Trust Wallet Token (TWT) Price Forecast: Could 2026 Mark a DeFi Surge?

- Trust Wallet Token (TWT) surged to $1.6 in 2025, driven by strategic partnerships and expanded utility via Trust Premium and FlexGas features. - Institutional adoption grew through RWA tokenization (e.g., U.S. Treasuries) and Binance CZ's endorsement, boosting TWT's transactional and governance roles. - Analysts project TWT could reach $3 by 2025 and $15 by 2030, but regulatory risks and DeFi competition pose challenges to its 1-billion-user vision. - With 17M active users and 35% wallet market share, TW

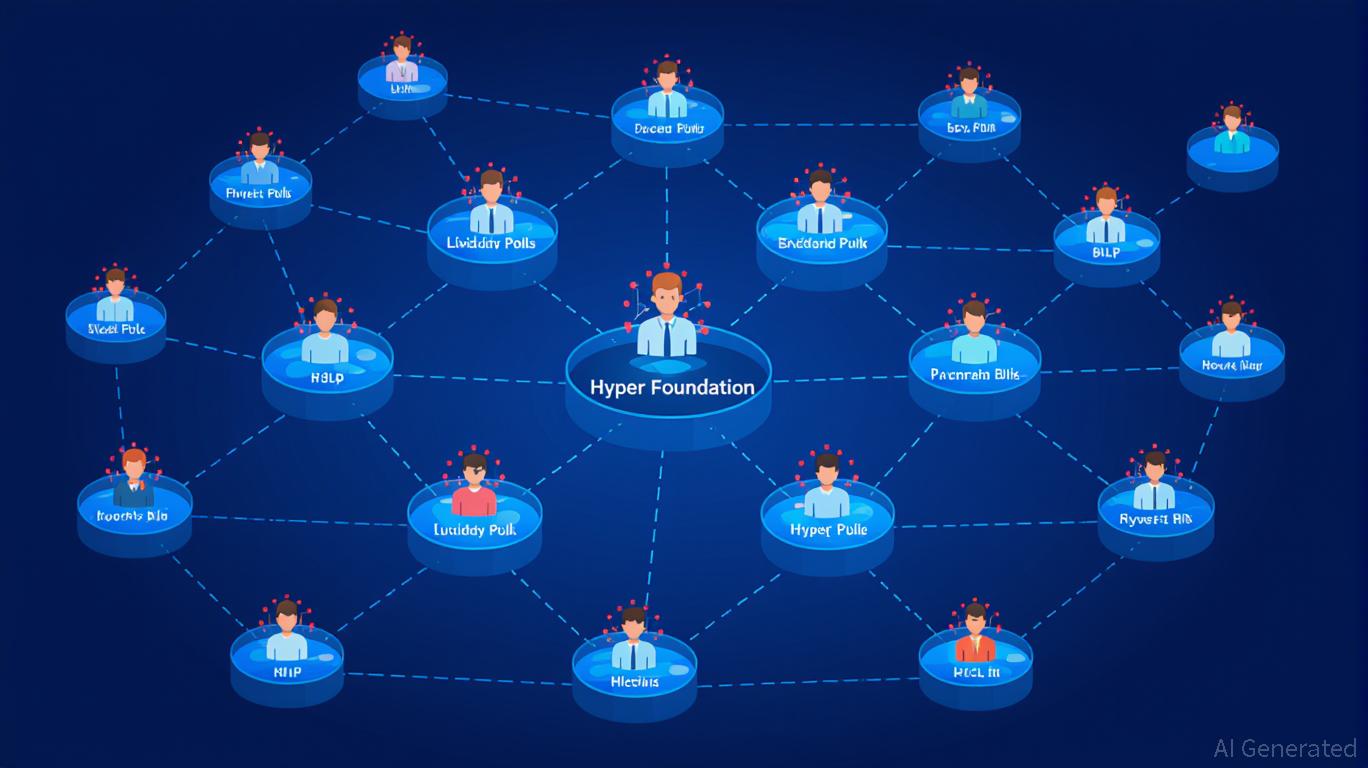

Strategic Partnerships and Ecosystem Expansion

Trust Wallet’s introduction of Trust Premium, a loyalty initiative powered by TWT, has transformed the token’s role by rewarding user participation. Through actions such as swapping, staking, and holding TWT, users accumulate Trust XPs, unlocking tiered rewards (from Bronze to Gold) that include perks like reduced gas fees and priority access to new features, as reported by

An important milestone is the launch of the FlexGas function in August 2025, enabling TWT to cover transaction fees on both

Institutional Interest and Price Drivers

Interest from institutions in TWT has been further fueled by endorsements from prominent figures. In September 2025, Binance co-founder Changpeng Zhao (CZ) publicly commended TWT’s “expanded utility,” which led to a 50% surge in price within hours, according to Bitget. While direct institutional investments are still limited, TWT’s integration into platforms designed for institutional use and its connection to RWAs indicate rising interest among professional asset managers and traders.

On-chain data from Q3 2025 supports this trend. Trust Wallet reported 17 million active users each month and held a 35% share of global crypto wallet downloads by March 2025, as stated in a

Challenges and Risks

Despite these advancements, TWT still encounters significant obstacles. Regulatory ambiguity, especially concerning tokenized RWAs, could slow down institutional participation. The competition from other DeFi-centric tokens and centralized wallet services is also fierce. Trust Wallet’s non-custodial approach and ISO/IEC security certifications, as referenced by CoinLaw, help address some risks, but achieving its ambitious 2030 goal of reaching one billion users will demand ongoing innovation.

Conclusion: A 2026 Breakout Candidate?

TWT’s transformation from a governance token to a versatile utility asset highlights its disruptive potential within DeFi. With strong institutional alliances, expanded transactional capabilities, and a large user community, TWT is well-placed to benefit from the expected surge in blockchain adoption in 2026. Nevertheless, investors should remain mindful of regulatory and market uncertainties that could alter its path. For those prepared to manage these risks, TWT serves as an intriguing example of how DeFi and institutional finance are converging.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Stellar News Today: Blockchain Opens Up Clean Energy Investment Opportunities While Turbo Taps Into $145B EaaS Sector

- Turbo Energy partners with Stellar and Taurus to tokenize solar energy financing via blockchain, targeting Spain's supermarket sector. - The pilot uses Energy-as-a-Service (EaaS) models with tokenized PPAs, enabling fractional investor ownership and reducing capital barriers. - Blockchain streamlines liquidity and transparency, aligning with a $145B EaaS market growth projection by 2030 driven by sustainable infrastructure demand. - Taurus manages token compliance via its platform, while Stellar's low-co

Ethereum Updates: Major Holders Increase Their Ethereum Stash Fivefold While BTC/ETH ETFs See Outflows—Altcoins Draw in $126 Million

- Bitcoin and Ethereum spot ETFs lost $605M in outflows, contrasting with $126M inflows into Bitwise's Solana ETF (BSOL), highlighting shifting investor priorities toward altcoins. - Ethereum's largest whale quintupled ETH holdings to $138M while closing Bitcoin longs, reinforcing institutional confidence in Ethereum's long-term potential amid stable technical indicators. - Solana's ETF success ($545M total inflows) reflects growing institutional demand for altcoins despite 16% price declines, driven by it

Red Bull Racing’s advantage? An engineer who approaches workflows with the precision of timing laps

Hyperliquid's Growing Influence in Crypto Trading: Can It Maintain Long-Term Investment Appeal?

- Hyperliquid dominates 80% of 2025 perpetual contract market via on-chain governance and user-driven liquidity innovations. - Centralized governance (HIP-3 protocol, USDH stablecoin launch) balances permissionless market creation with validator dominance risks. - HLP liquidity model generates $40M during crashes but faces regulatory scrutiny and token economics challenges from 2025 HYPE unlock. - TVL growth to $5B and 518K active addresses highlight adoption, yet governance centralization and institutiona