Strategy Reveals New IPO With Coming Launch of Preferred Stock ‘STRE’

The world’s largest corporate holder of Bitcoin (BTC) says it plans to launch a new initial public offering (IPO) of a euro-denominated perpetual preferred stock.

Strategy (MSTR) says it plans to issue 3.5 million shares of the Series A Perpetual Stream Preferred Stock (STRE).

The Bitcoin treasury firm intends to use the proceeds from the offering for general corporate purposes, which include bolstering its working capital and funding the acquisition of more BTC.

The company already holds 641,205 of the flagship cryptocurrency worth over $65 billion based on the asset’s current price of $101,967.

STRE will be offered at 100 euros ($115) per share, which will accumulate cumulative dividends equivalent to 10% of the stock’s price per year. Strategy says the declared regular dividends will be paid quarterly in cash starting December 31st this year.

“If Strategy fails to declare a regular dividend on or prior to a given regular record date, such failure will constitute the issuance of a notice of deferral.”

The regular dividends will compound quarterly if not paid on time. Strategy says continued failure to fully settle the regular dividends and the compounded dividends will increase the rate by 100 basis points per annum for each subsequent regular dividend period up to a maximum rate of 18% per year.

STRE will follow Strategy’s other preferred stocks in the US, including the 8% Convertible Preferred Stock (STRK), the 10% fixed-rate Income-Focused Preferred Stock (STRF), the 10% non-cumulative High-Yield Higher-Risk Preferred Stock (STRD) and the variable-rate High-Yield Stable Preferred Stock (STRC).

Featured Image: Shutterstock/U2M Brand/Panuwatccn

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

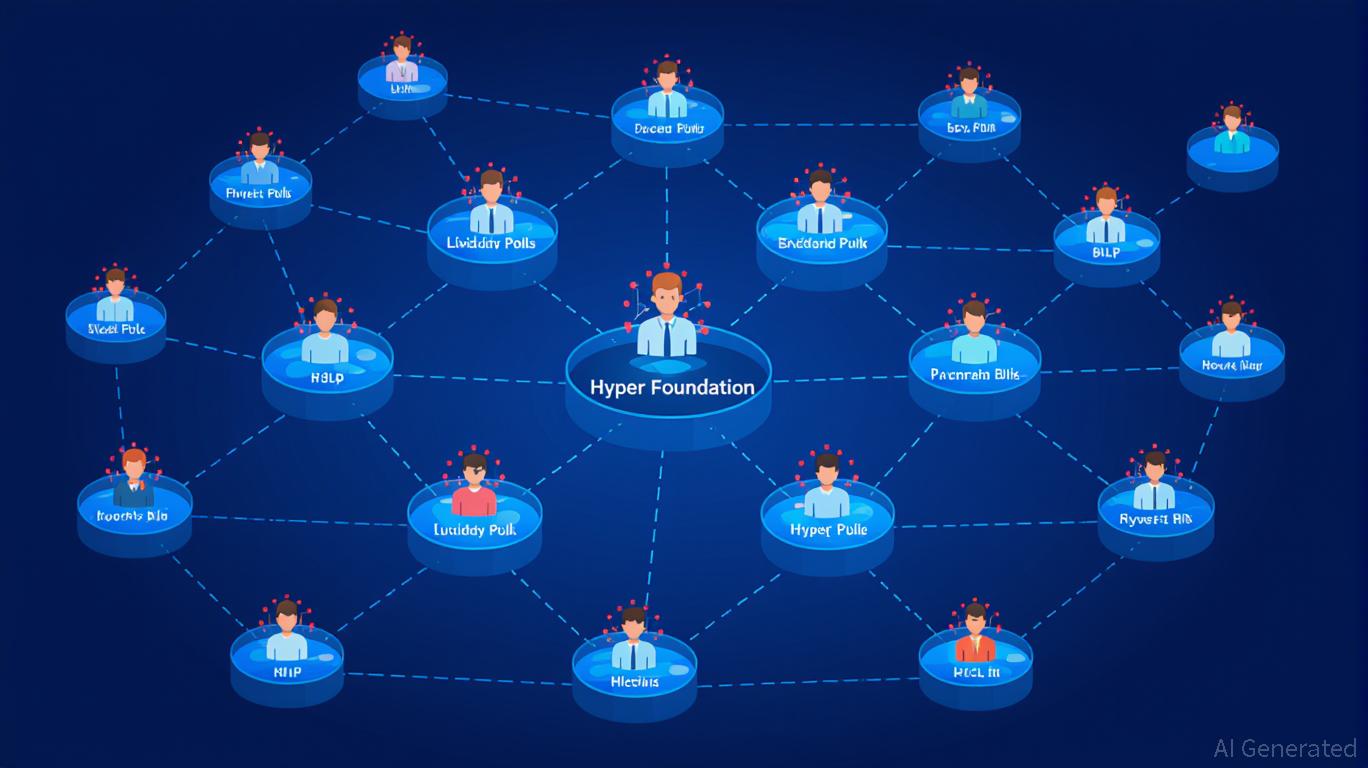

Hyperliquid's Growing Influence in Crypto Trading: Can It Maintain Long-Term Investment Appeal?

- Hyperliquid dominates 80% of 2025 perpetual contract market via on-chain governance and user-driven liquidity innovations. - Centralized governance (HIP-3 protocol, USDH stablecoin launch) balances permissionless market creation with validator dominance risks. - HLP liquidity model generates $40M during crashes but faces regulatory scrutiny and token economics challenges from 2025 HYPE unlock. - TVL growth to $5B and 518K active addresses highlight adoption, yet governance centralization and institutiona

Ethereum Latest Updates: JPMorgan and Bitmine Make $1.3B ETH Investment, Showing Institutional Trust Amid Market Fluctuations

- Institutional Ethereum investments surged $1.3B as JPMorgan and Bitmine capitalized on price dips, with Bitmine now holding 3.4M ETH (2.8% of supply). - JPMorgan's $102M Bitmine stake reflects strategic crypto exposure via traditional instruments, aligning with U.S. ETF approvals and regulatory clarity on staking ETPs. - Bitmine's 5% supply target and SharpLink's 6,575 ETH staking highlight growing institutional confidence, despite 27.7% monthly price declines creating buying opportunities. - Regulatory

Bitcoin News Today: Bitcoin Miners Bet on AI: Will Technological Advances Outpace Market Fluctuations?

- Bitcoin miners adopt AI/HPC to offset bear market pressures, leveraging energy infrastructure for GPU workloads. - TeraWulf's $1.85M/MW/year AI hosting benchmark and CleanSpark's Texas campus highlight infrastructure diversification. - Grid constraints and GPU shortages challenge transitions, while Bitcoin ETF outflows ($558M) signal shifting investor sentiment. - Analysts warn of potential $100,000 price correction if $104,000 resistance fails, despite positive on-chain demand signals. - JPMorgan identi

Brazil Sets Sights on Crypto Regulation to Build Confidence and Strengthen Regional Leadership

- Brazil's central bank introduced Latin America's strictest crypto regulations, requiring VASPs to obtain authorization and comply with banking-level oversight by November 2026. - New rules mandate $2M+ capital requirements, classify stablecoin transactions as forex operations, and cap unapproved crypto transfers at $100,000 per transaction. - The framework aims to combat fraud and illicit finance by extending AML protocols to stablecoins, which account for 90% of Brazil's crypto activity, while enhancing