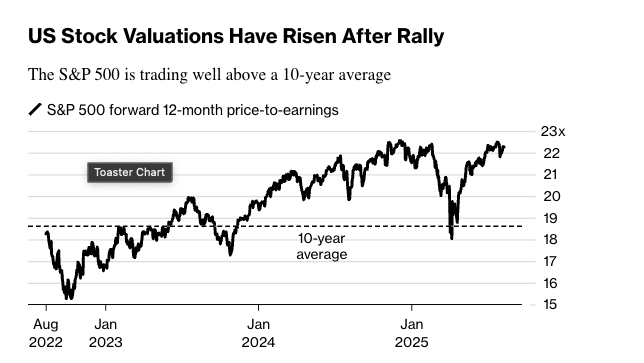

91% of Investors Say US Stock Market is Overvalued, According to New Bank of America Survey: Report

Over 90% of fund share managers, a new record, reportedly think that the US stock market is overvalued, according to a Bank of America (BofA) survey.

Per a new Bloomberg report, 91% of polled fund managers think US stocks are overvalued, the highest rate since 2001.

BofA’s poll also found that investor allocation in foreign markets has climbed to its highest weight since February, signalling a potential sentiment shift on US markets.

BofA strategist Michael Hartnett warns that the recent stock market rally may be at risk of turning into a bubble, especially given that the bank’s survey showed that cash levels as a percentage of total assets were at 3.9% – a level that has historically signalled an incoming sell-off.

Source: Bloomberg

Source: Bloomberg

On the contrary, a net 49% of respondents believe that emerging market (EM) stocks are undervalued, the most since February of 2024. Among the most “crowded trades,” the most popular answers were long the Magnificent 7 stocks, short the dollar, and long gold.

Respondents said that the biggest tail risks for markets include a trade war-induced recession, runaway inflation preventing Fed rate cuts, “disorderly rise” in bond yields, an artificial intelligence (AI) equity bubble and dollar debasement.

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

A World Beyond SWIFT (II): Moscow's Underground Ledger—Garantex, Cryptex, and the Shadow Settlement System

Three years after being cut off from SWIFT by the West, Russia is attempting a new financial trade channel.

Crypto tycoons spend eight-figure security fees annually, fearing encounters like BlueZhanfei's experience.

No one understands security better than crypto industry leaders.

With a valuation of $1 billion, why hasn’t Farcaster managed to become a “decentralized” Twitter?

Farcaster acknowledges the difficulty of scaling decentralized social networks and is abandoning its "social-first" strategy to focus on the wallet business.

If AI agents start hoarding Bitcoin, what will happen to this monetary system originally designed for ordinary people?

The underlying logic of Bitcoin assumes that users will eventually die, and the entire network is not yet prepared to accommodate holders who “never sell.”