Curve Finance revenue doubles in strong Q3, volume hit $29b

Decentralized finance protocol Curve Finance saw a notable increase in platform revenue in the third quarter of 2025, with trading volume also surging among other core metrics.

- Curve Finance revenue rose in strong Q3, with trading volume hitting $29 billion.

- Revenue rose from $3.9 million to $7.3 million, and was fully redistributed to veCRV holders.

- Data shows the protocol’s DEX trading volume hit $11 billion in October.

Curve Finance announced its third-quarter (Q3) 2025 growth report on Tuesday, November 11, highlighting a more than double increase in protocol revenue over the quarter. With a strong second half of the year to build on, Curve DAO ( CRV ) saw its three-month revenue jump to $7.3 million.

The platform, which redistributed a share of the generated revenue to veCRV holders, had ended Q2 with $3.9 million.

Meanwhile, momentum across stablecoin trading, helped by deeper liquidity, saw trading volume spike to $29 billion. Curve reported $25.5 billion in cumulative trading volume for the quarter ending June 30, 2025. In Q3, the DeFi protocol’s total value locked rose from $2.1 billion to $2.3 billion.

DEX trading volume jumped $11 billion in October, reaching a six-month high and signalling fresh DeFi momentum. Curve founder Michael Egorov reposted the metric below.

What drove Curve Finance’s Q3 gains?

According to the Curve Finance team, stablecoin demand is behind the momentum that drove the protocol’s Q3 outperformance.

Notably, the platform’s native stablecoin, crvUSD, remains steady, with volume hovering around $124 million and a market cap of $278 million. Volume on the day was up 25%, with this suggesting consistent usage as Curve prepares for Yield Basis integration.

Yield Basis is a new protocol by Curve Finance founder Egorov.

The project also documented key milestones, including multi-chain expansion across Plasma and Etherlink. Meanwhile, a PYUSD/USDS liquidity pool launched via a Spark partnership has swiftly surpassed $90 million in TVL.

CRV, the native Curve DAO token, is listed on Robinhood , which provides broader access and adoption in the U.S. market. The token traded around $0.48, about 18% up over the past week.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

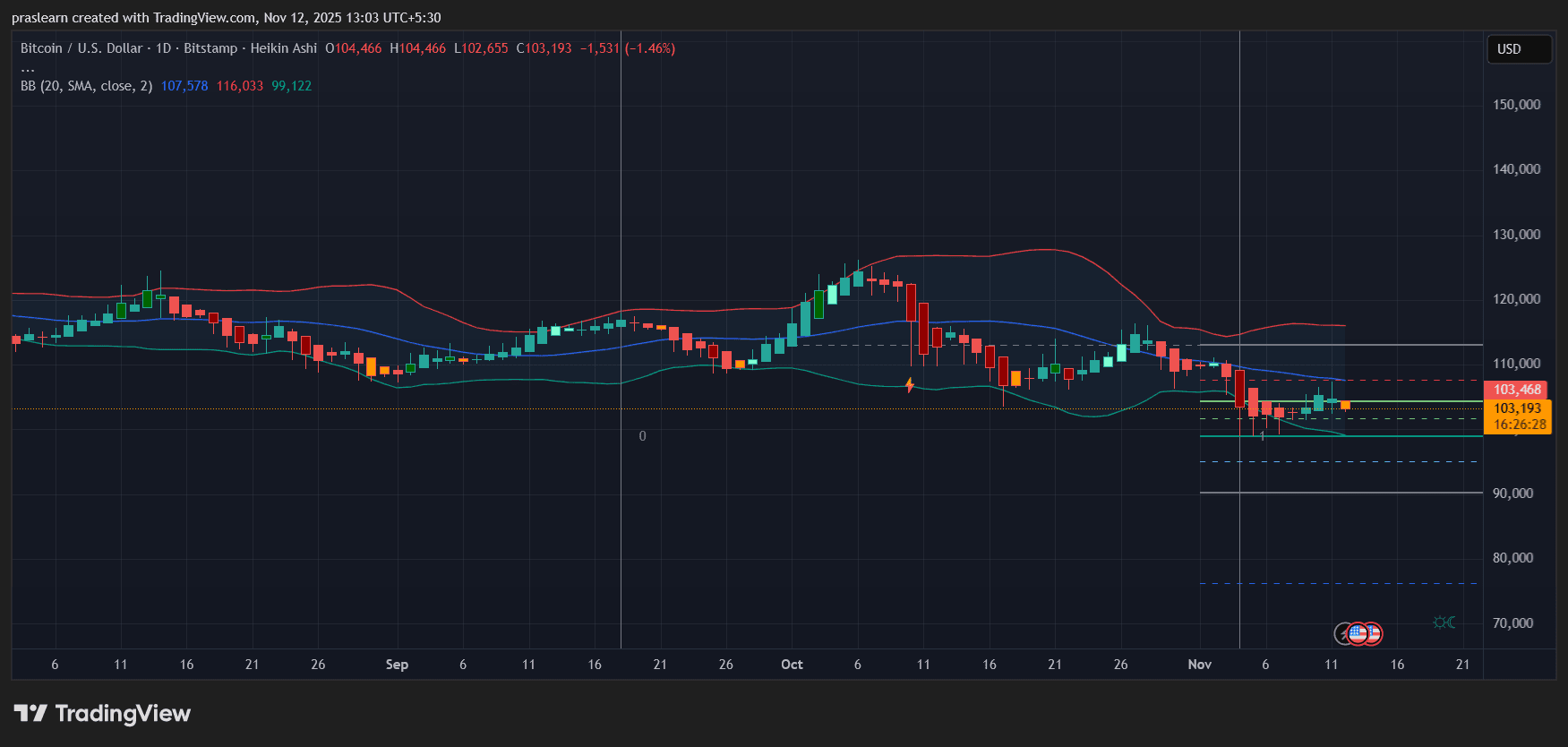

Bitcoin Faces a Reality Check as Small Business Optimism Crashes

Zcash Latest Updates: Privacy-Focused Funding: Cypherpunk Makes Major Investment in Zcash’s Secure Tomorrow

- Cypherpunk Technologies rebranded to Zcash-focused entity, acquiring $50M in ZEC via Winklevoss Capital-led funding. - The move positions it as a privacy-centric crypto treasury pioneer, contrasting with Bitcoin-centric corporate strategies. - Zcash's institutional adoption grows despite volatility, with 20–25% of tokens in shielded addresses and regulatory clarity emerging. - The firm balances biotech R&D with crypto operations, pending shareholder approval for its dual-track strategy on December 15, 20

Circle’s Rapid USDC Expansion Fails to Boost Struggling Shares Amid Rising Expenses and Divided Analyst Opinions

- Circle reported strong Q3 2025 results with $73.7B USDC growth but stock fell 5.4% premarket as costs rise and analysts split. - Revenue surged 66% to $740M while net income jumped 202% to $214M, yet RLDC margins dropped 270 bps to 39% amid expanding balances. - Arc blockchain's public testnet attracted 100+ institutional participants, with partnerships announced with Deutsche Börse and Visa to expand stablecoin adoption. - Analysts remain divided: J.P. Morgan "Sell" vs. Monness Crespi "Buy" at $150, whi

Bitcoin News Update: SoFi Integrates Cryptocurrency with Conventional Banking, Sets the Stage for a Decentralized Tomorrow

- SoFi becomes first FDIC-insured U.S. bank to launch integrated crypto trading via its app, offering BTC, ETH, and SOL alongside traditional services. - The 2025 relaunch follows regulatory clarity from the OCC enabling crypto custody and execution, addressing prior compliance uncertainties. - CEO Anthony Noto emphasizes blockchain's potential to reshape finance through faster, cheaper transactions, aligning with 60% member preference for bank-based crypto trading. - SoFi's platform combines FDIC-insured