BlackRock’s Bitcoin ETF Just Logged a Record Outflow

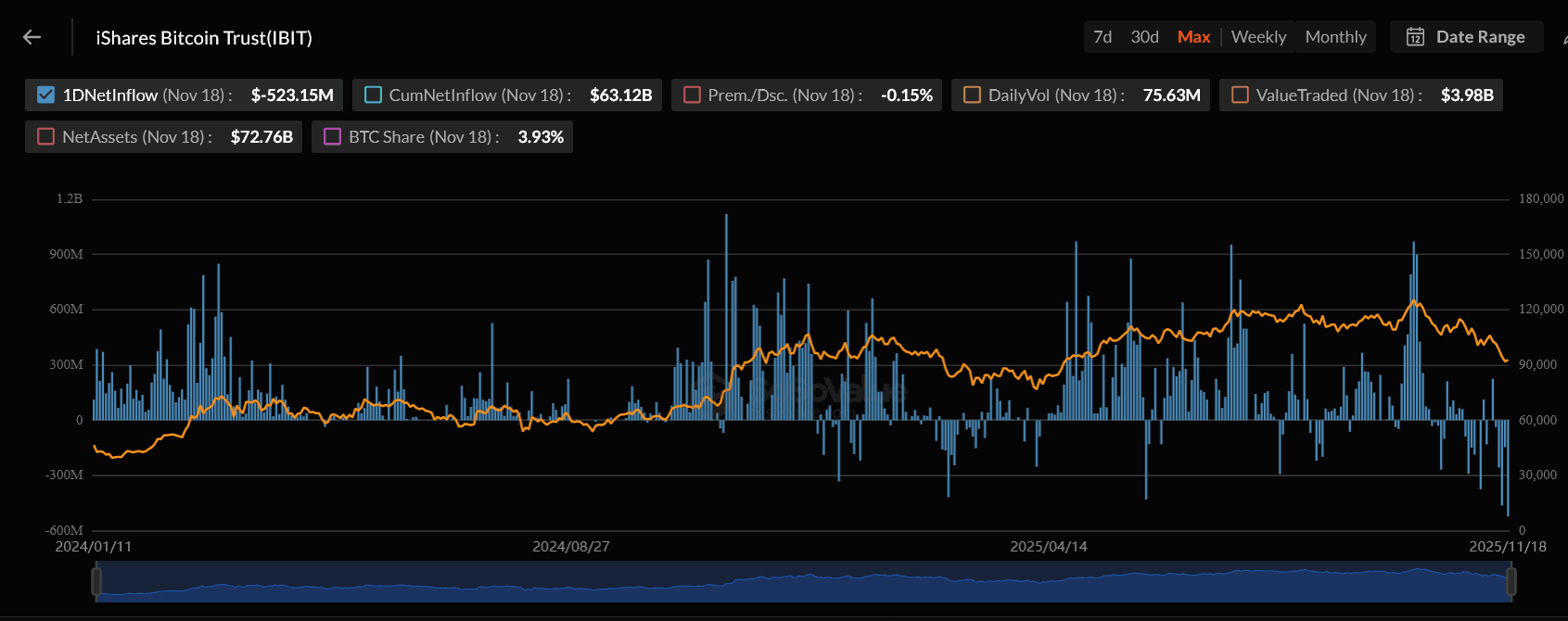

BlackRock’s iShares Bitcoin Trust (IBIT) saw the largest daily net outflow since its launch: $523.15 million leaving in a single day. That figure even beat the previous outflow record set earlier this month. It also capped off five consecutive days of withdrawals that now total $1.43 billion.

IBIT is still the biggest spot bitcoin ETF i n the world, sitting on more than $72 billion in assets, but the tone has shifted. Over the past four weeks, the fund has posted continuous net outflows worth $2.19 billion, lining up almost perfectly with bitcoin’s sharp pullback from its $126,080 all-time high down to below $90,000 earlier this week.

In other words, institutions aren’t dumping bitcoin outright. They’re lightening the load while macro signals remain noisy.

Are Institutions Really Leaving Bitcoin?

Not exactly. Vincent Liu, CIO at Kronos Research, put it plainly: this is recalibration, not capitulation. Big allocators are clipping risk and waiting for clarity. With the U.S. government finally reopening after a prolonged shutdown and the market staring at a December Fed decision that could swing everything, investors are simply protecting themselves.

Bitcoin is already responding with a modest bounce back above $91,000, but liquidity remains tight. The CME’s FedWatch Tool currently shows about a 49 percent chance of a 25-basis-point rate cut next month. Until that becomes more decisive, institutions will probably keep trimming rather than adding.

Also worth noting: IBIT’s giant outflows erased inflows from Grayscale and Franklin Templeton’s bitcoin funds, leaving the entire spot BTC ETF market at a net $372.7 million outflow for the day. Even Ethereum ETFs followed the same script, with BlackRock’s ETHA losing $165 million despite smaller inflows elsewhere.

While Bitcoin Bleeds, Solana ETFs Are Quietly Winning

Now here’s the twist: while bitcoin ETFs are seeing red, Solana ETFs are glowing green.

Tuesday marked the launch of Fidelity’s FSOL and Canary Capital’s SOLC. FSOL pulled in $2.07 million on day one. SOLC saw no flows. But the real action came from the early players:

- Bitwise’s BSOL: $23 million inflows

- Grayscale’s GSOL: $3.19 million inflows

Since BSOL launched on October 28, Solana ETFs have posted 16 straight days of net inflows, totaling $420.4 million.

That streak tells a bigger story. Investors are exploring altcoins that offer yield, activity, and momentum while bitcoin cools off. Liu captures it neatly: Solana is one of the freshest ETFs in the market, and the bundled staking exposure is pulling in a different class of investors—people who want upside plus productive assets.

What About XRP, Litecoin, and Hedera ETFs?

Canary Capital’s spot XRP ETF added $8.32 million on Tuesday, showing steady demand.

Meanwhile, its Litecoin ETF and Hedera ETF didn’t see any flows.

It doesn’t reflect rejection; it reflects attention gravity. Right now, Solana is the hot trade, bitcoin is in risk-off mode, and the rest of the market is waiting for direction.

IBIT’s record outflow is a flashing headline, but not a panic signal. Institutions are moderating exposure until macro conditions settle. Bitcoin remains the anchor, but Solana is the one quietly stealing the spotlight.

If liquidity improves and the Fed leans dovish in December, this entire dynamic could flip again. For now, the rotation tells the real story: capital isn’t leaving crypto—it’s moving around inside it

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Chainlink ETF Set to Debut as LINK Slips Amid Market Weakness

Striking baristas win $38.9 million in compensation, yet contract disputes continue

- Starbucks settles NYC Fair Workweek Law violations for $38.9M, including $35.5M restitution to 15,000+ workers. - Striking baristas demand collective bargaining amid ongoing labor disputes and unionization efforts at 550 stores. - Mayor-elect Mamdani and Sen. Sanders join protests, framing demands as moral issues against corporate resistance. - Settlement addresses 500,000 scheduling violations since 2021, with workers receiving $50/week compensation. - Starbucks defends labor law complexity but faces cr

Alphabet's AI-driven ecosystem accelerates flywheel momentum, driving shares up by 68% in 2025

- Alphabet's stock surged 68% in 2025, outperforming peers like Microsoft and Nvidia , driven by strong AI monetization and cloud growth. - Analysts raised price targets to $375-$335, citing Google Cloud's $15.2B Q3 revenue (34% YoY) and $155B cloud backlog growth. - The company's AI ecosystem spans Search, YouTube, and Workspace, generating premium subscriptions and ad yield through Gemini's 650M MAUs. - Projected cloud revenue could exceed estimates by $40B, but risks include regulatory scrutiny and comp

XRP News Today: Vanguard Changes Position on Crypto ETFs, Pointing to Market Maturity and Increased Demand

- Vanguard Group will enable crypto ETF trading on its platform from December 2, 2025, reversing years of opposition to digital assets. - The firm supports Bitcoin , Ethereum , XRP , and Solana ETFs but excludes memecoins, treating crypto as non-core assets like gold . - Market maturation, $25B+ ETF inflows, and regulatory compliance drive the shift, positioning Vanguard as the last major U.S. broker to adopt crypto ETFs. - The move reflects growing institutional confidence in regulated crypto structures a