How Investors Stockpiled Stellar (XLM) Despite Falling Prices in October

While market sentiment around Stellar (XLM) stays bearish, on-chain data reveals quiet accumulation. Rising TVL, major exchange outflows, and network upgrades point to renewed investor conviction amid short-term price weakness.

The unexpected price decline of Stellar (XLM) in October boosted demand, even though the token has not yet recovered its previous losses. On-chain data and the project’s latest updates reflect confidence among certain investors, while overall market sentiment remains pessimistic.

Investor accumulation of XLM throughout October indicates long-term conviction rather than short-term price chasing. The following factors provide a clearer explanation.

Exchange Reserves Plunge While TVL Hits Record High

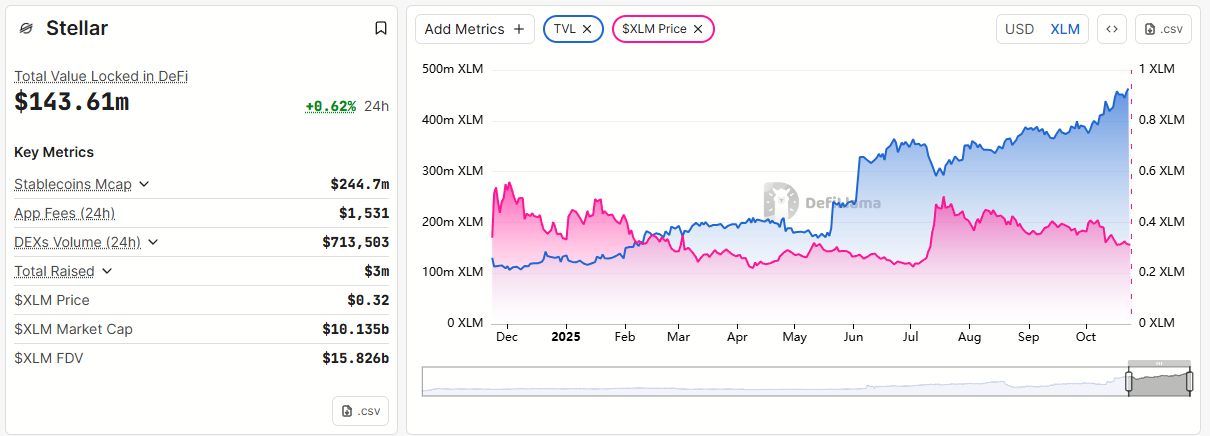

According to DeFiLlama, the total value locked (TVL) on the Stellar chain, measured in XLM, has surged to an all-time high of over 456 million XLM locked across various DeFi protocols.

Stellar TVL. Source:

Stellar TVL. Source:

Comparing XLM’s price performance with its TVL since last December highlights investors’ faith in the network’s ecosystem.

Specifically, since December, XLM’s price has dropped by 50%, but the amount of XLM locked in DeFi protocols has increased more than fourfold.

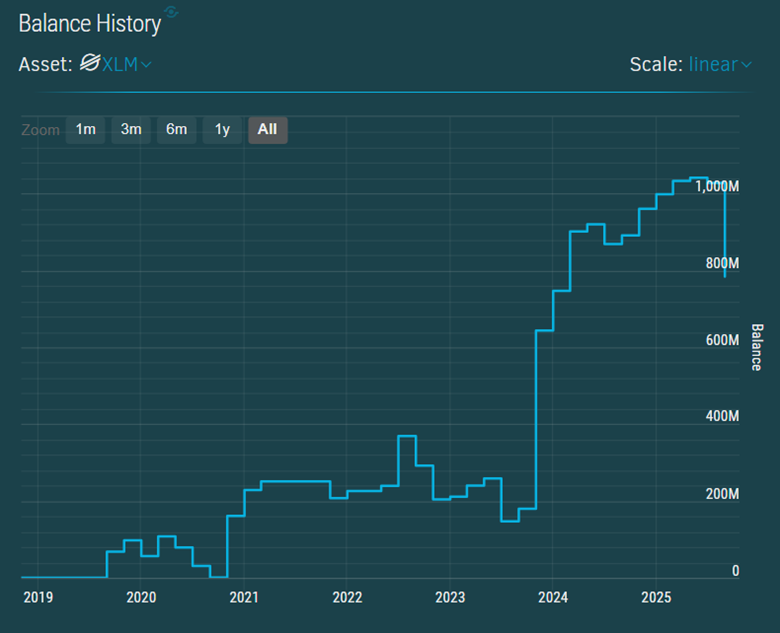

Another positive sign comes from Binance wallet data. The exchange’s official XLM address (GBA…GPA) recorded over 240 million XLM withdrawn from the exchange over the past two months, the largest outflow since 2024.

XLM supply on Binance. Source:

XLM supply on Binance. Source:

Combining these two data points suggests that many XLM investors were heavily accumulating during October. They may have moved tokens off exchanges for long-term storage or to deploy them in DeFi.

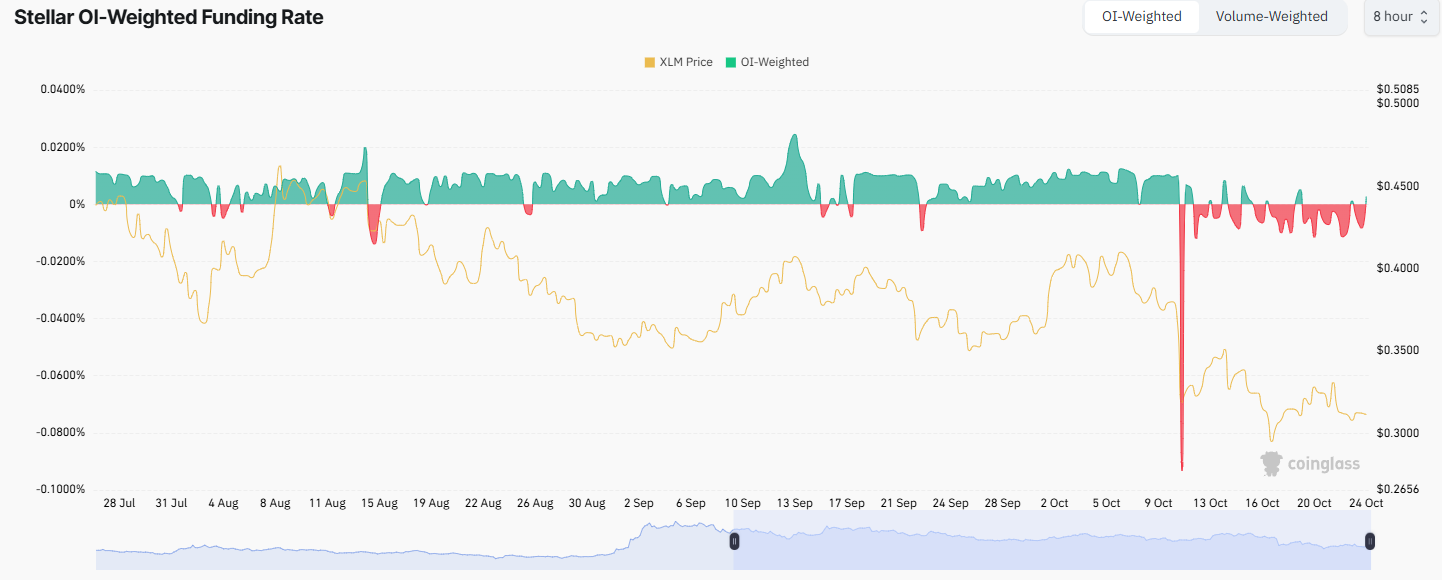

However, the overall picture is not entirely optimistic. Data from CoinGlass shows that the funding rate for XLM futures contracts has remained negative for the past two weeks, reflecting ongoing bearish sentiment among traders.

Stellar (XLM) Funding Rate. Source:

Stellar (XLM) Funding Rate. Source:

The OI-weighted funding rate has fluctuated below zero since October 11, indicating that traders are paying to maintain short positions. The drop below $0.20 has made market sentiment even more pessimistic.

While the TVL and exchange reserve data suggest long-term optimism, the negative funding rate reveals short-term selling pressure on exchanges. As a result, XLM’s price could continue to fall. Yet, for some investors, that weakness presents an opportunity.

Several investors believe that XLM below $0.20 represents an attractive entry point before a potential bull run similar to 2017.

XLM Price Prediction. Source:

XLM Price Prediction. Source:

“What’s coming next? The mass adoption rally — it’s written all over this chart. Two clean accumulation phases. Buy zone holding. The breakout won’t warn you,” investor X Finance Bull predicted.

Finally, Stellar’s vitality stems from its core upgrades and real-world use cases.

Validators on the Stellar network recently voted to upgrade the Stellar Mainnet to Protocol 24, fixing a bug in the state storage feature. At the same time, the value of real-world assets (RWA) on Stellar rose by 26.3% over the past month, reaching $638 million.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Growing Buzz Around Momentum (MMT) Token: Could This Be the Next Major Opportunity in Crypto Investments?

- Momentum (MMT) token surged 4,000% post-2025 TGE, driven by exchange listings and speculative demand, despite a 70% correction. - Institutional adoption accelerated by $10M HashKey funding and regulatory frameworks like MiCAR, while Momentum X targets RWA tokenization. - Retail investors face volatility risks from leveraged trading and token unlocks, contrasting institutions' focus on compliance and stable exposure. - Technical indicators show mixed outlook, with RSI suggesting potential bullishness but

Tech Learning as a Driver of Progress in 2025

- Global demand for AI, cybersecurity, and data science education drives enrollment surges, with U.S. AI bachelor's programs rising 114.4% in 2025. - Institutions innovate through interdisciplinary STEM programs and digital ecosystems, addressing workforce gaps with AI ethics and immersive tech integration. - Education-tech stocks gain traction as hybrid learning models and AI-driven platforms align with $4.9 trillion digital economy growth and rising cybersecurity job demand. - Federal funding challenges

TWT's Tokenomics Revamp for 2025: Supply Structure Adjustment and Lasting Value Impact

Aster DEX: Connecting Traditional Finance and DeFi by Streamlining Onboarding and Encouraging Institutional Participation

- Aster DEX bridges TradFi and DeFi via a hybrid AMM-CEX model, multi-chain interoperability, and institutional-grade features. - By Q3 2025, it achieved $137B in perpetual trading volume and $1.399B TVL, driven by yield-bearing collateral and confidential trading tools. - Institutional adoption surged through compliance with MiCAR/CLARITY Act, decentralized dark pools, and partnerships with APX Finance and CZ. - Upcoming Aster Chain (Q1 2026) and fiat on-ramps aim to enhance privacy and accessibility, pos