Major Exchange Listings Fail to Boost Prices as Crypto Market Sentiment Nosedives

Exchange listings that once triggered sharp rallies are now falling flat, with tokens dropping despite new market exposure as Extreme Fear and heavy liquidations shape trading behavior.

Recently, crypto token listings on major exchanges have failed to generate sustained price rallies, signaling a significant shift in market behavior.

This comes as the entire crypto market remains under pressure, with investor sentiment deteriorating sharply as losses deepen across the board.

Are Crypto Exchange Listings Losing Impact?

Historically, major exchange listings have been accompanied by sharp price surges. This happens because listings often increase visibility, expand liquidity, and attract new buyers. As a result, tokens typically experience a rapid influx of trading activity and interest immediately after going live.

However, in November 2025, the trend has slowed. For instance, today, OKX, one of the leading crypto exchanges, announced the listing of SEI (SEI) and DoubleZero (2Z).

“OKX is pleased to announce the listing of SEI (Sei), 2Z (DoubleZero) on our spot trading markets. SEI, 2Z deposits will open at 3:00 am UTC on November 14, 2025. SEI/USDT spot trading will open at 7:00 am UTC on Nov 14, 2025. 2Z/USDT spot trading will open at 9:00 am UTC on Nov 14, 2025,” the announcement read.

Nonetheless, neither token saw significant gains. BeInCrypto Markets data showed that SEI has dipped by over 8% in the past 24 hours. At the time of writing, it was trading at $0.16. At the same time, 2Z has fallen nearly 5% to $0.16.

This subdued reaction isn’t isolated. Other major platforms show similar behavior. Coinbase added Plasma (XPL) and Toncoin (TON) to its listing roadmap on November 13. The former jumped by around 8% after nearly 90 minutes of the announcement, while TON rose from $2.0 to $2.05.

However, the latest market data showed that both coins were down today. XPL traded at $0.23, down nearly 12% over the past day. TON dropped 6.4% in the same period to $1.94.

Lastly, BeInCrypto reported that Binance listed Lorenzo Protocol (BANK) and Meteora (MET) yesterday. These tokens saw brief, sharp pre-listing surges—60% for BANK and 8.6% for MET—but quickly lost traction. The altcoins closed in red on November 13.

According to the latest price data, BANK has lost nearly 46% of its value in the past day alone. Furthermore, MET has slipped nearly 1%. This highlights how cautious capital inflows are diminishing the impact of exchange listings on price performance.

Market Sentiment Reaches Extreme Fear

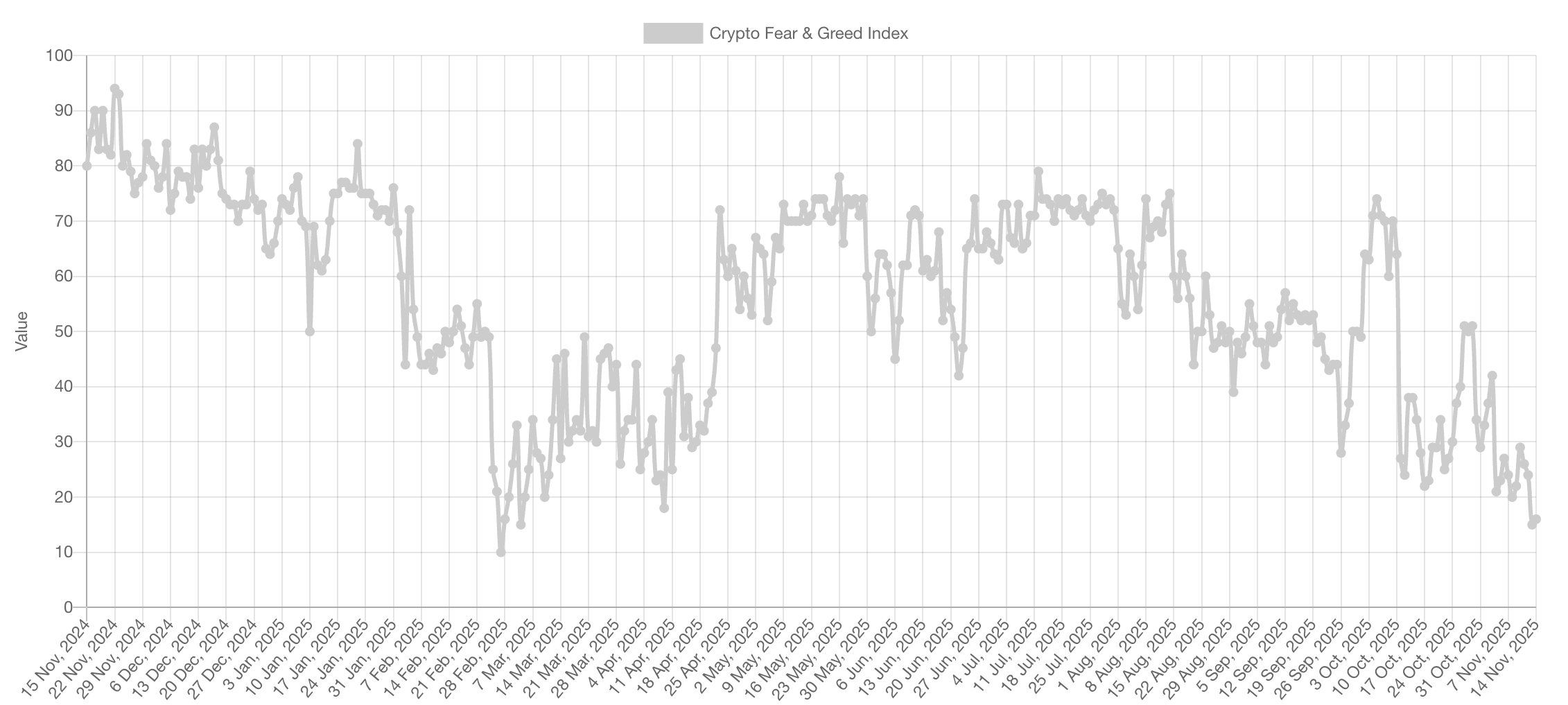

The shift could likely be tied to deteriorating sentiment, which continues to shape trader behavior across the market. The Crypto Fear and Greed Index, widely regarded as a gauge of market sentiment, has plummeted into “Extreme Fear.” Yesterday, the index dropped to 15, its lowest level since February.

Crypto Fear and Greed Index. Source:

Alternative.me

Crypto Fear and Greed Index. Source:

Alternative.me

A surge of liquidations has amplified the market’s difficulties. CoinGlass data shows that over $900 million in long positions were liquidated over the past 24 hours. Overall, the crypto liquidations affected 249,520 traders, resulting in widespread losses and weakening their market position.

With confidence collapsing and liquidity thinning, traders may be more focused on preserving capital than chasing exchange listings. The market is now driven primarily by fear and defensive positioning, overshadowing the speculative enthusiasm that once fueled sharp post-listing rallies.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The CFTC-Sanctioned Transformation in Clean Energy Trading

- CFTC's 2025 withdrawal of carbon credit derivatives guidance creates regulatory uncertainty but sparks innovation in blockchain/AI solutions. - OBBBA's 2026 construction deadline accelerates solar/wind project cancellations while preserving tax credit transferability mechanisms. - Battery storage, geothermal, and hydrogen emerge as resilient sectors amid market shifts, supported by IRA tax credits and OZ modernization. - Investors prioritizing domestic supply chains and third-party certified projects gai

Aligning university programs with new technology sectors to pinpoint areas with strong investment potential

- Higher education is redefining curricula to align with AI, quantum computing, green energy, and biotech sectors, addressing urgent talent gaps. - Green energy apprenticeships (e.g., ACE Network) and biotech-AI hybrid training programs are scaling rapidly to meet workforce demands. - Quantum computing initiatives like Connecticut's $1B QuantumCT plan highlight trillion-dollar investment potential in talent development and infrastructure. - AI ethics integration and edtech platforms for real-time labor mar

Tight Range Emerges: PEPE Trades at $0.054368 With 4.1% Weekly Decline and Key Levels in Focus

XRP Holds Steady Near $2.02 as 5-Day Chart Points to a Repeating Candle Structure