PENGU Token Experiences Rapid Climb: Genuine Technical Breakthrough or Inflated Hype?

- PENGU token surged 25% in 24 hours, sparking debates over technical breakout vs. speculative bubble. - Technical indicators show conflicting signals: overbought MFI and rising AO vs. weakening RSI and broken support levels. - Derivatives activity and negative funding rates suggest short-covering pressure, but high volatility (14.46%) risks sudden reversals. - Strategic partnerships with Bitso and Medicom Toy hint at long-term potential, though broader market uncertainty remains a key risk. - Traders must

PENGU Token: Is the Recent Price Rally a Breakout or a Bubble?

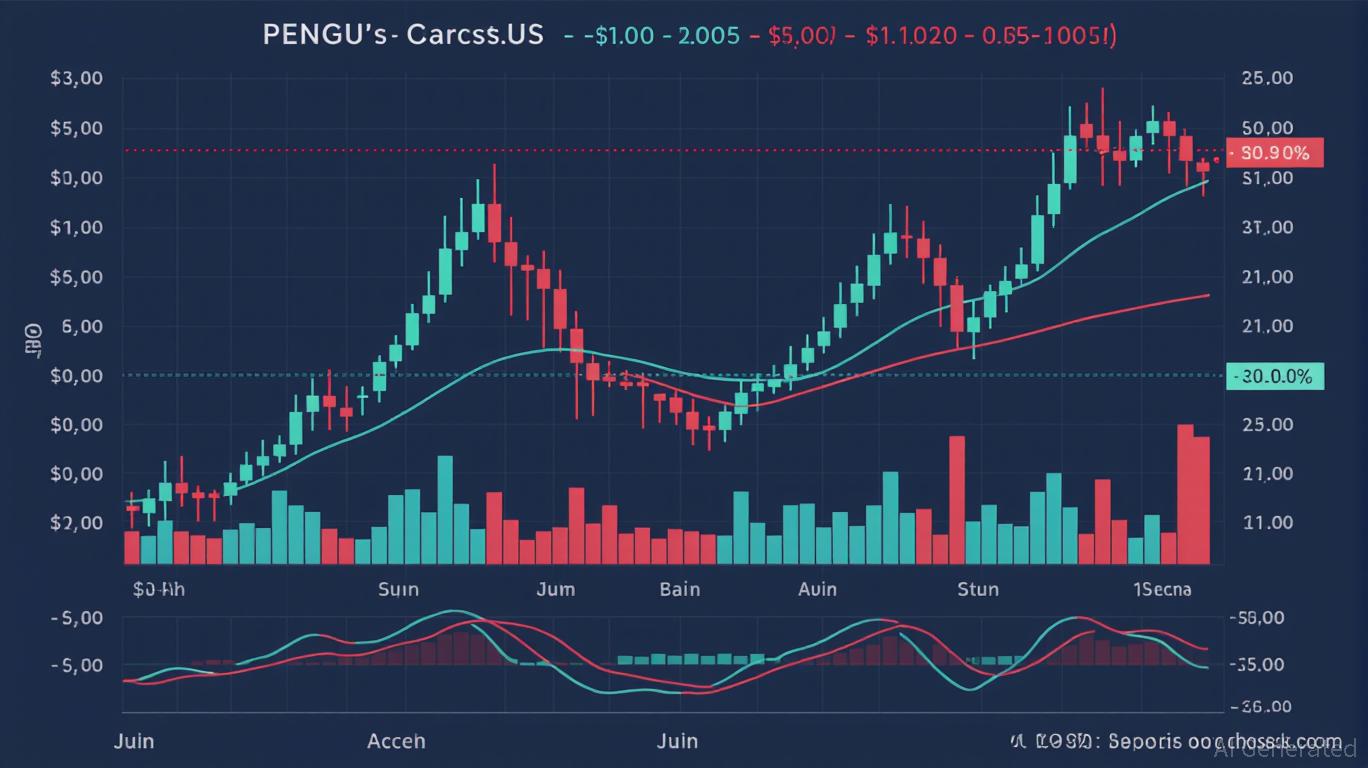

The PENGU token has recently made headlines after soaring by 25% within just one day. This dramatic price movement has ignited discussions among traders and market observers, who are debating whether this surge signals a true technical breakout or is simply the result of speculative trading. As PENGU navigates crucial support and resistance zones, a combination of technical indicators, on-chain data, and overall market sentiment is shaping its outlook.

Technical Overview: Mixed Signals and Crucial Price Zones

Recent trading activity for PENGU highlights a battle between bullish optimism and bearish caution. On the 4-hour chart, the Money Flow Index (MFI) is nearing overbought levels, while the Awesome Oscillator (AO) points to increasing capital inflows—indicating robust short-term momentum. In contrast, the daily chart reveals a declining Relative Strength Index (RSI) and a breach of key support, suggesting that bearish forces remain in play.

Currently, PENGU is consolidating near the $0.0100–$0.0105 range, an area that has historically attracted strong buying interest and sparked price reversals. Should the token break above the $0.0125–$0.0135 resistance band, it would strengthen the bullish case and could open the door to further gains. On the flip side, a drop below $0.010 could trigger a sharp decline toward $0.004, a level not seen since previous bearish cycles.

On-Chain Insights: Derivatives and Market Sentiment

Blockchain data reveals that derivatives trading is playing a significant role in PENGU's heightened volatility. There has been a notable increase in long positions on OKX, indicating that traders are making aggressive bullish bets. At the same time, a negative funding rate—a signal often associated with short squeezes—suggests that short sellers are being forced to exit their positions, which could further propel prices upward.

Spikes in trading volume during support tests point to active buying, especially from both institutional investors and retail traders. However, this positive momentum is fragile. Uncertainty across the broader cryptocurrency market, along with a decline in NFT trading activity, has created a cautious environment that could threaten PENGU’s recent gains.

Opportunity or Overextension?

While both technical and on-chain signals offer some reasons for optimism, PENGU’s volatility—currently at 14.46%, among the highest in the crypto sector—underscores its unpredictable nature. Increased institutional participation and a rise in open interest reflect growing confidence in the token’s potential, but these positives must be balanced against the risk of a wider market downturn.

Strategic partnerships, such as collaborations with Bitso in Latin America and Medicom Toy’s BE@RBRICK series, could enhance PENGU’s long-term prospects by broadening its utility and brand recognition. Nevertheless, these alliances may not be enough to counteract immediate risks if negative sentiment persists across the crypto market.

Final Thoughts: Navigating Uncertainty

PENGU’s recent rally is fueled by a blend of technical momentum and speculative enthusiasm. For those considering entering the market, the $0.0100–$0.0105 support zone is a key area to watch, with a confirmed move above $0.0125 serving as a potential bullish trigger. However, the token’s high volatility and mixed on-chain signals make careful risk management essential.

As the market approaches a pivotal moment, investors must weigh whether PENGU’s ascent is built on solid foundations or is simply a product of short-term hype. The answer will likely depend on the token’s ability to maintain strong trading volumes above resistance levels while withstanding broader market pressures.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Emerging Prospects for Industrial Real Estate in Webster, NY

- Webster , NY, is transforming its industrial real estate through the $9.8M FAST NY Grant, upgrading infrastructure on a 300-acre Xerox brownfield into a high-tech hub. - The initiative aims for a 2% industrial vacancy rate by 2025, boosting residential property values by 10.1% and attracting projects like the $650M fairlife® dairy facility. - Xerox campus reconfiguration and 600 Ridge Road redevelopment, supported by state programs, create shovel-ready spaces with modern infrastructure for advanced manuf

Why Solana's Latest Plunge Highlights Underlying Weaknesses in the Crypto Market

- Solana's 57% price crash in Nov 2025 exposed systemic crypto vulnerabilities, including psychological biases, excessive leverage, and fragile infrastructure. - Token unlocks from Alameda/FTX estates and $30M selling pressure triggered the downturn, yet $101.7M in institutional inflows highlighted market paradoxes. - Fed rate cuts drove $417M into Solana ETFs, but uncertainty caused 14% price drops, revealing crypto's growing integration with traditional finance. - $19B in liquidations during the Oct 11 "

The Growing Impact of Security Systems Technology on the Future Development of Higher Education Infrastructure

- 21st-century higher education infrastructure increasingly relies on advanced security systems to address cyberattacks and campus safety threats. - AI and zero-trust architectures enable proactive threat detection, with 80% of institutions adopting zero-trust strategies by 2025. - Integrated security investments boost enrollment, research credibility, and institutional reputation, though skill gaps and outdated infrastructure hinder full implementation. - ROI extends beyond cost savings, with 60% of stude

Bitcoin Leveraged Position Liquidations and Market Fluctuations: Urging Proactive Risk Control Strategies

- 2025 crypto market saw $21B in leveraged liquidations as Bitcoin's volatility triggered systemic collapses in October and November. - Over-leveraged long positions, social media hype, and automated deleveraging mechanisms fueled cascading losses across exchanges. - Traders shifted to 1-3x leverage and AI-driven risk tools post-liquidations, with 65% reducing exposure in Q4 2025. - Experts emphasize dynamic position sizing, diversification, and 5-15% stablecoin allocations to mitigate volatility risks in