Date: Sun, July 27, 2025 | 04:15 AM GMT

The cryptocurrency market is regaining momentum after its recent correction, with Ethereum (ETH) bouncing to $3,775 from a recent low of $3,509. This renewed bullish sentiment is spilling into major altcoins including Hedera (HBAR).

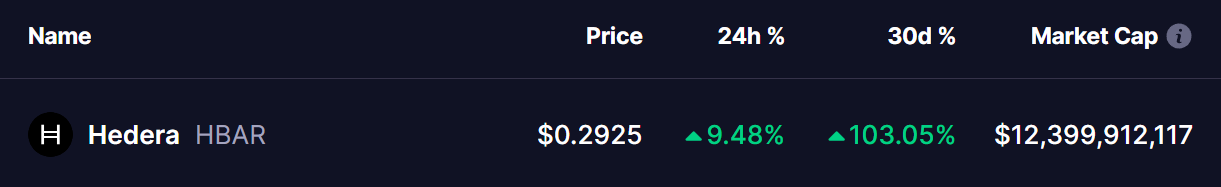

HBAR jumped 9% today, pushing its monthly gains to an eye-catching 103%. Beyond these strong numbers, its daily chart is displaying a bullish harmonic pattern that suggests more upside could be on the horizon.

Source: Coinmarketcap

Source: Coinmarketcap

Harmonic Pattern Hints at Bullish Continuation

On the daily chart, HBAR is developing a Bearish Crab harmonic pattern — a formation that, despite its bearish label, often forecasts strong rallies during the CD leg, the final and most explosive part of the pattern.

The setup began with point X near $0.3022, followed by a sharp decline to point A, a rebound to point B, and a dip to point C around $0.1275. Since reaching that low, HBAR has been climbing steadily, now trading close to $0.2922 as it moves through the CD leg of the pattern.

Hedera (HBAR) Daily Chart/Coinsprobe (Source: Tradingview)

Hedera (HBAR) Daily Chart/Coinsprobe (Source: Tradingview)

The CD leg is where momentum typically accelerates, and HBAR’s price action suggests it is the motion of that surge.

What’s Next for HBAR?

If the harmonic pattern completes, the next target lies near $0.4262, which aligns with the 1.618 Fibonacci extension of the XA leg. Achieving this would represent an additional 45% upside from current levels.

With the broader crypto market showing strength and Hedera now following a technically reliable pattern, the coming sessions could be critical in determining whether HBAR can sustain this rally.