House of Doge Acquires Italian Soccer Team

House of Doge, the corporate arm of the Dogecoin Foundation, has acquired a majority stake in Italy’s soccer team US Triestina Calcio 1918, marking a milestone in the convergence of digital assets and traditional industries. The move comes as cryptocurrency firms seek tangible footholds in regulated sectors. By acquiring a century-old European football club, House

House of Doge, the corporate arm of the Dogecoin Foundation, has acquired a majority stake in Italy’s soccer team US Triestina Calcio 1918, marking a milestone in the convergence of digital assets and traditional industries.

The move comes as cryptocurrency firms seek tangible footholds in regulated sectors. By acquiring a century-old European football club, House of Doge is translating token-based enthusiasm into real-world ownership and signaling a shift in how crypto brands pursue legitimacy and growth.

Crypto and Football: A Growing Alliance

House of Doge becomes Triestina’s largest shareholder, bringing capital and blockchain plans. The club, based in Italy’s Serie C, will test cryptocurrency-based ticketing and merchandise payments.

The acquisition was executed in collaboration with Brag House Holdings, House of Doge’s publicly traded merger partner. Brag House provided the listed structure that enabled the purchase and continues to oversee governance and market access. Together, the firms are integrating Brag House’s gaming and fan ecosystem with House of Doge’s blockchain network, creating a single framework that connects digital communities with traditional sports audiences.

“Our investment is about proving that digital assets can drive real-world value, culture, and passion. Football provides the ideal stage to demonstrate how decentralized communities can create sustainable impact,” said Marco Margiotta, CEO of House of Doge.

It’s official! House of Doge is now the majority owner of U.S. Triestina 1918, one of Italy’s oldest professional football clubs!Dogecoin was founded on Community—and the world’s game is one of the biggest communities there is. We will support Triestina with immediate capital…

— House of Doge (@houseofdoge) October 20, 2025

Analysts note that crypto firms are converting on-chain communities into off-chain assets that generate revenue. By entering sports, gaming, and entertainment, companies like House of Doge aim to balance volatility with stable operations.

Expanding the Industry’s Legitimacy

The link between cryptocurrency and football is growing quickly. Clubs now use blockchain for sponsorships, fan-voting, and tokenized loyalty systems. For crypto firms, partnerships with trusted teams bring access to millions of fans and help reinforce credibility.

In 2025, Tether increased its stake to 10.7% in Juventus F.C., becoming the second-largest shareholder. The firm aims to expand fan-token integration and stablecoin payments in Serie A. Bitpanda also teamed with Arsenal F.C. and Paris Saint-Germain F.C. to enhance blockchain-based fan rewards. Socios continues its partnerships with FC Barcelona and Inter Milan to build global fan engagement.

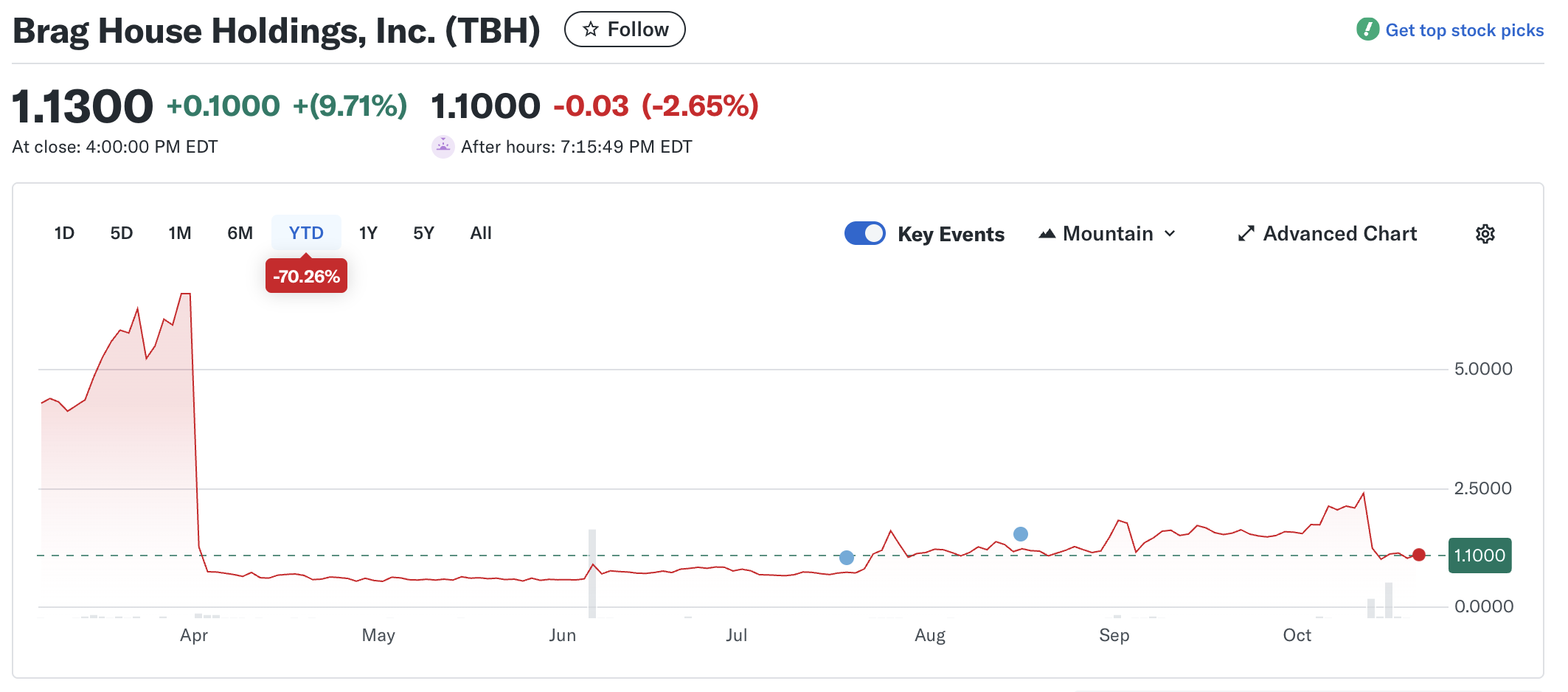

The House of Doge deal aligns with its plan to go public via a reverse merger with Brag House Holdings (TBH). TBH also began trading in March at about $4.30 per share but has since fallen to $1.13, a drop of nearly 74%. This reflects the broader volatility among small-cap digital asset firms.

TBH Performance Since Launch /

Source:Yahoo

TBH Performance Since Launch /

Source:Yahoo

Dogecoin (DOGE) trades near $0.20—up 1.9% from yesterday but down 25% over the month. Its one-year high was $0.466, recorded on December 8 last year. At that time, optimism about a potential $1 breakout was strong, but the current price represents a decline of roughly 57% from that peak.

DOGE performance over the past year / Source: BeInCrypto

DOGE performance over the past year / Source: BeInCrypto

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin, Ethereum now operate in ‘different monetary’ universes: Data

XRP News Today: Investors Consider XRP ETF Prospects Versus Presale Options

- XRP consolidates between $2.39-$2.41 in late 2025 amid mixed market sentiment, with analysts debating its breakout potential and $1.90 support level significance. - Pending XRP ETF approvals could inject $3-8B in capital, pushing price toward $2.50-$2.80 if SEC clears Bitwise, Franklin Templeton, and 21Shares applications. - XRP defies broader crypto outflows with $28M weekly inflows and $2.4B AUM, contrasting Bitcoin/Ethereum's $1.37B combined outflows despite subdued open interest at $3.36B. - Presale

Bitcoin News Update: Crypto Takes a New Turn as DeFi's Core Strengths Surpass the Hype-Fueled Phase

- Crypto market shifts focus to DeFi fundamentals as altcoins like Plug Power , Hyperion, and Mutuum show strong financial growth and innovation. - Plug Power reports $177M Q3 revenue and $370M funding, targeting EBITDAS-positive results by mid-2026 despite $363.5M net loss. - Hyperion DeFi achieves $6.6M net income via HYPE token treasury, leveraging Hyperliquid's 70ms block time for transparent trading and dApps. - Mutuum's $18.7M presale and 250% token price surge highlight DeFi lending growth, while Bi

ZEC Rises 5.93% in 24 Hours as Privacy Coins Experience a Surge

- Zcash (ZEC) surged 5.93% to $524.73 on Nov 13, 2025, despite a 10.98% weekly decline, driven by long-term gains of 32.18% monthly and 850.45% yearly. - Cypherpunk Technologies (formerly Leap Therapeutics) rebranded to focus on ZEC, purchasing 203,775 ZEC ($50M) or 1.25% of circulating supply, with Winklevoss Capital leading a $58.88M funding round. - The firm restructured leadership, appointing Khing Oei and Will McEvoy, and rebranded its ticker to CYPH , emphasizing ZEC’s privacy-centric zk-SNARKs techn