News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Dogecoin May Face Breakout or Pullback After Volume Spike, Market Cap Rises to $31.7B2World Liberty Financial (WLFI) Undertakes Token Burn as Possible Measure to Curb Post-Launch Price Decline3Yunfeng Financial, Linked to Jack Ma, Acquires 10,000 ETH and May Bolster Institutional Support for Ethereum in Hong Kong

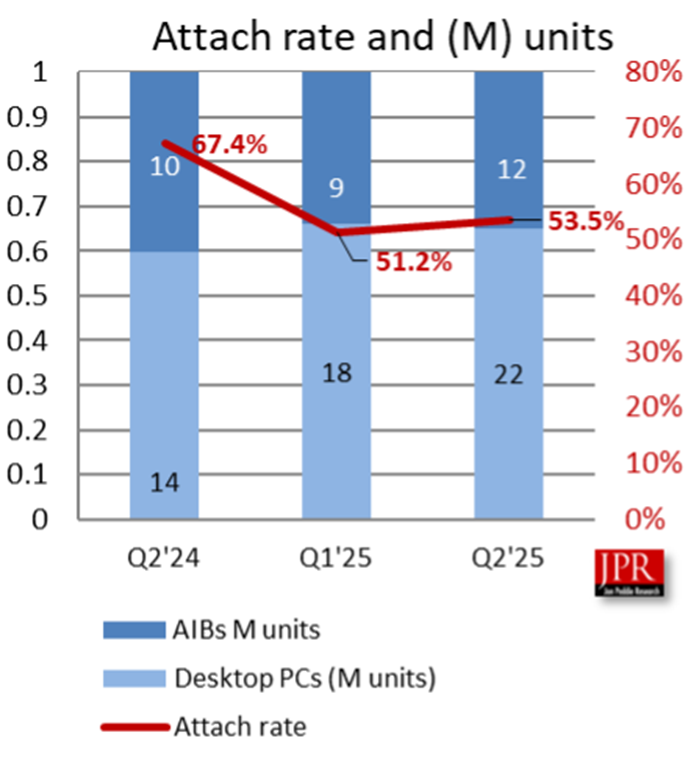

Nvidia GPU, 94% market share

老虎证券·2025/09/04 10:09

Why did Jack Ma buy Ethereum?

老虎证券·2025/09/04 10:07

Is Bitcoin about to fight the 100,000 defense battle again?

Regaining $114,000 will bring all short-term holders back into profit, strengthening the bull market narrative; on the other hand, falling below $104,000 could potentially repeat the previous pattern of “post-all-time-high exhaustion.”

ForesightNews 速递·2025/09/04 10:02

Flash

- 10:33Report: Hackers Use Ethereum Smart Contracts to Hide Malicious CodeJinse Finance reported that according to the latest report from security company ReversingLabs, hackers are adopting innovative methods by using Ethereum smart contracts to hide malicious instructions in npm packages. Two malicious packages named "colortoolsv2" and "mimelib2" appeared in July this year, and instead of hardcoding links directly in the code, they obtain the next stage of attack instructions by querying Ethereum contracts, which greatly increases the difficulty of detection and removal. The attackers also created fake cryptocurrency-themed GitHub repositories, boosting credibility by forging stars and auto-generated commit records to lure developers into adding these dependencies.

- 10:25Analysis: Bitcoin Slightly Above Key Monthly Bull Market Support Level, Market in Recovery PhaseBlockBeats News, on September 4, CryptoQuant analyst Axel Adler Jr stated that any recovery could push the price of bitcoin back above $113,000, moving towards the fair thirty-day average value range. Recent bullish scenarios include a technical rebound to the $113,000–$115,000 range, with capital flows simultaneously stabilizing. The current price of bitcoin at $110,700 is slightly above the short-term holders' (STH) realized price of $107,600 (a key monthly bull market support level). On higher time frames, the outlook remains bullish, but the market is in a repair phase and is more sensitive to profit-taking.

- 10:25Data: Institutions have steadily accumulated Bitcoin this year, increasing their holdings by approximately 400,000 BTC in the first eight months.BlockBeats News, September 4, according to Sentora statistics, since the beginning of this year, the holdings of bitcoin treasury companies have been expanding every month. Despite the continued volatility in the market environment, the steady accumulation indicates lasting institutional confidence. In January this year, bitcoin treasury companies held 1,417,058 BTC, which increased to 1,813,247 BTC as of August.