BTC Market Pulse: Week 34

Bitcoin rebounded from last week’s drop below $114K to $121K, with on-chain activity and derivatives sentiment improving. However, falling spot volumes and high profitability suggest caution. This week’s Market Pulse breaks down key BTC market signals across spot, futures, ETFs, and on-chain.

Overview

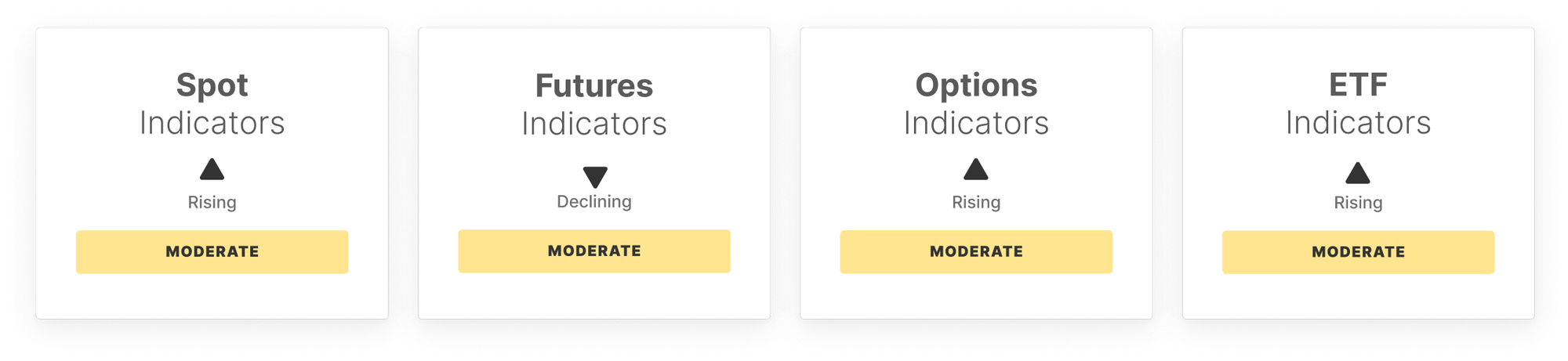

In the past week, Bitcoin's spot price reached a new all-time high of over $123k, before retreating toward a recently created air gap near $114k. Spot market momentum has softened, with RSI cooling and Spot CVD sliding deeper negative, though trading volumes briefly recovered as sellers dominated.

In futures, open interest surged beyond its statistical extremes before a wave of deleveraging hit, while funding payments show traders remain willing to pay for long exposure, albeit with fragile conviction. Perpetual CVD reflects this shift, with sharp sell-side aggression suggesting higher risk in the near term.

Options markets show heightened engagement, with open interest climbing above its extremes and volatility spread surging, reflecting increased hedging and speculative activity. Meanwhile, 25-delta skew remains positive, pointing to sustained demand for downside protection.

ETF flows flipped strongly positive, with over $880M of weekly inflows, accompanied by higher trading volumes. This highlights resilient institutional demand, though the sustainability of these inflows will be critical amid price volatility.

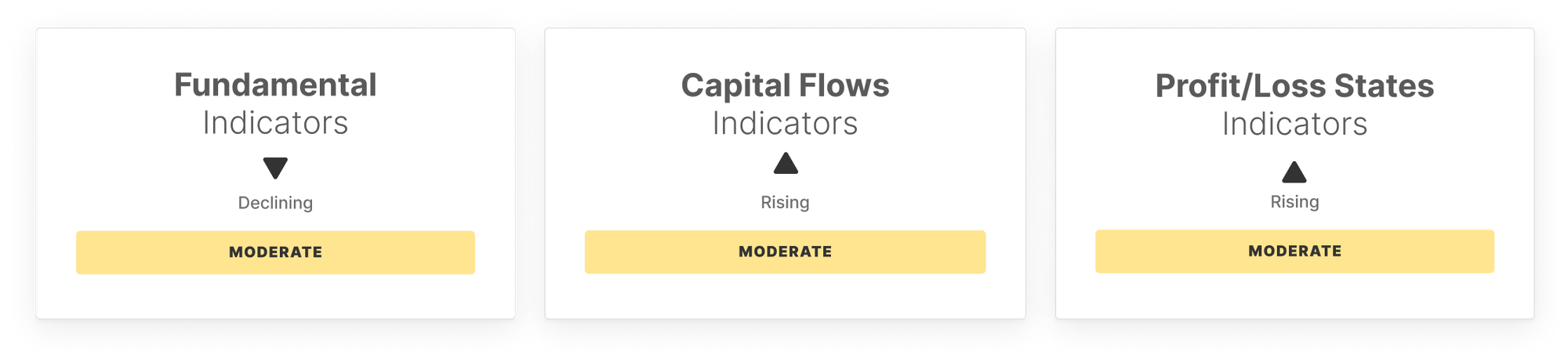

On-chain, user activity and fee volumes softened, yet entity-adjusted transfer volume spiked, showing robust capital movement likely tied to volatility. Capital flows via realized cap have slowed, while holder composition remains stable, with only modest shifts toward short-term ownership.

Profit/loss metrics indicate elevated profitability, with Percent Supply in Profit at 96% and Realized P/L Ratio climbing to 2.4. While profitability is widespread, levels remain short of euphoric extremes, suggesting cautious sentiment balanced by fear of further profit-taking pressures.

In sum, the market has shifted from a rally to a new ATH into a sharp pullback toward the upper band of the sub-$114k air gap. Strong ETF inflows and elevated derivatives activity stand in contrast to weakening on-chain signals, leaving conditions fragile. With profit-taking on the rise, the sustainability of institutional flows and renewed buyer conviction in both spot and futures will determine whether this contraction stabilizes into fresh upward momentum or extends into deeper consolidation.

Off-Chain Indicators

On-Chain Indicators

Don't miss it!

Smart market intelligence, straight to your inbox.

Subscribe nowPlease read our Transparency Notice when using exchange data .

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

KWT debuts at Shanghai press conference, attracting attention with a new token model anchored to electricity value

KWT co-founder JZ has comprehensively outlined the project's long-term vision: KWT is not a short-term speculative product, but aims to build a "power plant economy underpinned by the intrinsic value of electricity."

The Importance of x402 for Stablecoin Payments

X402+ stablecoins and on-chain crypto infrastructure will gradually and continuously impact the existing payment system. This not only involves the use of stablecoins, but also transfers money, credit, identity, and data into a parallel financial universe.

From "Crime Cycle" to Value Reversion: Four Major Opportunities for the Crypto Market in 2026

We are currently experiencing a "purification" that the market needs, which will make the crypto ecosystem better than ever before, potentially improving it tenfold.

SociFi dream shattered? Farcaster pivots to focus on the wallet track

Past data has shown that the "social-first strategy" is ultimately unsustainable, as Farcaster has consistently failed to find a sustainable growth mechanism for a Twitter-like social network.