Stablecoin Market Surges to $15.6 Trillion in Transfers and $300B Supply in Q3 2025

The third quarter of 2025 marked a major milestone for the stablecoin market, reflecting growing global adoption and institutional use. Fueled by record DeFi activity and greater regulatory clarity, stablecoins reached historic highs in both supply and transaction volume, solidifying their role as a core pillar of the digital asset economy.

In brief

- Stablecoin transfer volume hit $15.6T in Q3 2025, the strongest quarter on record for digital assets.

- Total stablecoin supply expanded by $45B, pushing the market above $300B for the first time in history.

- Ethereum reclaimed dominance with 69% of new issuances, while Tron’s supply saw a rare decline.

- USDT led DEX trading with over $100B monthly volume as stablecoins power global DeFi and payments.

Ethereum Reclaims Dominance as Tron Sees Rare Supply Dip

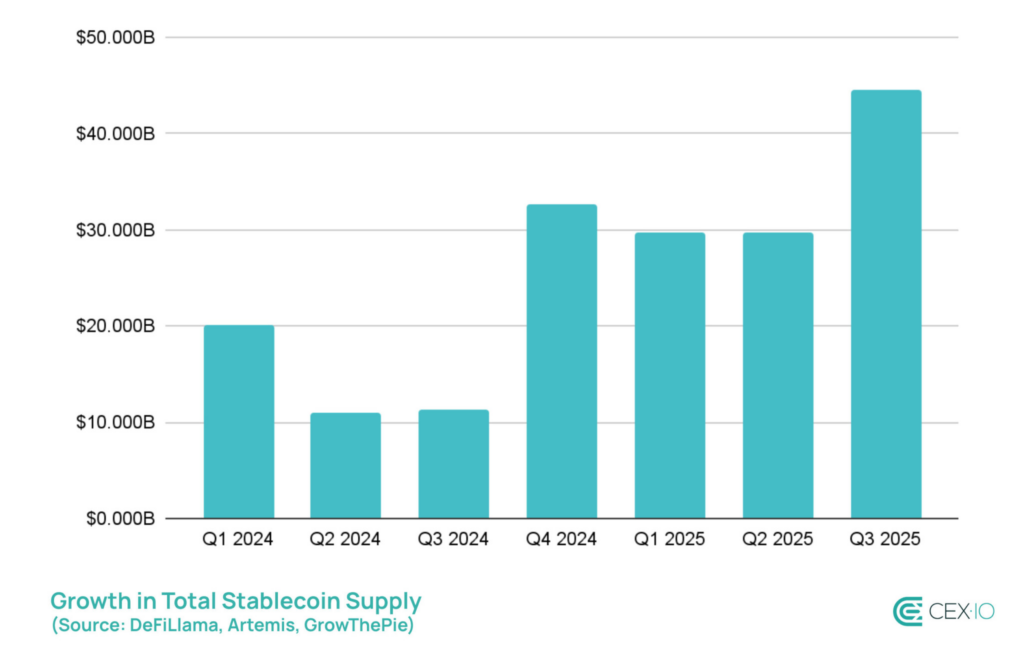

Stablecoins recorded their strongest quarter on record in Q3 2025, with transfer volumes exceeding $15.6 trillion and total supply expanding by $45 billion. The 18% quarterly growth pushed the stablecoin market above $300 billion , according to a report by CEX.IO.

USDT, USDC, and USDe drove most of the growth, making up 84% of all new stablecoin issuance. Even with U.S. limits on yield-bearing tokens under the Genius Act, USDe and PayPal’s PYUSD saw the fastest expansion, jumping 173% and 152%. The surge was fueled by strong DeFi activity and growing use across cross-chain platforms like LayerZero’s Stargate Hydra.

On-chain activity also reached new highs, with several notable developments:

- Total stablecoin transfers in Q3 2025 exceeded $15.6 trillion , marking a new record.

- Automated bots accounted for 71% of all on-chain transactions.

- Retail activity strengthened, with sub-$250 transfers reaching all-time highs in September.

- Small-value transactions are projected to exceed $60 billion by the end of 2025.

- Ethereum regained market dominance, hosting 69% of new stablecoin issuances, while Tron experienced a rare supply decline.

Layer 2 networks such as Arbitrum also gained traction, driven by demand from perpetual trading platforms and liquidity migration. As a result, USDC’s market share on Arbitrum rose from 44% to 58%, strengthening the network’s role as a hub for trading and DeFi activity.

Stablecoin Ecosystem Reaches New Heights as Final Quarter Kicks Off

Trading volumes across all stablecoins soared to $10.3 trillion, the highest level since 2021. USDT extended its dominance, surpassing $100 billion in monthly decentralized exchange (DEX) volume for the first time.

It overtook USDC as the most used trading pair on decentralized exchanges, boosted by rapid growth in activity on Binance Smart Chain (BSC). By the end of Q3, USDT’s share of total trading volume rose from 77.2% to 82.5%, while USDC declined to 10.5%. Other stablecoins collectively fell to a combined 7% share of the market.

Stablecoins cemented their central role in digital asset markets during the third quarter of 2025. Once viewed mainly as liquidity tools, they are now essential for settlement , payments, and retail adoption. With stablecoin usage historically rising in Q4, the sector may be poised for another strong quarter.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Zcash (ZEC) Experiences Price Rally in Late 2025: Privacy-Focused Cryptocurrencies Return as Macro Safe-Haven Choices

- Zcash (ZEC) surged 750% in late 2025, outperforming Bitcoin and Ethereum amid growing demand for privacy-focused crypto assets. - Network upgrades by Electric Coin Company enhanced privacy via ephemeral addresses and zk-SNARKs, while Japan's crypto-friendly regulations boosted institutional adoption. - Institutional interest in Zcash's shielded transactions and low correlation with traditional crypto assets positions it as a strategic hedge against surveillance and volatility. - Regulatory clarity in Jap

Ethereum News Update: Major Ethereum Holders Invest $1.37B During Market Dip, Indicating Potential Rise to $10K

- Ethereum whales spent $1.37B buying 394,682 ETH during November 2025's 12% price drop, signaling strong bullish conviction. - Aave whale leveraged $270M loans to acquire 257,543 ETH ($896M), using a high-leverage borrowing-swapping cycle to expand holdings. - Institutional buyers like Bitmine Immersion added $139.6M ETH, joining coordinated accumulation as exchange reserves hit 2016 lows. - Market fundamentals show negative MVRV readings and $3,400 ETH stabilization, with analysts projecting $4,800–$10,0

UAE Executes Its Inaugural Digital Dirham Transaction: A Key Step Toward Shaping the Worldwide Digital Economy

- UAE executed first government transaction using Digital Dirham CBDC via mBridge platform in under two minutes. - The pilot involved Dubai Finance and Ministry of Finance, demonstrating blockchain-driven efficiency in public sector payments. - mBridge collaboration includes BIS, CBUAE, and regional partners, with Saudi Arabia joining in 2024 to expand cross-border capabilities. - UAE leaders called the initiative a "strategic pillar" for digital economy growth, aligning with global financial modernization

Visa’s Stablecoin Express Lane: Seamless, Real-Time Global Payments for Freelancers

- Visa launches stablecoin pilot for instant global payouts to gig workers, bypassing traditional banking infrastructure. - Program uses USD-backed stablecoins to address currency volatility and limited banking access in underbanked regions. - Initiative aligns with blockchain integration strategy, supported by regulatory clarity from the GENIUS Act and Visa's tokenized asset platform. - Pilot complements Visa's legal settlement negotiations with merchants and positions the company to maintain leadership i