October 30th Market Key Insights -- How Much Did You Miss?

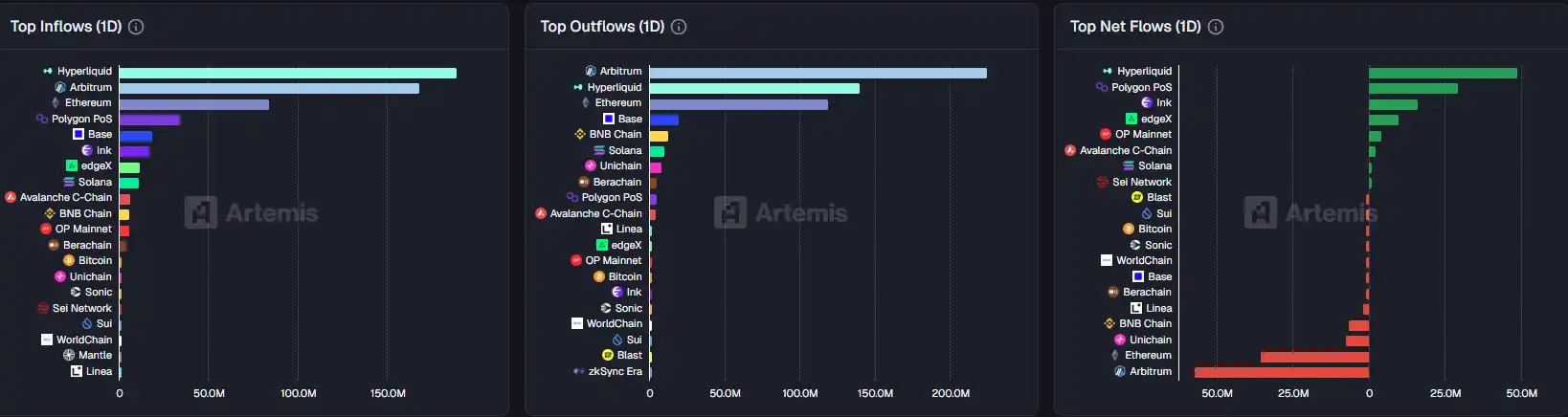

1. On-chain Fund Flows: $48.9M USD has flown into Ethereum today; $57.1M USD has flown out of Arbitrum. 2. Largest Price Swings: $JELLYJELLY, $PEPENODE 3. Top News: MegaETH Public Sale has raised over $1 billion, with oversubscription reaching 20x.

Top News

1. MegaETH Public Sale Fundraising Amount Surpasses $1 Billion, Oversubscribed 20x

2. Pre-market Crypto Concept Stocks in the U.S. Soar, with Strategy Up by 0.96%

3. $590 Million Liquidated Across the Network in the Past 24 Hours, Mainly Long Positions

4. Binance Alpha Airdrop Scheduled for Today at 20:00, Score Threshold at 240 Points

5. Pacifica's Weekly Trading Volume Exceeds $50 Billion, User Balances Receive a 20x Points Bonus

Featured Articles

1. "Earning and Distributing Money at the Same Time: A Look at the Recent Developments of Top Perp DEXes"

According to the latest on-chain data, the market landscape of decentralized perpetual contract exchanges (Perp DEXes) has become relatively clear. In terms of 24-hour trading volume, Aster leads with $121.2 billion, Lighter ranks second with $86.16 billion, Hyperliquid ranks third with $59.58 billion, while edgeX and ApeX Protocol hold the fourth and fifth positions with $50.6 billion and $21.22 billion, respectively. For investors and traders looking to delve deeper into the Perp DEX race, keeping an eye on the dynamics of these top five platforms should provide insights into the overall direction of the race.

2. "CZ Invests in a Chinese College Junior, $11 Million Seed Round, Venture into Education as an Agent"

Chinese third-year student, $11 million seed round, the highest-funded product by a Silicon Valley student entrepreneur. The flagship product is VideoTutor, an educational agent product targeting K12 education, which can generate personalized teaching/explanatory videos with just one sentence. VideoTutor announced today that it has completed a $11 million seed round of financing. The round was led by YZi Labs, with participation from Baidu Ventures, JinQiu Fund, Amino Capital, BridgeOne Capital, and several well-known investors.

On-chain Data

On-chain Fund Flow Last Week on October 30

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Solana News Today: Pi Coin Faces Critical $0.29 Threshold—Will It Recover or Is This a Temporary Surge?

- Pi Coin's 26% surge to $0.2610 triggered a golden EMA crossover, signaling short-term bullish momentum despite weak institutional buying indicators. - Fibonacci support at $0.20-$0.22 and a bullish engulfing candle suggest potential for a $0.29 retest, but bearish divergences in RSI/MFI persist. - A $0.29 breakout could validate a falling wedge reversal toward $0.37, while breakdown below $0.20 risks exposing $0.15 support amid 36.8% three-month losses. - Rising Smart Money Index and retail participation

JP Morgan CEO Reverses Stance on Cryptocurrency

Trader’s 100% Win Rate Influences BTC, ETH, SOL Moves

From Ethereum Misses to La Culex Wins: A Next 1000x Crypto Presale Deep Dive