News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Federal Reserve Payments Conference May Accelerate RWA Tokenization as Ethereum Remains Dominant Onchain2Satoshi-era Bitcoin Wallet Appears Active After Decade as $328M Flows Into Spot Bitcoin ETFs3Ether whales have added 14% more coins since April price lows

Dialogue with BlackRock CEO Larry Fink: AI and Asset Tokenization Will Reshape the Future of Investing

ChainFeeds·2025/09/04 18:22

Pokémon Card Craze: The Cognitive Gap Between Crypto Players and Collectors

Bitpush·2025/09/04 18:22

Tom Lee: ETH is experiencing its "1971 moment," a $60,000 valuation is reasonable

Bitpush·2025/09/04 18:20

Speculation on the New Fed Chair: How Would Waller Influence the Crypto Wallet?

Bitpush·2025/09/04 18:19

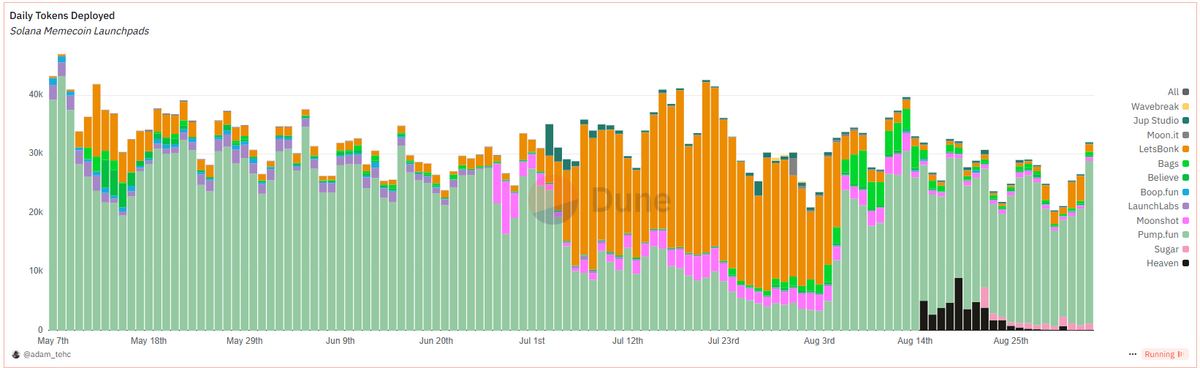

New On-chain Creation Model: Will Pump.fun's CCM Reshape the Solana Creator Ecosystem?

Bitpush·2025/09/04 18:19

Pump.fun’s Upgrade Pays Creators Millions. Will It Spark New Memecoin Boom?

DailyCoin·2025/09/04 18:18

Gary Yang: The Trend of Asset On-Chainization under Stablecoin Pricing Models

Bitpush·2025/09/04 18:17

New Progress in "Stock Tokenization": Galaxy Launches Native U.S. Stock Tokens, Achieving On-Chain Equal Rights

"Equal rights between tokens and stocks" is a prerequisite for the large-scale adoption of stock tokenization, but an even bigger issue lies on the circulation side.

BlockBeats·2025/09/04 18:14

$40 million financing, with participation from Vitalik Buterin, Etherealize aims to become the "spokesperson" for Ethereum

It is rare for both Vitalik and the Ethereum Foundation to get directly involved.

BlockBeats·2025/09/04 18:12

Flash

- 19:17"Federal Reserve Mouthpiece": It is a rare arrangement for Federal Reserve Board nominee Milan to consider retaining a White House position during his term.Jinse Finance reported that "Federal Reserve mouthpiece" Nick Timiraos wrote that Milan, the Federal Reserve Board nominee appointed by U.S. President Trump, stated that after completing his short-term tenure at the Federal Reserve, he is considering returning to his original position at the White House next year—an arrangement that has been unprecedented for decades since Congress sought to separate the executive branch from the Federal Reserve. At the Senate confirmation hearing on Thursday, Milan said that his lawyers advised him that he could take an unpaid leave of absence from his current position as Chairman of the White House Council of Economic Advisers, so that he could return to his post next year without going through another round of Senate confirmation. Milan has been nominated to fill the term left vacant by Kugler's unexpected resignation last month, which will last until January 31, 2026. Democratic lawmakers questioned whether such an arrangement might affect his ability to exercise the independent judgment he promised. Mike Rounds, a Republican senator from South Dakota, later told reporters that he was surprised by the proposal, but no Republican lawmakers indicated that they would oppose Milan's confirmation because of it.

- 18:15Justin Sun responds to address being blacklisted: the involved address was only used for small-scale testing, with no buying or selling involvedJinse Finance reported that Justin Sun responded on social media to the incident where "World Liberty blacklisted Justin Sun's address, locking 540 million unlocked tokens and 2.4 billion locked tokens," stating, "Our address only conducted a few generic exchange deposit tests with very small amounts, and then performed an address distribution. There was no buying or selling involved, so it could not have had any impact on the market."

- 18:02Trump Administration Submits New Arguments Seeking Court Support to Remove Federal Reserve Governor CookJinse Finance reported that the U.S. Department of Justice has presented new arguments regarding why President Trump should be allowed to remove Federal Reserve Governor Lisa Cook, stating that her claims about a "rate cut pretext" are unfounded. Cook is accused of mortgage fraud and is currently challenging the decision to remove her from office. On Thursday, U.S. government lawyers again urged the judge to dismiss Cook's request to prohibit her removal during the lawsuit, reinforcing arguments made at last week's hearing. Just hours before the legal documents were filed, reports emerged that the Department of Justice had launched a criminal investigation into Cook. The U.S. government asserts that the fraud allegations, first raised by Federal Housing Finance Agency Director Sandra Thompson, already constitute sufficient "cause" under U.S. law for Trump to dismiss her. In Thursday's filing, the Department of Justice emphasized that the judge must not "second-guess" Trump's judgment regarding the existence of grounds for dismissal, and once again refuted the claim that the dismissal was merely a pretext to control the Federal Reserve and cut rates. "Her only 'evidence' is that the President has criticized the Federal Reserve's policies," the document stated, "but mere policy disagreements do not mean the President dismissed Cook for that reason."