Altcoin season signals hide in 'many weeks' of bearish BTC dominance: Analyst

The recent volatility in Bitcoin’s dominance could be a signal that altcoin season is approaching sooner than many traders expect, according to a crypto analyst.

“The reason why you should have confidence in the altcoin price action is because the BTC Dominance chart looks bearish and has looked bearish for many weeks,” crypto analyst Matthew Hyland said in an X post on Friday.

“The downtrend is favorable to continue; therefore, this relief rally has been a dead cat bounce in a downtrend,” Hyland said. In a separate video on Saturday, Hyland said that the recent volatility in Bitcoin’s (BTC) price may have been orchestrated by traditional finance giants.

“Over the past month, I’ve kind of just maintained the view that a lot of this was really just manipulation, essentially for Wall Street to set themselves up,” he claimed.

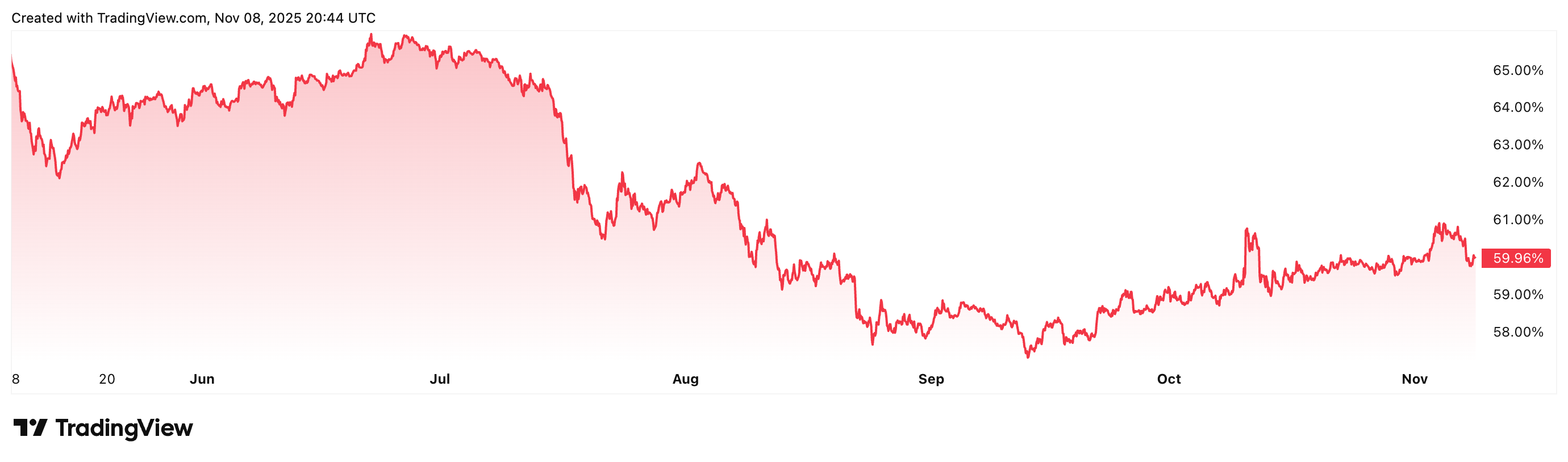

Bitcoin dominance has dropped 5% since May

Bitcoin’s dominance, which measures Bitcoin’s overall market share, is down 5.13% over the past 6 months, and holding 59.90% at the time of publication, according to TradingView.

It was only on Nov. 4 that Bitcoin slipped below the $100,000 price level for the first time in four months, leading to broader market concerns about where the asset’s price will go next.

Bitcoin is trading at $102,090 at the time of publication, according to CoinMarketCap.

While Hyland speculated that the altcoin market may gain momentum soon, other indicators, however, continue to point to a market centered around Bitcoin.

CoinMarketCap’s Altcoin Season Index currently sits at 28 out of 100, well within “Bitcoin Season” territory.

Altcoin season may be different from previous cycles

The last time the indicator signaled “Altcoin Season” was on Oct. 8, just days after Bitcoin hit a new all-time high of $125,100, when traders appeared to anticipate a rotation of capital further up the risk curve.

However, the indicator quickly plunged to risk-off mode after the Oct. 10 market crash which saw around $19 billion in leveraged positions wiped out of the crypto market.

Some crypto executives expect the next altcoin season to be more selective and concentrated than in previous market cycles.

Maen Ftouni, CEO of CoinQuant, a company that produces algorithmic trading tools, recently said that older cryptocurrencies with an exchange-traded fund (ETF) or expected to receive an ETF will soak up much of the capital deployed during the next altcoin season.

“Not every single coin is going to have massive returns; the liquidity is going to be concentrated into certain places, dinosaurs being one of them, of course,” Ftouni said.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

UAE’s Digital Dirham: Shaping a Diverse Future for International Finance

- UAE completes first government transaction using Digital Dirham CBDC via mBridge platform, settling in under two minutes. - Pilot by UAE Ministry of Finance and Dubai Department of Finance validates cross-border and domestic payment capabilities without intermediaries. - Officials highlight CBDC's role in enhancing financial transparency, reducing settlement times, and advancing UAE's fintech leadership goals. - Global CBDC adoption grows with 137 countries exploring digital currencies, as UAE plans phas

Yen-backed Stablecoin Initiative May Challenge the Dollar’s Leading Role in Digital Finance

- JPYC, Japan's yen-pegged stablecoin issuer, plans to allocate 80% of 10-trillion-yen token proceeds to JGBs, aiming to fill gaps left by BOJ's stimulus tapering. - The strategy could reshape Japan's bond market as BOJ reduces its 50% JGB ownership stake, with JPYC CEO predicting global adoption of stablecoin-driven government bond demand. - Japan's FSA supports innovation through sandbox programs, including a pilot with major banks , while regulators warn stablecoins might divert funds from traditional b

COAI's Unexpected Price Decline in Early November 2025: An Indicator of Fluctuations in the AI Industry

- Canaan Inc. (COAI) saw a sharp stock price drop in early November 2025 amid AI/crypto sector volatility driven by regulatory uncertainty and strategic shorting. - C3.ai's 54% YTD decline and exploration of a potential sale highlighted the sector's shift from speculative hype to earnings-focused scrutiny. - Gemini's poor Q3 earnings and Nano Labs' bond redemption signaled broader pessimism, amplifying COAI's 88% YTD valuation decline. - Analysts project 20% downside for AI sector valuations, emphasizing p

Dogecoin News Update: Poain Launches 'Stablecoin 2.0' Featuring AI-Powered Returns and Green Energy Infrastructure

- Poain BlockEnergy expanded its AI-powered staking platform to include USDT , offering stablecoin yield generation via smart contracts and a presale for its PEB token. - The platform uses renewable energy-powered AI algorithms to optimize staking returns, providing a low-risk alternative to traditional trading with flexible 2-10 day plans. - Users can withdraw or reinvest profits in multiple assets, while PEB’s presale roadmap projects a 300x price increase from $0.007 to $2.50, pending adoption and regul