December 3 Key Market Insights - A Must Read! | Alpha Morning Report

1. Top News: Crypto Market Experiences Rebound with Universal Price Surge, SUI and PENGU Up Over 20% 2. Token Unlocking: $HMX, $GFAL, $WMTX

Featured News

1. Cryptocurrency Market Sees Rebound Rally, SUI and PENGU Surge Over 20%

2. Trump Suggests Hassett Will Succeed Powell as Fed Chair, Criticizes Powell for Not Cutting Rates

3. Vanguard Reverses Course on Navigation Attitude, Bank of America Advises Interested Investors to Allocate 1%-4% to Digital Assets

4. Anthropic Initiates IPO Preparation, Earliest Listing Possible in 2026

5. $3.76 Billion Liquidated Across the Network in the Last 24 Hours, Mainly Short Positions

Articles & Threads

1. "Major Update for Global Social Platform Telegram - Your GPU Can Now Mine TON"

Yesterday, Telegram founder Pavel Durov tweeted the launch of their decentralized privacy-preserving computation network, Cocoon. Anyone can become a worker node and earn $TON by leveraging their GPU. Cocoon enables GPU owners to contribute AI compute power to the TON decentralized network. By running the Cocoon protocol stack on a TEE-supported GPU server, one can provide private, verifiable AI model execution and transparently receive $TON payment for each processed request.

2. "Why Did Japan Hike Rates While Bitcoin Crashed?"

The key reason for the significant market volatility was a speech by the Governor of the Bank of Japan, Haruhiko Kuroda, on December 1st in Nagoya, which was very hawkish. The market interpreted this as Japan preparing to raise interest rates. So why did Japan's interest rate hike cause a Bitcoin crash? To understand all this, we must return to the underlying logic of the capital markets: liquidity.

Market Data

Daily Market-wide Funding Heatmap (based on funding rates) and Token Unlocks

Data Source: Coinglass, TokenUnlocks

Funding Rate

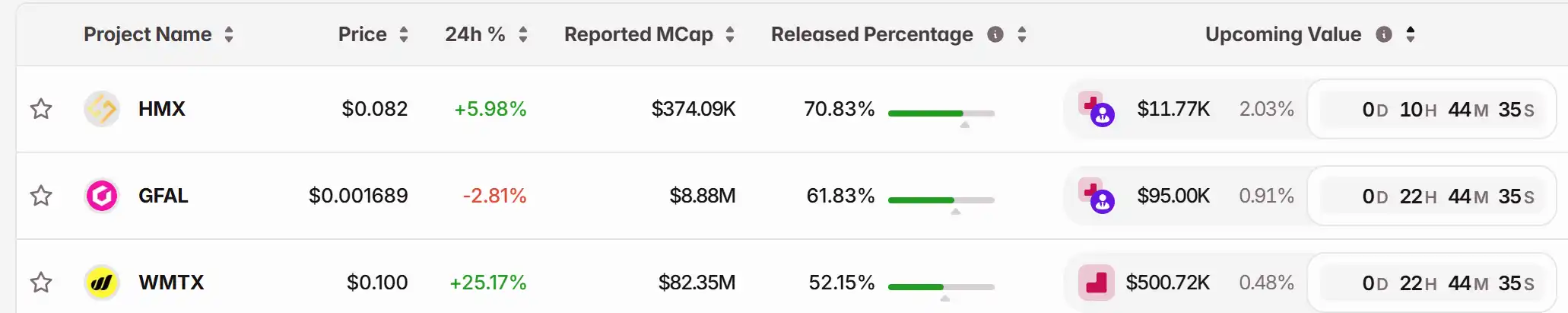

Token Unlocks

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin’s Steep Drop: Uncovering the Triggers and What It Means for Investors

- Bitcoin's 2025 year-end 20% plunge highlights systemic risks and psychological volatility in crypto markets. - Trump's 100% China rare earth tariffs and Fed's 75-basis-point rate hike triggered initial 38% price collapse. - China's crypto ban erased 5% of Bitcoin's value, amplifying global regulatory risks for digital assets. - Algorithmic trading accelerated selloffs by detecting bearish signals faster than human traders could respond. - Investors must prioritize diversification and adapt strategies to

Bitcoin’s Latest Price Swings: Causes, Impacts, and Tactical Prospects

- Bitcoin's 2023-2025 volatility stemmed from macroeconomic uncertainty, delayed Fed rate cuts, and AI-driven credit strains, with prices swinging from $109,000 to $70,000 amid Bybit's security breach. - Regulatory shifts like U.S. Strategic Bitcoin Reserve and custody rules, plus offshore stablecoin risks, exacerbated systemic fragility as crypto financialized through ETFs and derivatives. - Growing equity correlations (e.g., Nasdaq 100) and institutional adoption (MicroStrategy, ETF inflows) highlight Bi

Dogecoin Could Reboot Soon: Rising Wallets Signal Accumulation Around Key Zones

The Impact of New Financial Crises on Technology-Based Asset Classes: Systemic Threats and Hedging Strategies in AI and Blockchain Investment

- AI and blockchain reshape finance but introduce systemic risks like synchronized market crashes. - 2025 Bank of England study warns AI-driven strategies using shared data could trigger cascading liquidity crises. - Blockchain offers resilience via DeFi platforms but crypto volatility creates feedback loops in traditional banking. - Strategic hedging combines AI dynamic portfolios (12% 2024 outperformance) with NIST/EU regulatory frameworks to mitigate risks. - Future stability requires balancing AI innov