury Firm CEA Industries

DeFi Planet·2025/12/02 11:24

Forward Industries Taps Ryan Navi as CIO to Drive Solana Treasury Strategy

DeFi Planet·2025/12/02 11:24

Japan Backs Major Crypto Tax Overhaul With Flat 20% Rate

DeFi Planet·2025/12/02 11:24

569 XRP Whales Disappear—Yet Whale Holdings Hit 7-Year High. What’s Going On?

Coinpedia·2025/12/02 11:12

![Crypto News Today [Live] Updates On December 2,2025 : Federal Reserve News, Bitcoin Price Today, Ethereum Price And XRP Price](https://img.bgstatic.com/multiLang/image/social/cc963d16638fb3fac964f28463fe5c9a1764673944776.webp)

Pi Network Flashback: Did the Founder Reveal When Pi Coin Will Actually Start Rising?

Coinpedia·2025/12/02 11:12

HashKey prospectus in detail: 1.5 billion HKD loss over three years, 43% equity controlled by Wanxiang Chairman Lu Weiding

Despite HashKey's significant total revenue growth over the past two years, with rapid expansion in trading volume and client base, the underlying financial pressure remains evident: ongoing losses, long-term negative operating cash flow, and consistently high net debt all contribute to continued uncertainty regarding its financial resilience ahead of its IPO.

Chaincatcher·2025/12/02 09:43

A Good Opportunity to Buy the Dip? In-depth Analysis of “Real Yield” DeFi Tokens

The market has indeed offered better entry points, but the narrative of "real yield" needs to be carefully scrutinized.

Chaincatcher·2025/12/02 09:41

Flash

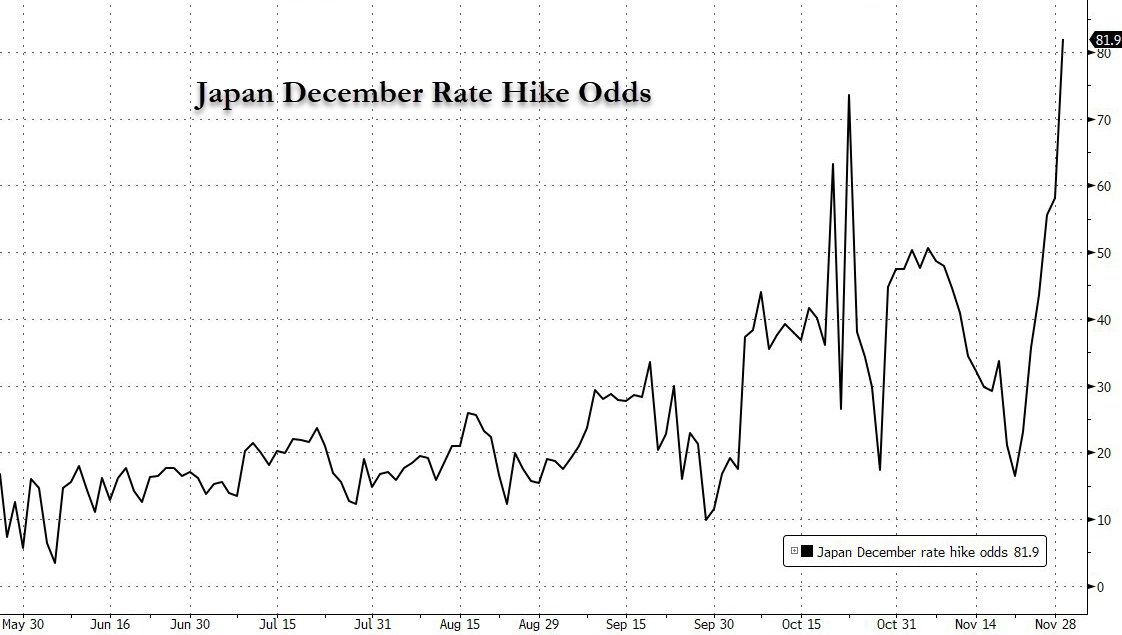

- 11:24Bloomberg: Federal Reserve officials increasingly divided over long-term interest rate planningAccording to news on December 2, Bloomberg reported that after lowering interest rates by more than 1 percentage point, Federal Reserve officials are now considering where to stop—only to find that internal disagreements are greater than ever before. Over the past year or so, expectations for where interest rates should ultimately settle have shown the largest divergence since at least 2012, when the Fed began publishing related estimates. This has led to an unusually public split: whether to cut rates again next week, and what actions to take thereafter.

- 11:14Bank of America recommends that wealth management clients allocate 1%-4% of their portfolios to cryptocurrencies.Jinse Finance reported that Bank of America has announced its wealth management clients should consider allocating cryptocurrencies in their portfolios. The bank recommends that clients of Merrill, Bank of America Private Bank, and Merrill Edge platforms allocate 1%-4% of their assets to digital assets. Starting from January 5 next year, the bank's investment strategists will begin covering four bitcoin ETFs, including Bitwise Bitcoin ETF (BITB), Fidelity Wise Origin Bitcoin Fund (FBTC), Grayscale Bitcoin Mini Trust (BTC), and BlackRock iShares Bitcoin Trust (IBIT).

- 11:05Honeypot Finance launches multi-chain and CEX asset transfer features to simplify liquidity managementChainCatcher news, integrated liquidity hub Honeypot Finance has officially launched a brand new cross-chain and CEX asset transfer feature, aiming to enable users to deposit assets from any chain or mainstream exchange (such as a certain exchange) to Honeypot with one click, or withdraw from Honeypot to a specified on-chain address or exchange account. Key highlights of this upgrade include: One-click On-Ramp: Supports direct deposits from any public chain and mainstream CEX to Honeypot. One-click Off-Ramp: Allows users to directly withdraw assets from Honeypot to any public chain or exchange. Honeypot Finance stated that this feature is designed to reduce the operational complexity for users when using DeFi products, achieving seamless and instant fund transfers between chains, CEX, and DeFi.

News