Key Market Information Discrepancy on November 14th - A Must-See! | Alpha Morning Report

Editor's Picks

1.Crypto Market Suffers Another Blow as Bitcoin Touches $98,000, US Stock Crypto Concept Stocks Fall Across the Board

2.Musk Announces X Money Will Soon Go Live

3.Aster Launches DEXE Trading Event with Rewards Totaling Over $200,000

4.Boosted by Robinhood Listing, AVNT Surges Over 8%

5.Total Liquidations in the Past 24 Hours Soar to $748 Million, Over 197,000 People Liquidated

Articles & Threads

1. "The New Era of Token Financing, a Milestone in US Regulatory Financing"

The discussion about Monad's ICO on Coinbase with a $25 billion FDV was a hot topic this week. Apart from debating whether the sale at a $25 billion FDV is worth participating in, the "compliance level" as Coinbase's first ICO also sparked widespread discussion and was seen as a landmark event in the industry's compliance. Stablecoin issuer Circle mentioned in its recent quarterly report that it is exploring the possibility of issuing native tokens on the Arc Network. Coinbase also hinted at the launch of the Base token this October, almost two years after the joint founder of Base Chain, Jesse Pollak, said in an interview. All signs indicate that asset issuance in the industry is entering a new era of compliance.

2. "Major Adjustment in U.S. Crypto Regulation, CFTC Could Take Over Spot Market"

The long-standing blurred boundary of crypto regulation in the United States is being redrawn. With Mike Selig nominated as CFTC chairman and Congress advancing new legislation, the division of labor between the SEC and CFTC is emerging for the first time at a policy level, and a rare clear trend in the regulatory structure is appearing: the SEC focuses on securities; the CFTC focuses on the digital commodity spot market.

Market Data

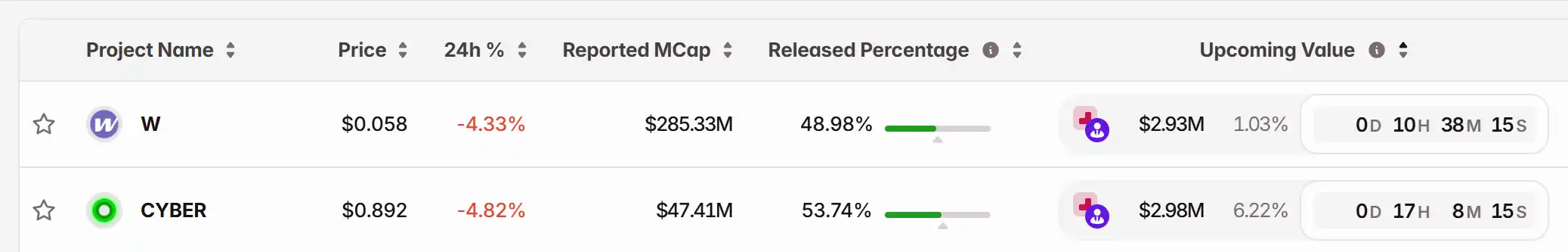

Daily Marketwide Capital Flow Heatmap (reflected by funding rate) and Token Unlocks

Data Source: Coinglass, TokenUnlocks

Funding Rate

Token Unlocks

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ZEC drops 5.9% over 24 hours as significant institutional funds flow in

- Zcash (ZEC) fell 5.9% in 24 hours amid a 20.64% 7-day drop, but gained 768.62% over one year. - Cypherpunk Technologies acquired 1.25% of ZEC supply via a $58.88M Winklevoss Capital-backed investment, aiming to accumulate 5% total supply. - Tyler Winklevoss positioned Zcash as "encrypted Bitcoin ," emphasizing privacy-driven value transfer and potential to capture Bitcoin's market share. - Technical analysis shows ZEC breaking key support levels with RSI near neutrality, while institutional activity reve

LUNA Drops 2.7% Over 24 Hours as Overall Market Shows Signs of Weakness

- LUNA fell 2.7% in 24 hours to $0.0788, continuing a 12.29% weekly and 15.2% monthly decline. - Technical indicators show bearish momentum, with RSI below key support and MACD in negative territory. - The drop reflects broader market caution and waning investor confidence amid persistent risk-off behavior.

Bitcoin News Today: The Bipartisan Promise of Bitcoin: Defined by Fundamental Principles Rather Than Political Agendas

- BTC Policy Institute study reveals Bitcoin's bipartisan appeal in U.S. politics, with Democrats valuing financial inclusion and Republicans/Independents prioritizing energy benefits and anti-government control. - Market data shows $1.15M ETF inflow and rising spot trading volume ($14.1B) on Nov 11, 2025, signaling stabilization amid $100K price floor support and geopolitical tensions over BTC seizures. - Institutional innovation like Amboss-Voltage's Lightning Network payments system reduces processing c

LINK Chart Points Toward $29.57 $49.28 and $79.21 as Channels Hold