Date: Fri, Nov 28, 2025 | 09:42 AM GMT

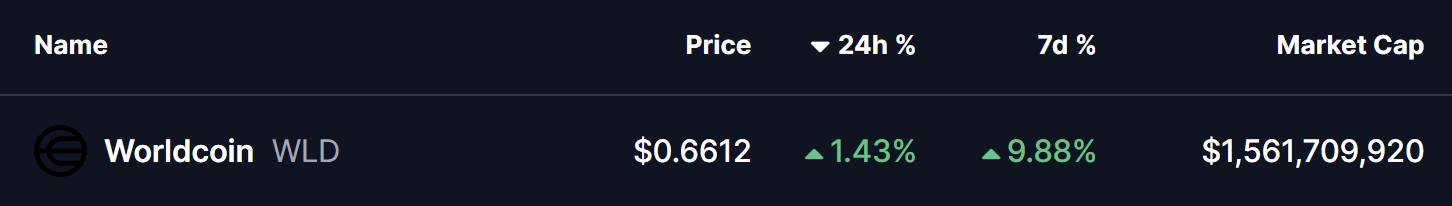

The broader cryptocurrency market continues its steady rebound after last week’s sharp volatility, which dragged Ethereum (ETH) to a low of $2,622 before recovering above the $3,000 mark with 12% weekly gains. This improving sentiment is now helping several altcoins regain momentum — including Worldcoin (WLD).

WLD has climbed over 9% in the last seven days, but what stands out more than the short-term bounce is the emerging structure developing across the chart. A clean fractal setup, closely aligned with a successful breakout pattern from KAS, now appears to be forming — and it may be signalling that a larger shift is quietly underway.

Source: Coinmarketcap

Source: Coinmarketcap

WLD Mirrors KAS’s Breakout Pattern

A direct comparison between WLD and KAS on the daily timeframe shows an almost identical structural behaviour, suggesting that a powerful fractal repetition may be unfolding.

KAS spent several weeks moving within a descending channel before rebounding sharply from the lower boundary. That rebound led into a reclaim of the 50-day moving average, which aligned perfectly with a channel breakout. Once price pushed through that zone, momentum accelerated rapidly, triggering a clean 30% expansion.

KAS and WLD Fractal Chart/Coinsprobe (Source: Tradingview)

KAS and WLD Fractal Chart/Coinsprobe (Source: Tradingview)

WLD now appears to be setting up in a remarkably similar way.

The token has already bounced from the lower edge of its own descending channel and is gradually advancing toward a key resistance — the 50-day moving average, currently positioned near $0.7203. This exact level acted as the structural ignition point in the KAS fractal, and WLD is now approaching it with increasing stability.

What’s Next for WLD?

If WLD continues to follow KAS’s behaviour, a reclaim of the moving average followed by a breakout above the descending channel could act as the spark for the next major upswing. The chart highlights a breakout target at $0.9305 — a potential 41% move from current levels.

The structure remains clean, momentum is gradually shifting, and the fractal alignment between WLD and KAS is difficult to overlook. While fractals don’t guarantee identical results, they often provide early clues about shifting trends — and right now, WLD’s price action is signalling the beginnings of a possible bullish reversal.