Key Market Intelligence on November 11th, how much did you miss?

Top News

1. The U.S. Senate approves a bill to end the government shutdown and sends it to the House

2. On-chain tokens related to the Base ecosystem see a general decline today, with tokens like PAY AI and PING dropping over 20%

3. Coinbase discloses full details of the Monad document, including market maker fund size and protocol cycle, with third-party oversight of market maker token usage

4. FARTCOIN's market value briefly drops by 10%, with over $7.8 million in liquidations in less than 1 hour, ranking first in network-wide liquidations

5. UNI retraces about 20% from the daily high and is currently priced at $8.246

Featured Articles

1. "Destruction is Uniswap's last trump card"

Waking up, UNI surged by nearly 40%, leading a general DeFi rally. The reason for the rise is that Uniswap revealed its last trump card. Uniswap founder Hayden released a new proposal focused on the age-old "fee switch" topic. In fact, this proposal has been put forward 7 times in the past two years, so it is not new to the Uniswap community. However, this time is different. The proposal is initiated by Hayden himself, and in addition to the fee switch, it also includes a series of measures such as token burning, Labs, and Foundation merger.

2. "Earning Nearly $3 Million by Winning the Championship with Faker"

The League of Legends S15 Global Finals has come to a close, and Faker has once again stood on the highest award podium, claiming his 6th championship title and continuing to write his legend. In the cryptocurrency community, as the prediction market has risen, players have been enjoying esports events while participating in the prediction market. Among the many cryptocurrency players involved in the prediction market, an ID named "fengdubiying (Winning at Every Bet)" has become a new legend. In the prediction for the T1 vs. KT finals, he boldly wagered around $1.58 million on T1's victory, ultimately making a profit of around $820,000.

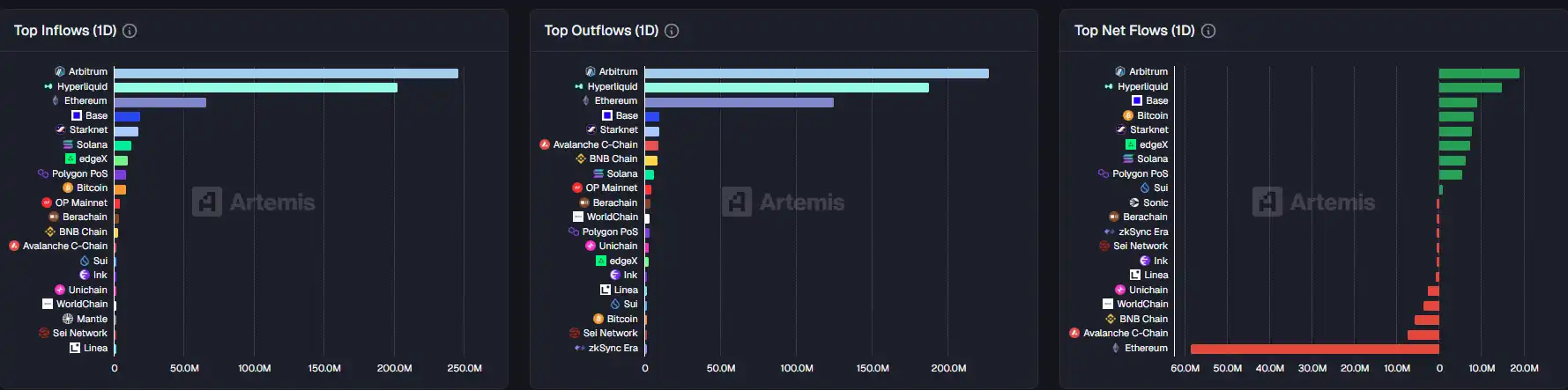

On-chain Data

On-chain Fund Flow last week on November 11

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

JPMorgan and DBS Establish Interoperability Framework to Transform Worldwide Tokenized Financial Systems

- JPMorgan and DBS Bank partner to create a blockchain-based interoperability framework for tokenized deposits, aiming to revolutionize cross-border institutional payments and set digital finance standards. - The framework enables real-time 24/7 settlements across public and permissioned blockchains, allowing seamless exchange of tokenized deposits between institutions via JPMorgan's Kinexys and DBS's tokenization expertise. - By addressing ecosystem fragmentation and enhancing operational flexibility, the

Europe’s AI Application Ecosystem: Ten Years of Momentum Poses a Challenge to US Dominance

- Europe and Israel are closing the AI application gap with the U.S., per Accel's 2025 report. - European startups now secure 66% of U.S. private funding, up from 10% a decade ago. - The application layer focuses on real-world solutions, leveraging technical talent and industry expertise. - Traditional cloud firms integrate AI, while ethical governance strengthens Europe's position. - Challenges include hardware supply bottlenecks and financial pressures on top firms.

MUTM's Two-Tier Lending Approach Projects Returns Up to 50 Times

- Mutuum Finance (MUTM) has raised $18.5M in presale, with Phase 6 nearing 95% allocation at $0.035. - Analysts project 50x returns by 2026 ($3.00) due to its dual-lending model (P2C/P2P) and 45,000% long-term growth potential. - The project features 90/100 CertiK audit, $50K bug bounty, and plans for a Sepolia testnet stablecoin by Q4 2025. - With 45.5% supply sold and Phase 7 priced at $0.04, MUTM aims to disrupt DeFi lending through institutional-grade security and decentralized governance.

Dogecoin News Today: The 2025 Cryptocurrency Split: Is DOGE Driven by Hype or MUTM Leading DeFi Advancements?

- Dogecoin (DOGE) surges to $0.17 amid Bitwise ETF approval progress, but analysts question its long-term viability beyond speculative hype. - Mutuum Finance (MUTM) nears $18.6M in Phase 6 presale, attracting 17,900 investors with a projected 400% return if listed at $0.06. - MUTM's structured growth (250% from $0.01) and DeFi lending innovation contrast with DOGE's reliance on regulatory tailwinds and viral momentum. - Institutional crypto whales shift focus to MUTM's dual-lending model as Solana ETFs dra