Bitcoin rebounds above $103k after Iran missile attack intercepted

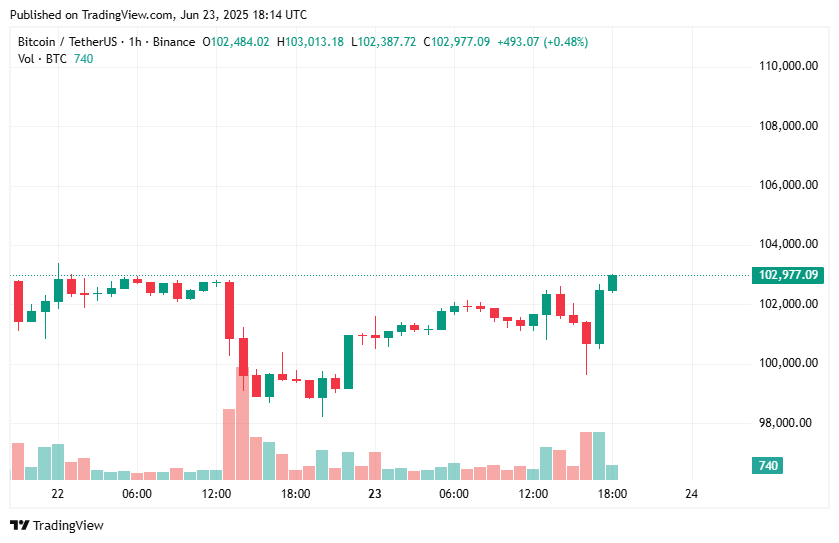

Bitcoin price has swiftly bounced above $103,000 after a sharp decline triggered by reports of Iran firing missiles at a U.S. base in Qatar.

Following confirmation that U.S. interceptor missiles successfully intercepted the Iranian missiles with no casualties, Bitcoin ( BTC ) surged. The benchmark cryptocurrency had briefly touched the $100,000 level after Iran announced it had fired missiles at Al Udeid Air Base in Qatar.

However, a statement from the Qatari Ministry of Defense detailing a successful interception of the ballistic missile attack helped boost sentiment, with Bitcoin and the broader crypto market responding positively.

According to Axios, President Donald Trump’s administration was “aware” of Iran’s coordinated attack on Al Udeid Air Base and in Iraq. Sources said the White House had “good advance warning,” noted .

The New York Times also reported that Iran had given Qatari advance information on the impending attack, with Qatar closing its airspace.

Bitcoin touches $102.5k

At the time of writing, BTC price was hovering around $102,800, up nearly 4% in the past 24 hours. The gains marked a V-shaped recovery following the sharp drop seen during afternoon U.S. trading. Bitcoin touched highs of $103k across major exchanges.

BTC chart on crypto.news

BTC chart on crypto.news

While the crypto market saw a swift rebound, further downside could follow. Reports indicate that Qatar has stated it reserves the right to respond to the attacks. Iraq, Kuwait, Bahrain, and the UAE have also shut down their airspace, and U.S. military bases across the Middle East—including at Ain Al-Asad Airbase in Iraq—are on high alert.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Making of a Crypto "Veteran"

The long-term survival game of cryptocurrencies.

Visa Introduces Swift Payments with Dollar-Backed Stablecoins

In Brief Visa launches direct payments via stablecoins for freelancers and digital services. The pilot project aims to improve speed and transparency in global payments. Visa plans global expansion of this payment system by 2026.

Bitcoin Dependency Could Be XRP’s Biggest Weakness

Injective breaks down walls between Ethereum and Cosmos with its EVM