KITE Post-IPO Price Movement: Understanding Investor Sentiment and Managing Short-Term Market Fluctuations

- KITE's Q3 2025 results showed a $0.07 EPS loss and $205M revenue, below forecasts, but a 2.1% NOI increase and high-profile retail leases. - Management raised 2025 FFO guidance and boosted dividends 7.4%, yet anchor tenant bankruptcies and re-leasing risks persist in volatile retail markets. - The Fed's rate cuts and OBBBA's $3.4T deficit impact add volatility risks for KITE, a REIT sensitive to interest rates and credit availability. - AI-driven data center demand offers growth potential, but KITE's exp

Earnings Shortfall and Signs of Stability

KITE’s financial results for Q3 2025 revealed notable short-term instability. The company

The company’s move to

Market Sentiment and Volatility Factors

The market landscape in Q4 2025 has shown signs of stabilization, with the S&P 500

For KITE, the commercial real estate (CRE) sector’s uneven performance adds further complexity. The CRE Sentiment Index for Q4 2025

Macroeconomic and Policy Uncertainties

The Federal Reserve’s 0.25% rate reduction in September 2025, intended to address both inflation and economic slowdown, has added a layer of unpredictability. Although this move hints at a possible easing cycle, there are ongoing concerns about the fiscal consequences of the recently enacted "One Big Beautiful Bill Act" (OBBBA), which is

Key Points for Investors

KITE’s journey since its listing underscores the delicate interplay between operational achievements and broader economic pressures. Investors should keep a close eye on the company’s ability to execute its re-leasing plans, particularly in light of anchor tenant bankruptcies, while also considering wider market risks such as the concentration in AI-related sectors and changes in fiscal policy. Maintaining a diversified portfolio is crucial, as the CRE sector’s uneven recovery and the Federal Reserve’s policy direction could trigger significant price volatility in the short term.

To sum up, KITE’s shares reflect the combined challenges of a rapidly changing retail sector and a turbulent economic backdrop. While its operational improvements and rising dividends provide some encouragement, the outlook remains clouded by near-term uncertainties that call for careful and informed investment choices.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Vanguard Breaks Conservative Tradition, Opens to Crypto ETFs

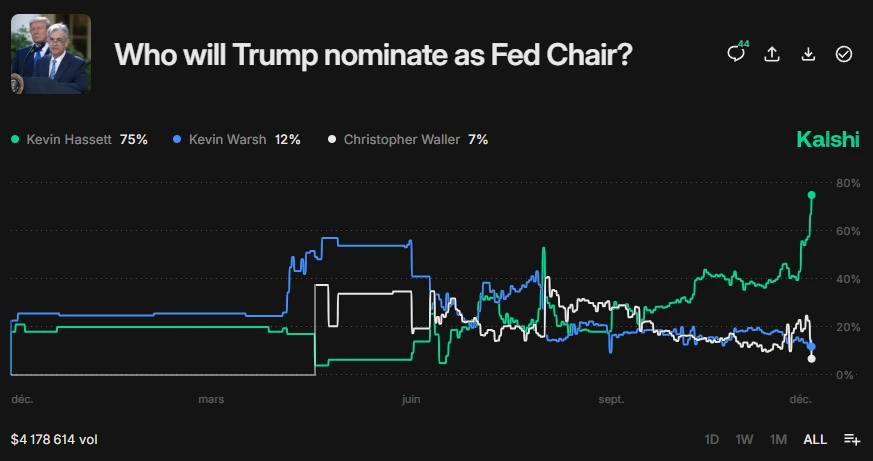

Trump’s Fed Chair Announcement Likely This Week: Is It the Needed Crypto Bullish Catalyst?

XRP Price News: Breakout or Breakdown?

Huione Pay Halts Withdrawals After Run on Banks, Users Fear Major Losses