Bitcoin Whales Buy $32 Billion on the Dip as BTC Holds Above $100,000

Bitcoin whales purchased over $32 billion in BTC, helping the crypto king recover above $105,000. With strong profitability metrics and rising confidence, BTC may soon target $108,000 and $110,000.

Bitcoin has shown notable resilience in recent days, avoiding a break below the crucial $100,000 support level despite heavy market volatility.

The crypto king’s ability to maintain its position despite pressure signals underlying strength. What many perceive as a bearish phase has instead revealed strong structural support within the market.

Bitcoin Is Doing Better Than Anticipated

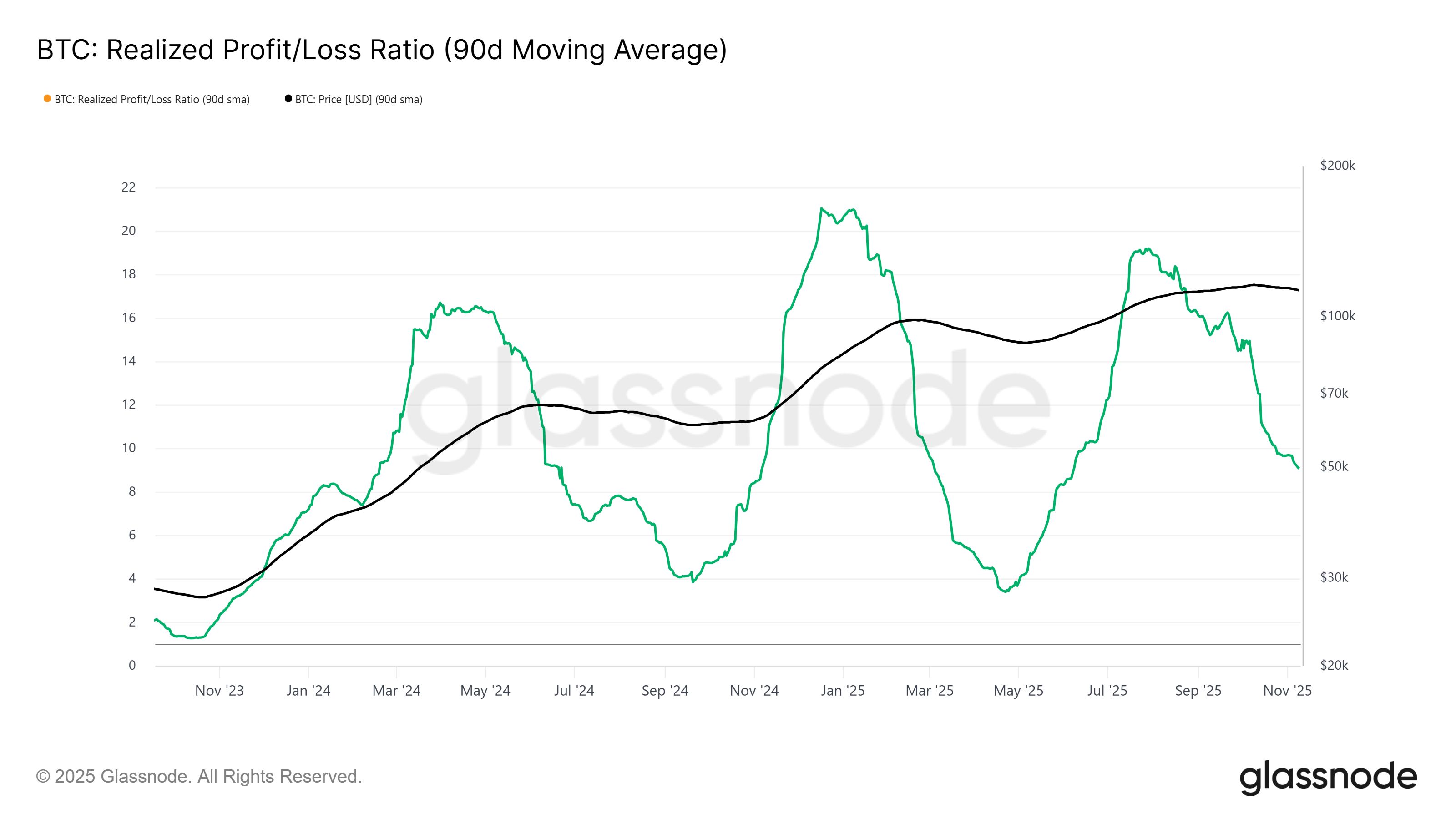

The Realized Profit/Loss Ratio, which measures investors’ net profitability, supports this bullish interpretation. The 90-day simple moving average (SMA) currently stands at 9.1, reflecting a moderate cooldown from July’s peak. Yet, profits remain more than twice as high as levels recorded during the last two mid-cycle bear phases, when the P/L Ratio dropped to 3.4.

This shows that investors are not in panic mode and that recent dips are largely driven by mild profit-taking rather than capitulation. The sustained profitability across Bitcoin holders suggests that market participants are confident about the long-term outlook.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

Bitcoin Realized P/L Ratio. Source:

Glassnode

Bitcoin Realized P/L Ratio. Source:

Glassnode

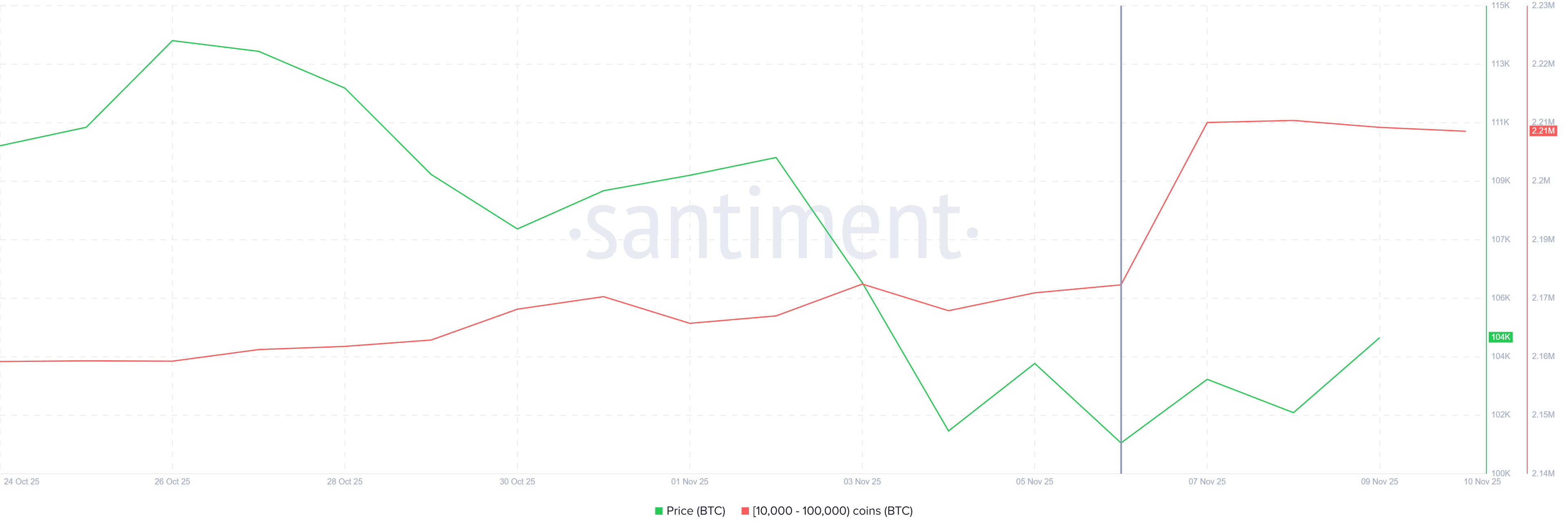

The on-chain data also highlights the role of Bitcoin whales in reinforcing this bullish momentum. These large investors are seizing the opportunity to accumulate during moments of weakness. Addresses holding between 10,000 and 100,000 BTC have collectively purchased more than 300,000 BTC this week after prices briefly touched $101,000.

This accumulation spree, valued at nearly $32 billion, demonstrates high conviction among large-scale holders. Their buying activity has helped drive Bitcoin’s recovery past the $105,000 mark, strengthening the case for an extended uptrend.

Bitcoin Whale Holding. Source:

Santiment

Bitcoin Whale Holding. Source:

Santiment

BTC Price Is Recovering

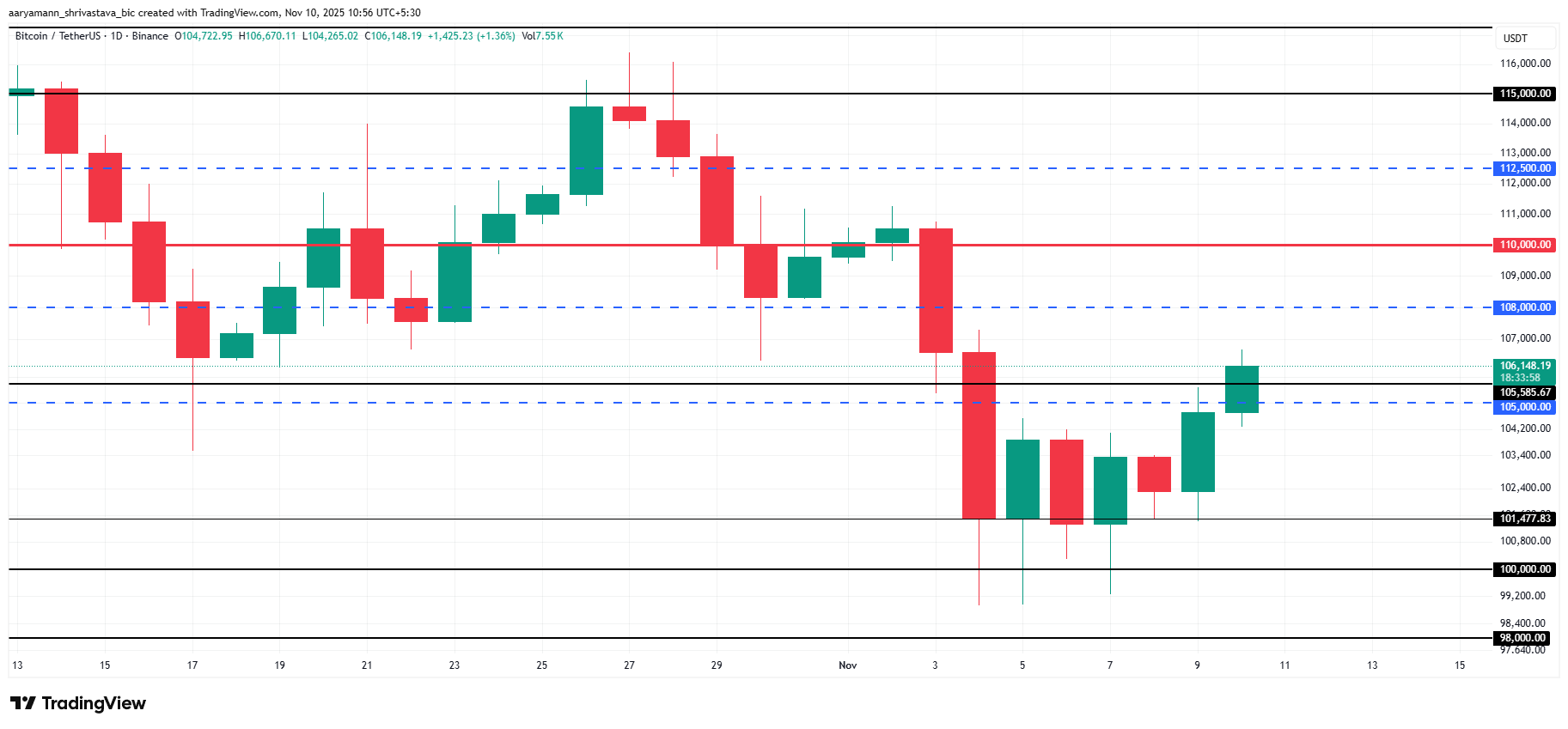

At the time of writing, Bitcoin trades at $106,148, comfortably above the $105,085 support level. The recent whale-driven surge pushed BTC past its critical psychological resistance, signaling renewed investor optimism.

Given the improving sentiment and rising institutional accumulation, Bitcoin could continue its rally toward $108,000 and possibly retest $110,000 in the coming days. Sustained demand and stable macro conditions would further reinforce this momentum.

Bitcoin Price Analysis. Source:

TradingView

Bitcoin Price Analysis. Source:

TradingView

However, if short-term traders resume profit-taking, Bitcoin’s price could slip back below $105,000. This could lead to BTC retesting support at $101,477, temporarily halting its bullish trajectory.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP News Today: XRP ETF Breaks Inflow Records While Bitcoin ETFs See $866M in Outflows

- Canary Capital's XRPC ETF shattered 2025 records with $245M inflows and $58.6M trading volume on debut, outperforming all other ETFs. - SEC-approved in-kind creation model enabled XRP token exchanges for shares, driving inflows exceeding real-time trading data. - XRPC surpassed Bitcoin ETFs like BlackRock's IBIT , fueled by XRP's retail following and post-Ripple regulatory wins. - XRP stabilized near $2.30 despite 8% 24-hour drop, while Bitcoin ETFs saw $866M outflows amid broader market weakness. - Regu

Ethereum Updates: India's Web3 Expansion—Digital Advertising, E-Commerce, and Blockchain Unite at IBW2025

- Bengaluru hosts IBW2025, India's largest Web3 conference, reinforcing its global digital innovation hub status. - India's digital ads show resilience: desktop web viewability (66%) exceeds global (63%) and APAC (61%) averages. - Meesho's asset-light e-commerce model targets 20% CAGR growth, aligning with Web3's decentralized infrastructure principles. - Intchains expands into Ethereum/PoS platforms, leveraging ETH holdings for yield while Kneat.com reports 33% YoY revenue growth. - Converging digital ads

Hyperliquid's Growing Influence in Crypto Trading: The Impact of Institutional Engagement on DeFi Evolution

- Hyperliquid drives DeFi mainstream adoption via institutional partnerships and a $2.15B TVL, including a HYPE token ETF application by 21Shares. - Regulatory compliance through zk-KYC and smart contract audits aligns with SEC/CFTC frameworks, accelerating institutional trust in DeFi protocols. - Zero-gas fee Layer 1 blockchain and $3T+ trading volumes position Hyperliquid as a scalable bridge between decentralized infrastructure and institutional capital. - Leadership transitions and 160% vault APYs high

SOL Trading Volume Surges 60% as Analysts Predict Fresh Highs