Bitcoin's $100K Question: Here's Why BTC, XRP, SOL May Surge This Week

Bitcoin BTC$103,508.20 has faced a challenging few weeks, retreating sharply from its record highs and weighing on the broader market, including ether ETH$3,526.49, XRP$2.3078, solana SOL$162.78 and others.

However, there's a compelling reason to expect the cryptocurrency to stay above the pivotal $100,000 level and rally this week, and it's tied to a positive shift in the U.S. financial system that signals potential for renewed investor risk-taking.

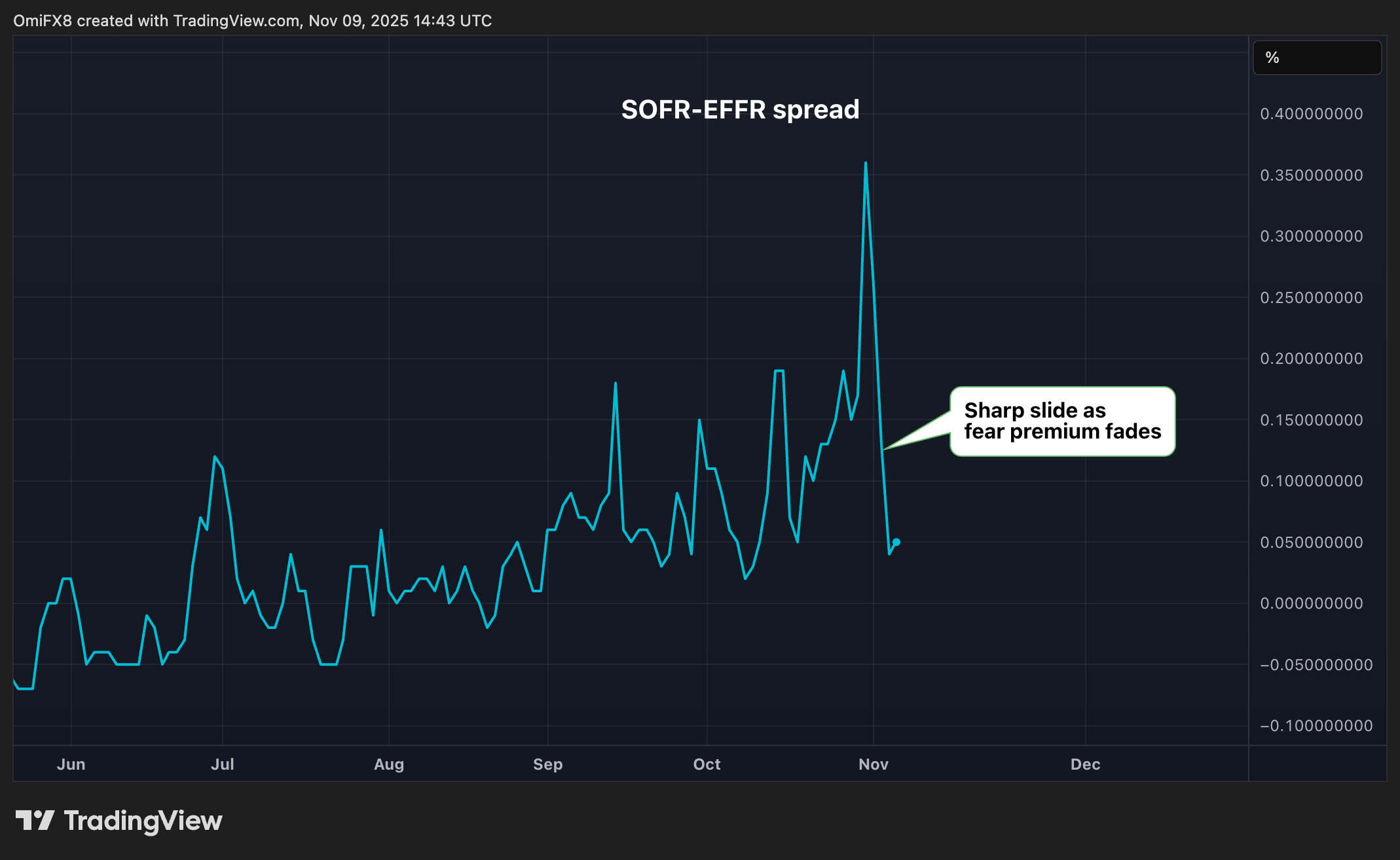

At the heart of the story is the spread between the SOFR and EFFR, which gauges dollar liquidity conditions in the U.S. banking sector. SOFR, the Secured Overnight Financing Rate, is the overnight interest rate that banks pay to borrow cash using Treasuries as collateral. The Effective Federal Funds Rate (EFFR) is the rate at which banks led reserves to each other overnight without collateral.

Usually, this spread hovers in a narrow range, but late last month it surged to the highest since 2019, signaling stress and liquidity tightening in the financial system. The result? the dollar index, which tracks the greenback's value against major fiat currencies, rose and bitcoin fell sharply, breaching the $100,000 level at one point.

But over the last couple of days, the SOFR-EFFR spread has sharply tanked to 0.05 from 0.35, erasing that spike. This reversal hints at easing financial conditions—the fear premium has faded, and liquidity is normalizing.

All else being equal, tightening of this spread signals looser financial conditions, favorable for risk assets like bitcoin. And guess what, BTC is on the rise as of writing, trading above $103,000, representing a 1.6% gain on a 24-hour basis, according to CoinDesk data. ETH, XRP, SOL, BNB have gained 1.5% to 2.5% following BTC's lead.

SRF borrowing slides, DXY rally stalls

Other key indicators also point to easing liquidity stress. For instance, banks' borrowing from the Federal Reserve's standing repo facility (SRF), a key liquidity management tool, has dropped back to zero after peaking at a record $50 billion earlier this month, according to data from ING. Banks had borrowed billions through the SRF as a response to temporary funding pressures.

Concurrently, the dollar index's rally has softened at resistance from the August high of 100.25, causing the upward momentum to stall. A renewed sell-off in the DXY could bode well for BTC, which is seen as a hedge against dollar debasement and a proxy for inflation protection.

All these factors combine to create a compelling case for bitcoin and the wider crypto market to rally in the coming week.

Key risks

Keep an eye on flows into the U.S.-listed spot ETFs, as they will need to show strength following nearly $2.8 billion in outflows over the past four weeks.

A breakout in the DXY above 100.25 could dent BTC's bullish prospects.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

SpacePay’s test network demonstrates that cryptocurrency has the potential to achieve widespread adoption

- SpacePay ($SPY) raised $1.4M in presale, launching a testnet on Base/Ethereum Sepolia to validate its crypto-merchant payment protocol. - The platform enables Android POS crypto integration with 325+ wallet support, fixed 0.5% fees, and fiat settlement to mitigate volatility risks. - $SPY token offers governance rights, revenue-sharing from 0.5% fees, and community rewards like airdrops to incentivize participation. - With 34B token supply and 20% public allocation, the project combines functional infras

Zcash News Today: a16z Calls on U.S. to Adopt Privacy-Centric Technology to Stay Ahead in Digital Finance

- a16z urges U.S. Treasury to prioritize privacy-preserving identity tech in GENIUS Act implementation, advocating zero-knowledge proofs (ZKPs) and MPC for AML compliance. - Privacy-focused cryptos like Zcash (ZEC) and Midnight gain traction, with Zcash surging 1,172% YTD and GDPR-compliant Midnight attracting institutional interest. - Microsoft's "Whisper Leak" AI vulnerability highlights risks to privacy, prompting calls for obfuscation techniques to protect data in blockchain and AI ecosystems. - Regula

Tether Invests $100 Million in VCI's OOB Tokens, Connecting Conventional Finance with Blockchain Technology

- VCI Global acquires $100M OOB tokens via restricted shares and secondary market purchases, making Tether its largest shareholder. - Tether's $180B market cap and OOBIT's cross-border payments platform strengthen ties between traditional finance and blockchain ecosystems. - OOB token migration to Solana and digital treasury initiatives aim to enhance scalability, with 70% of crypto payments targeting retail/food sectors. - Mixed market reactions follow 26.55% VCIG share drop, though analysts highlight sta

DODO Rises 2.11% on November 12, 2025 Despite Ongoing Yearly Decline

- DODO rose 2.11% on Nov 12, 2025, but remains in a 12-month bearish trend with an 80.93% annual decline. - Analysts debate if the short-term rebound signals a critical support level reversal amid oversold RSI conditions (30) and downtrend indicators. - A backtest strategy evaluates historical cases of similar sharp one-day gains (-80.93% annual drop + 2.11% daily rise) to assess reversal probabilities.