Key Market Information Gap on November 12th - A Must-Read! | Alpha Morning Report

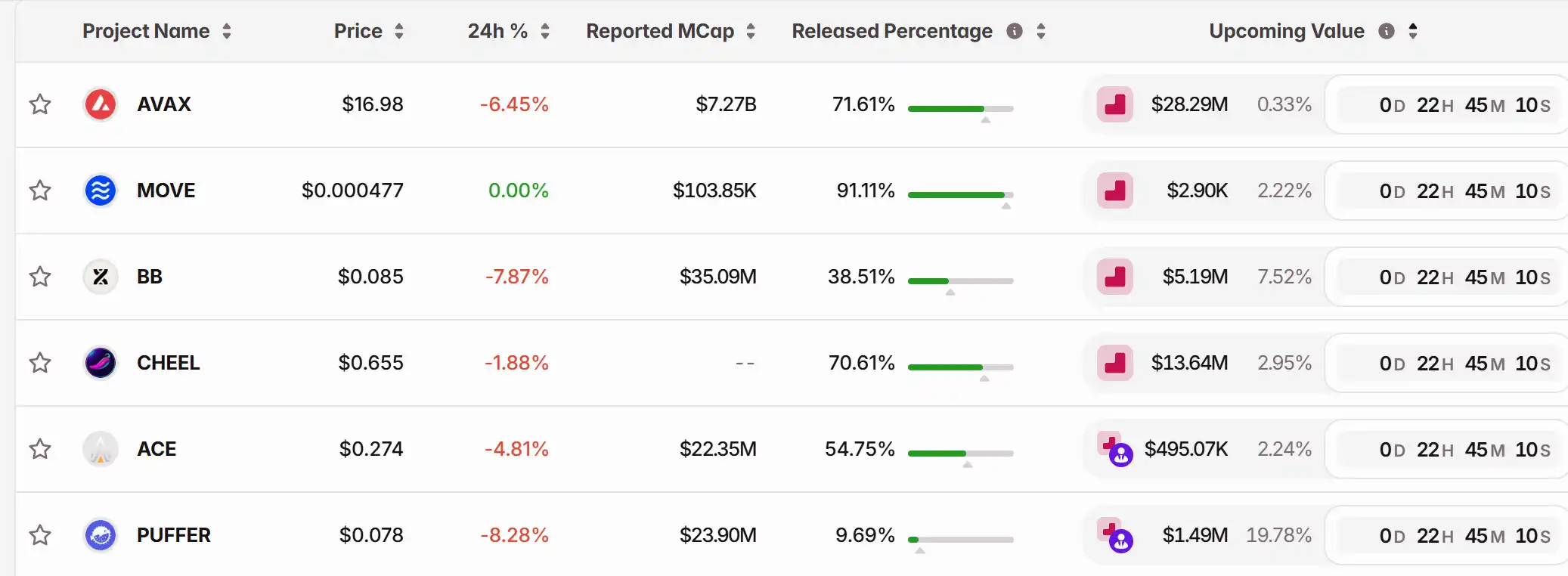

1. Top News: CFX Surpasses $0.14, Up Over 45% in 24 Hours 2. Token Unlock: $AVAX, $MOVE, $BB, $CHEEL, $ACE, $PUFFER

Featured News

1.CFX Breaks $0.14, Surges Over 45% in 24 Hours

2.US Stock Market Closing with Mixed Moves, Crypto Stocks Generally Down

3.$4.11 Billion Liquidated Across the Board in the Past 24 Hours, Mainly Longs

4.Coinbase Cancels $2 Billion Acquisition of Stablecoin Startup BVNK

5.SOL Reserves Strategy Firm Upexi Reveals "Record-Breaking" Quarterly Performance, Staking Rewards Reach $6.1 Million

Articles & Threads

1.《Destruction, Uniswap's Last Ace》

Waking up, UNI surged nearly 40%, leading the entire DeFi sector in a general uptrend. The reason for the rise is that Uniswap revealed its last ace. Uniswap founder Hayden proposed a new proposal focusing on the age-old "fee switch" topic. In fact, this proposal has been raised 7 times in the past two years, not new to the Uniswap community. However, this time is different, as the proposal is personally initiated by Hayden and covers a series of measures including fee switch, token burning, Labs and Foundation merger.

2.《Winning the Championship Thanks to Faker, He Earned Nearly $3 Million》

The League of Legends S15 Global Finals has come to an end, and Faker once again stood on the highest award podium, securing his 6th championship title, continuing to write his legend. In the crypto world, with the rise of prediction markets, players are enjoying esports events while participating in the prediction markets. Among the many crypto players participating in prediction markets, an ID named "fengdubiying (Sure Bet Sure Win)" has become a new legend. In the final prediction of T1 versus KT, he boldly wagered around $1.58 million on T1's victory, ultimately earning approximately $820,000 in profit.

Market Data

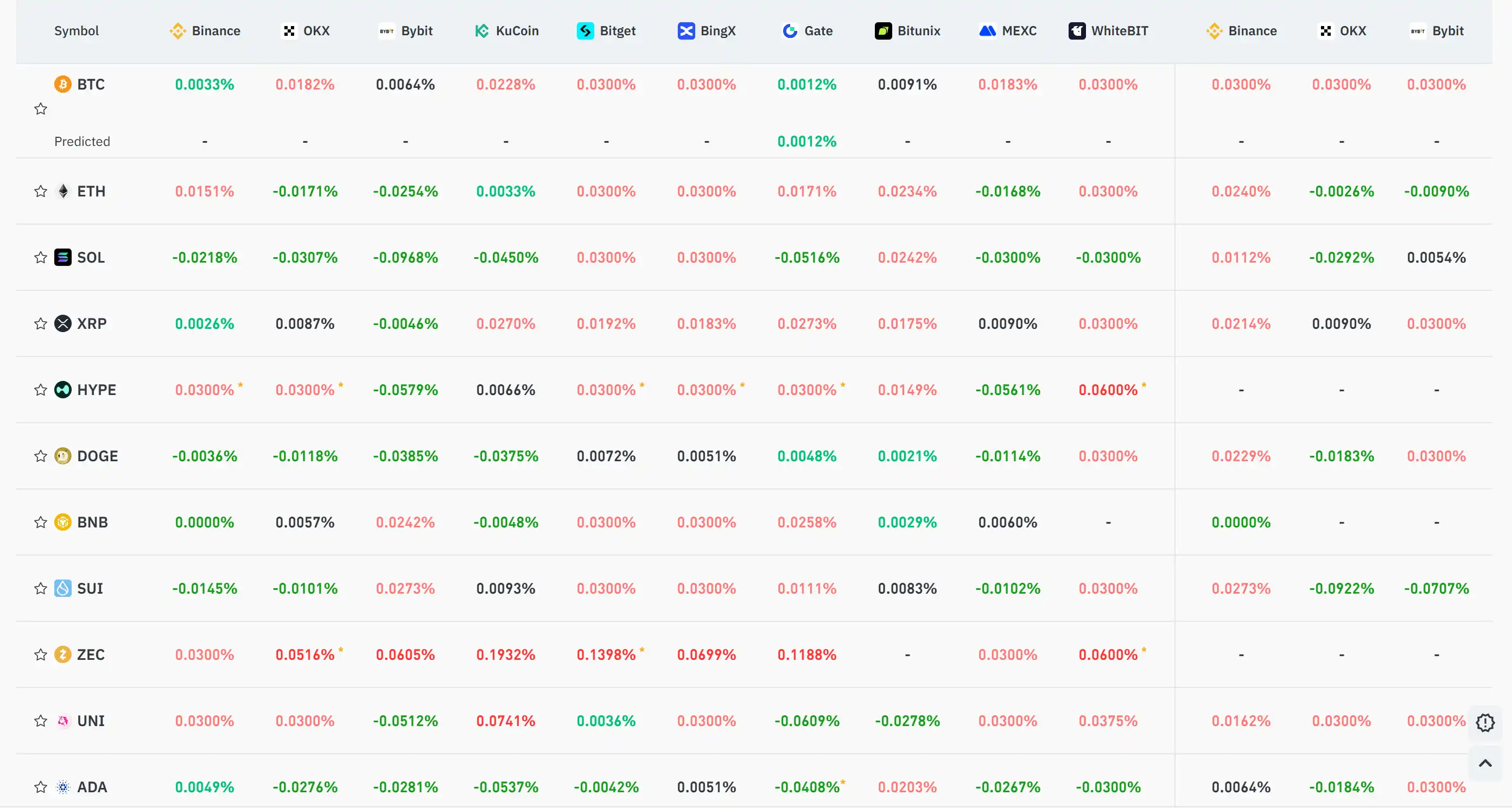

Daily Market Overall Fund Heat (Reflected by Funding Rate) and Token Unlocks

Data Source: Coinglass, TokenUnlocks

Funding Rate

Token Unlocks

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Trump’s Wall Street Fundraiser Sparks Renewed Debate Over Deregulation and Regulatory Oversight Following Trade Finance Crisis

- Trump dined with Wall Street leaders amid First Brands' $3B trade finance collapse, exposing non-bank lending risks and triggering calls for stricter oversight. - Jefferies faces scrutiny over $3B in tied debt as its stock fell 19%, while JPMorgan's Dimon warned of systemic gaps in non-bank lending oversight. - Trump's 50-year mortgage proposal sparked debate, with critics fearing "debt for life," while a 42-day government shutdown worsened market uncertainty. - The administration's deregulatory agenda c

Digital Identity, No Data Required: ZK Protocol Secures $9M to Champion a Privacy-Centric Tomorrow

- Self Labs raised $9M in seed funding led by Greenfield Capital and SoftBank, with participation from Web3 leaders like Sreeram Kannan and Sandeep Nailwal. - The ZK-based platform enables privacy-preserving identity verification using zero-knowledge proofs and supports 129 countries' biometric passports and India's Aadhaar system. - A points-based rewards program incentivizes on-chain verification, while integrations with Google, Aave , and Velodrome expand use cases like token distribution and age checks

Bitcoin’s Sharp Decline: Is This a Healthy Correction or an Ominous Signal?

- Bitcoin fell 10.5% in November 2025 amid a $19B derivatives crash, driven by Fed policy uncertainty and U.S.-China trade tensions. - Regulatory shifts and leveraged liquidations (1.6M traders impacted) exposed vulnerabilities in crypto's derivatives-heavy market structure. - Institutional demand persisted (e.g., JPMorgan's 64% ETF stake increase), suggesting long-term adoption despite short-term volatility. - Derivatives recovery may lag until 2026, hinging on Fed rate clarity and inflation trends, with

Bitcoin Leverage Liquidation Spike: Systemic Threats in Crypto Derivatives During Q4 2025 Market Turbulence

- Q4 2025 crypto derivatives saw $20B in liquidations as Bitcoin fell below $100,000, exposing systemic risks from extreme leverage (up to 1,001:1) and interconnected markets. - Platforms like Hyperliquid and Binance faced $500M+ losses in 24 hours due to cascading margin calls, with 78% of perpetual futures volume amplifying volatility through feedback loops. - Regulators scramble to address risks as unregulated leverage, macroeconomic pressures, and geopolitical tensions (e.g., U.S.-China trade wars) inc