Chinese electric vehicles push Ford to rethink its strategy as it faces major challenges and tariff issues

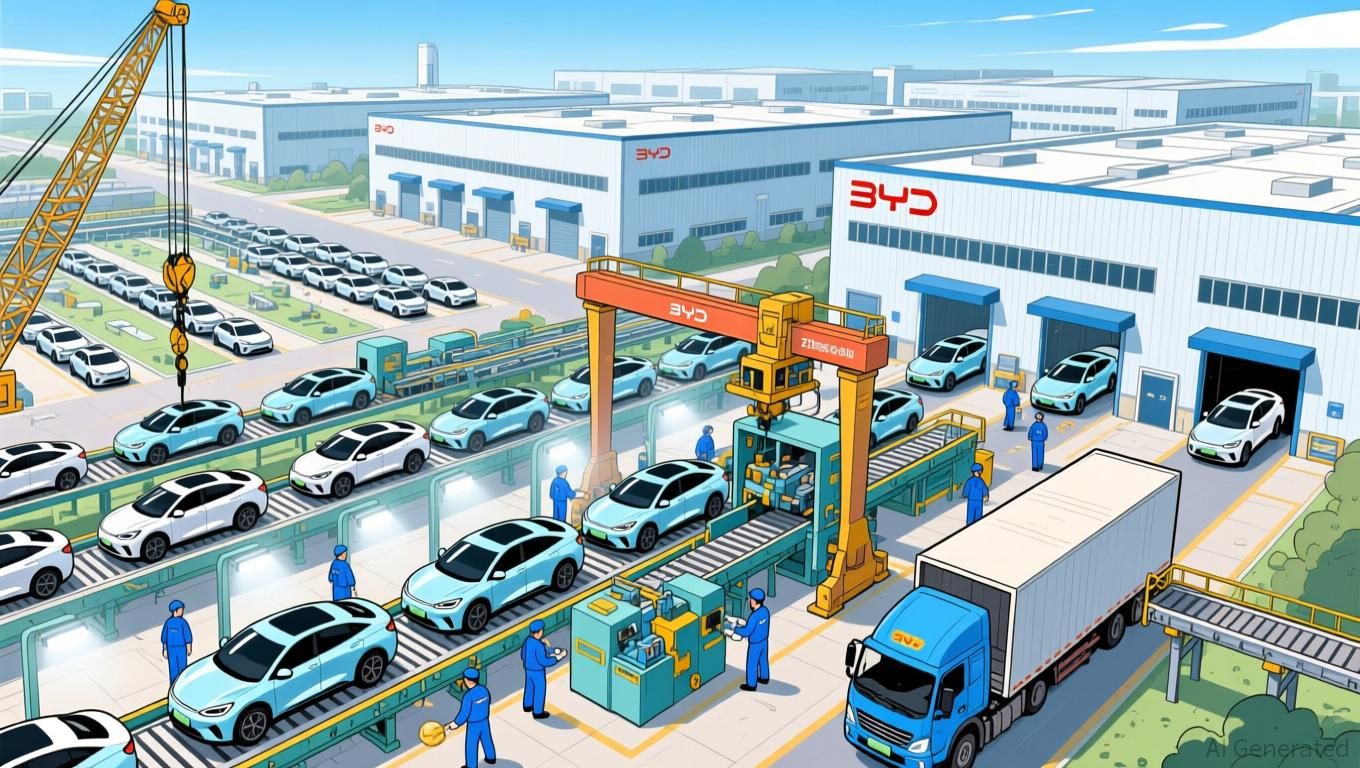

- Ford CEO Jim Farley warns Chinese EVs pose an "existential threat" to U.S. automakers , surpassing historical Japanese competition in scale and pricing risks. - Ford cancels three-row electric SUV, delays electric pickup to 2027, and prioritizes hybrids/commercial EVs amid $4.5B annual losses and 70% import tariffs. - BYD's Zhengzhou megafactory, producing 545K vehicles in 2024 and expanding to 20K employees, exemplifies Chinese rivals' aggressive production and market expansion. - Farley admits driving

Ford CEO Jim Farley has strongly cautioned that Chinese electric vehicle (EV) makers represent a fundamental danger to the survival of U.S. car companies, describing their manufacturing prowess and pricing tactics as a "whole new kind of risk" compared to the Japanese competition of the 1980s, as noted in a

For example, BYD’s Zhengzhou megafactory has more than doubled in area since late 2023 and now far surpasses Tesla’s Austin plant, based on satellite images and official records. The facility produced 545,000 vehicles last year and intends to hire 20,000 more workers in early 2025, demonstrating its rapid expansion, as reported by

Ford’s financial woes add urgency to its change in direction. The automaker posted a $1.4 billion loss in its EV division for the third quarter of 2024, contributing to a projected $4.5 billion loss for the year, based on a

In response to the Chinese challenge, Ford is turning its attention to more compact, budget-friendly EVs and bringing back classic models like the Capri. Farley also cautioned against "Trojan horse" strategies, where Chinese brands might use established names such as Mazda or Nissan to enter international markets, according to the MechHelp analysis. Ford’s updated approach seeks to combine cost savings with innovation, but Farley admitted that the chances of maintaining U.S. manufacturing are "shrinking with each passing day," as the MechHelp analysis observed.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP News Update: Altcoin ETFs Move Closer to U.S. Approval After DTCC Surpasses Major Obstacle

- DTCC's approval of Bitwise's CLNK ETF marks a key step toward U.S. altcoin ETFs, with XRP-focused funds from 5 firms now listed. - XRP ETFs like Canary's XRPC and Grayscale's proposed offering highlight growing institutional demand for crypto exposure. - SEC resumes reviews post-government shutdown, accelerating approvals for pending applications including XRP Trust conversion. - Historical ETF inflows and CME's crypto derivatives success suggest regulatory clarity could drive significant capital into al

Bitcoin News Today: Whale Faces $190M Short Liquidation Risk as Bitcoin Approaches $104K

- Bitcoin nears $104K as a whale's $190M short position risks liquidation, potentially boosting prices to $105K. - Market volatility grows from $240M institutional selling and leveraged trading risks highlighted by Arkham Intelligence. - CME Group expands crypto products (XRP futures) amid regulatory scrutiny and record October trading volumes. - Whale liquidation could trigger cascading effects, testing Fibonacci resistance and accelerating BTC's bullish momentum. - CME's $7.3B 2028 revenue forecast contr

ZEC rises by 5.95% as whales reduce holdings and accumulation becomes evident

- ZEC surged 5.95% in 24 hours amid whale liquidation reducing its stake from $37M to $10.37M, triggering $960K realized losses. - Binance saw $33M ZEC accumulation via 2,200 coins/second trades, suggesting coordinated large-scale buying. - Grayscale’s Zcash Trust hit $151.6M AUM, reflecting institutional interest in ZEC’s hybrid privacy model aligned with U.S. regulatory clarity. - Whale position reversals and accumulation signals highlight ongoing bear-bull dynamics, with technical indicators like RSI di

DASH rises by 6.6% as quarterly results and recent strategic actions fuel near-term positive sentiment

- DASH surged 6.6% in 24 hours ahead of its Nov 12 earnings report, driven by strategic investments in autonomous delivery and a $5.1B acquisition. - The company’s 35.22% monthly gain and 88.68% annual rise reflect expanded partnerships with McDonald’s , Waymo, and Kroger , boosting order growth and market reach. - Analysts remain cautious due to high valuation risks and competition from Uber Eats and Instacart, despite DoorDash’s aggressive expansion into AI-driven commerce.