3 Meme Coins To Watch In The First Week Of December

Meme coins have had a volatile week, with many tokens observing gains while many others suffer losses. The cascading effect of the broader market’s crash could further impact the meme coins that are noting losses. BeInCrypto has identified three meme coins that investors should watch, considering the market’s movement. Pippin (PIPPIN) PIPPIN has delivered one

Meme coins have had a volatile week, with many tokens observing gains while many others suffer losses. The cascading effect of the broader market’s crash could further impact the meme coins that are noting losses.

BeInCrypto has identified three meme coins that investors should watch, considering the market’s movement.

Pippin (PIPPIN)

PIPPIN has delivered one of the strongest performances of the week, soaring 451% over seven days. The meme coin now trades at $0.152, marking a 10-month high.

PIPPIN is holding above the $0.136 support level, and the Parabolic SAR indicates a continuing uptrend with markers positioned below the candlesticks. This setup could drive the price toward $0.193 and potentially $0.255 if bullish momentum remains intact.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter.

PIPPIN Price Analysis. Source:

PIPPIN Price Analysis. Source:

If the rally loses strength due to profit-taking, PIPPIN could slip below $0.136 and retreat toward $0.100. Such a move would invalidate the bullish thesis and signal the start of a deeper correction.

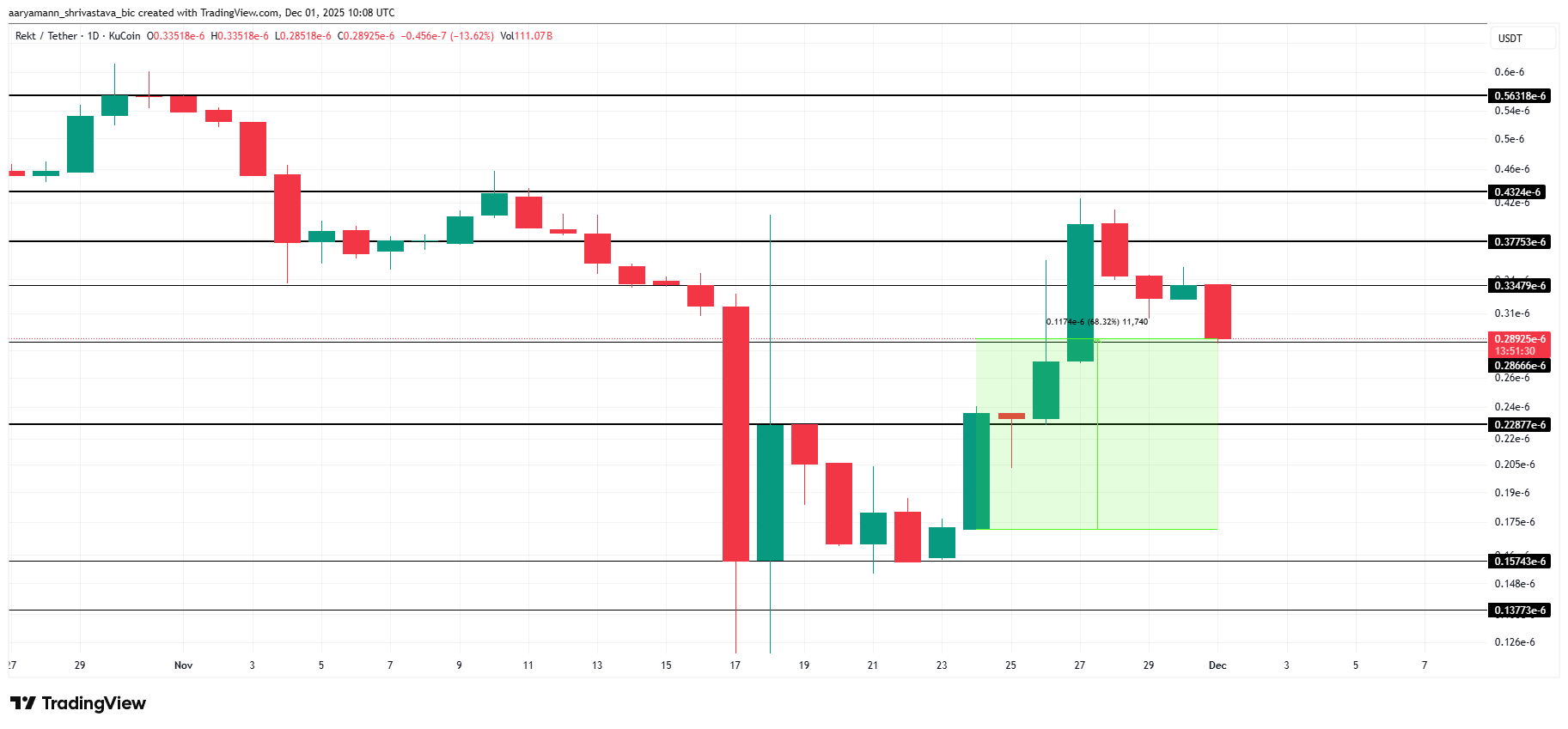

Rekt (REKT)

REKT has emerged as a strong performer despite volatile market conditions, climbing 68% in the past day. The meme coin now trades at $0.0000002892, showing resilience even as broader sentiment leans bearish.

REKT is holding above the $0.0000002866 support level and may attempt an upward bounce if investors provide sufficient backing. A move past $0.0000003347 and $0.0000003775 is essential for the meme coin to revisit the $0.0000004324 local peak.

REKT Price Analysis. Source:

REKT Price Analysis. Source:

If market conditions deteriorate further, REKT could lose its immediate support and drop toward $0.0000002287. Such a decline would invalidate the bullish thesis and signal a deeper correction.

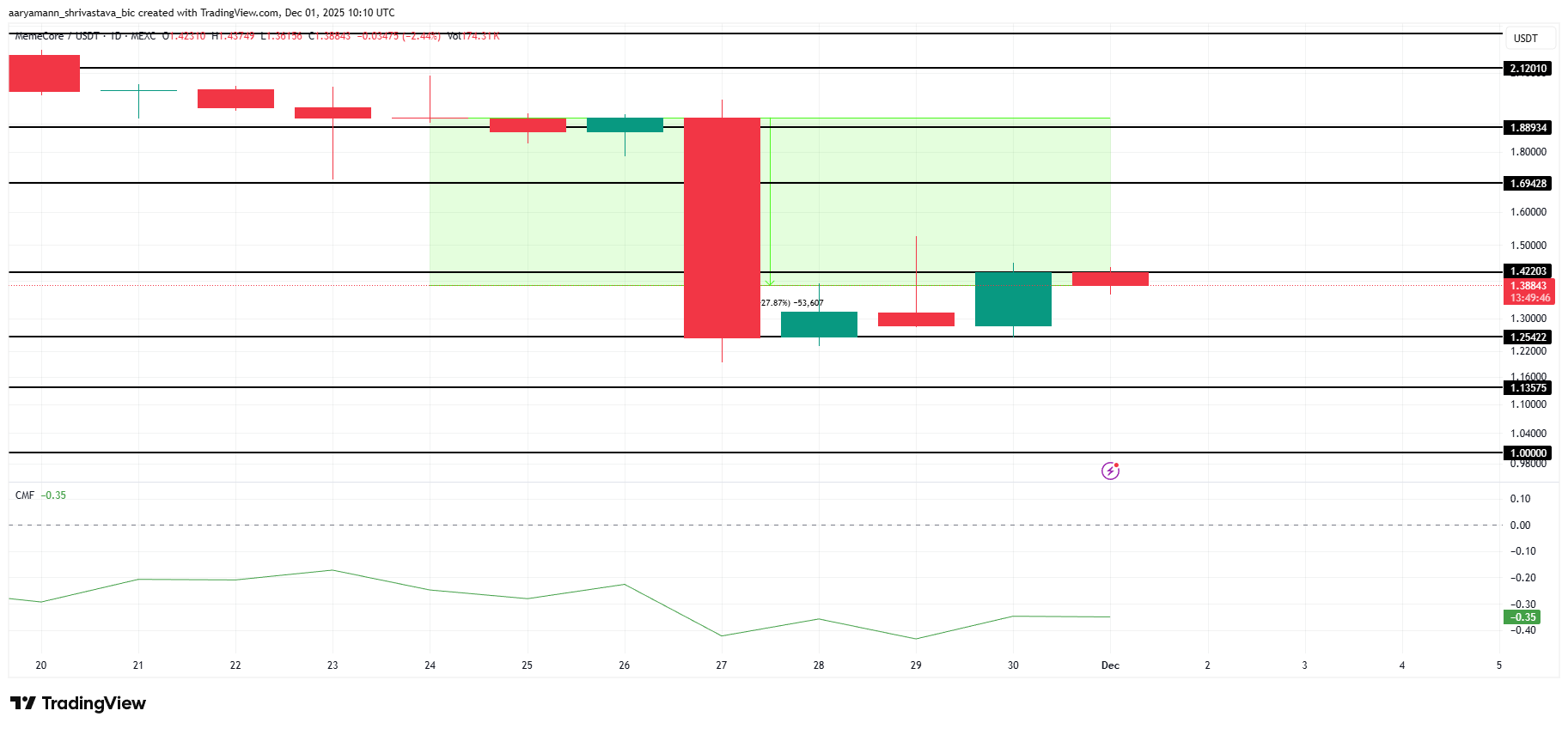

MEMECORE (M)

Memecore fell 27% over the past week and is now trading at $1.38, sitting just below the $1.42 resistance level. The meme coin is struggling to regain momentum after sustained market weakness.

Current CMF readings show strong outflows dominating Memecore, signaling fading investor confidence. If this continues, M could lose the $1.25 support and drop toward $1.13 or even $1.00.

Memecore Price Analysis. Source:

Memecore Price Analysis. Source:

However, if bullish momentum returns, Memecore could rebound and push toward $1.69. Clearing this barrier may open the path to $1.88, which would invalidate the bearish outlook and support a stronger recovery.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin buries the tulip myth after 17 years of proven resilience says ETF expert

Dash's Price Soars 150%: Temporary Volatility or the Start of a Lasting Rally?

- Dash (DASH) surged 150% in June 2025, driven by Platform 2.0 upgrades, institutional adoption, and pro-crypto policies. - Institutional inflows ($780M+), cross-chain interoperability, and retail payment integrations boosted DASH's utility and speculative demand. - Privacy features and 0.80 Bitcoin correlation fueled gains, but 77% PrivateSend opacity and regulatory risks question sustainability. - DASH's future hinges on balancing privacy-transparency trade-offs, macroeconomic clarity, and expanding merc

Investing in Educational Technology as Demand for AI and STEM Expertise Grows

- Global EdTech market valued at $277.2B in 2025 is projected to surge to $907.7B by 2034, driven by AI integration in personalized learning and VR/AR tools. - Investors prioritize platforms aligning academic programs with AI/STEM workforce needs, achieving 20-75% higher ROI through systemic AI adoption across institutions. - Case studies like MIT's $350M AI college and OpenClassrooms' 43,000 career-advancing learners demonstrate scalable ROI from workforce-aligned education models. - Despite uneven AI int

Zcash’s Unpredictable Rise: Immediate Drivers and Future Outlook for Privacy

- Zcash (ZEC) rebounded 20% after a 55% drop, testing $375 as liquidity events and technical indicators fueled short-term optimism. - RSI/MACD signals suggest potential $475 breakout if bulls reclaim $375, though ZEC remains 57% below its 2025 peak. - Institutional adoption grows with Grayscale Zcash Trust assets surging 228%, driven by optional privacy tech attracting both retail and institutional users. - Regulatory scrutiny under MiCA and FinCen rules, plus Zcash's hybrid privacy model vs. Monero/Dash,