Bitcoin Eyes $112K as Support Holds and Dev Activity Slows

- BTC is at $106K while holding the trendline that started in late April without breakdowns.

- Liquidity from central banks is rising and is pushing the global M2 supply closer to $100T.

- Bitcoin’s developer activity has dropped to 9.93, and its equity divergence stands at -0.00847.

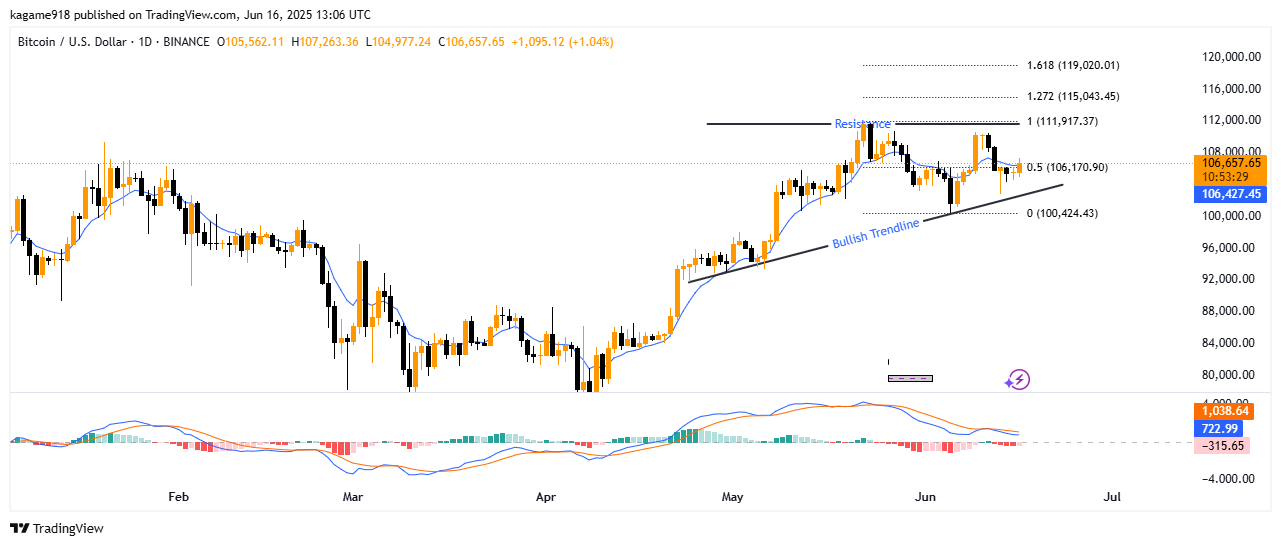

Bitcoin closed the June 16 session at $106,657.65, posting a daily gain of 1.04% after opening at $105,562.11. The day’s low touched $104,977.24, while the high hit $107,263.36. Price ended above the crucial Fibonacci 0.5 retracement level of $106,170.90, holding tight to a rising trendline that has guided the market upward since late April. This upward-sloping trendline has acted as key support and remains active. BTC is now positioned just below the major resistance level of $111,917.37, with Fibonacci extensions plotted at $115,043.45 (1.272 level) and $119,020.01 (1.618 level). The $100,424.43 mark remains the base support at the Fibonacci 0 level.

Source: Tradingview

The MACD line stands at 722.99, while the signal line remains higher at 1,038.64. A negative histogram value of -315.65 clearly shows a high bearish divergence. This reflects slowing upward pressure despite Bitcoin’s ability to hold price above trend support. A bullish MACD crossover or a clear surge in trading volume could reignite upward momentum.

Global Liquidity Expansion Mirrors BTC Structure

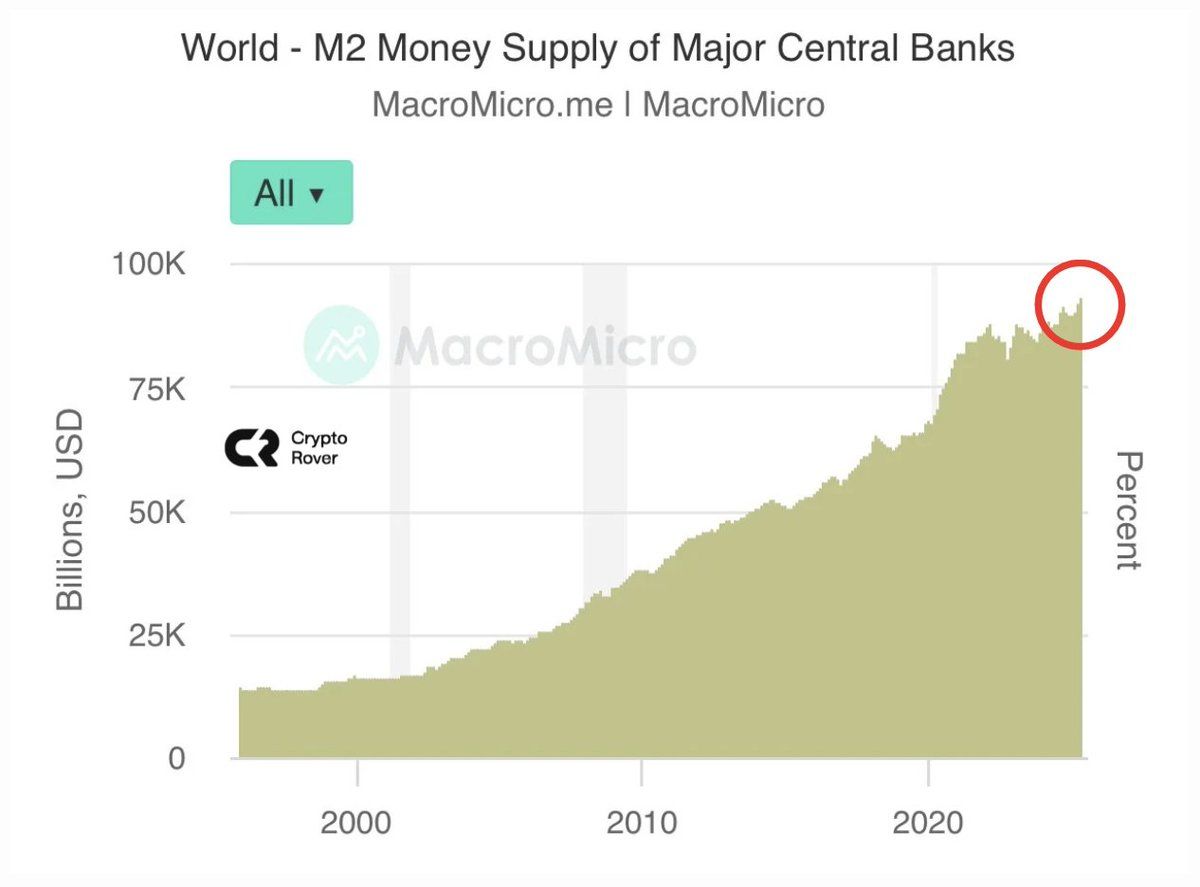

On June 16, Crypto Rover reported a fresh spike in global M2 money supply using MacroMicro data. The chart shows a renewed incline in global liquidity, currently pushing close to the $100 trillion mark. From under $20 trillion in 2000, the M2 supply surged through the decades, peaking during COVID-related monetary easing. After pulling back in 2023, liquidity has now bounced back, forming a clear uptrend in the final segment of the chart.

Source: X

This liquidity rise suggests central banks are once again expanding monetary supply. Rover described the trend as “The Global Liquidity is skyrocketing. BULLISH FOR BITCOIN!” The move is seen as positive for limited-supply assets like BTC, especially when price action holds above the rising trendline. With fiat liquidity rising globally, Bitcoin remains well-positioned for further gains, provided it maintains this structure.

Hence, broader macro support coincides with BTC’s current attempt to retest resistance near $112K. Price holding above the trendline could see targets of $115K or even $119K next.

Related: Metaplanet Buys 1,112 BTC as Holdings Reach 10,000 BTC Total

On-Chain Divergence and Developer Drop Weigh on Sentiment

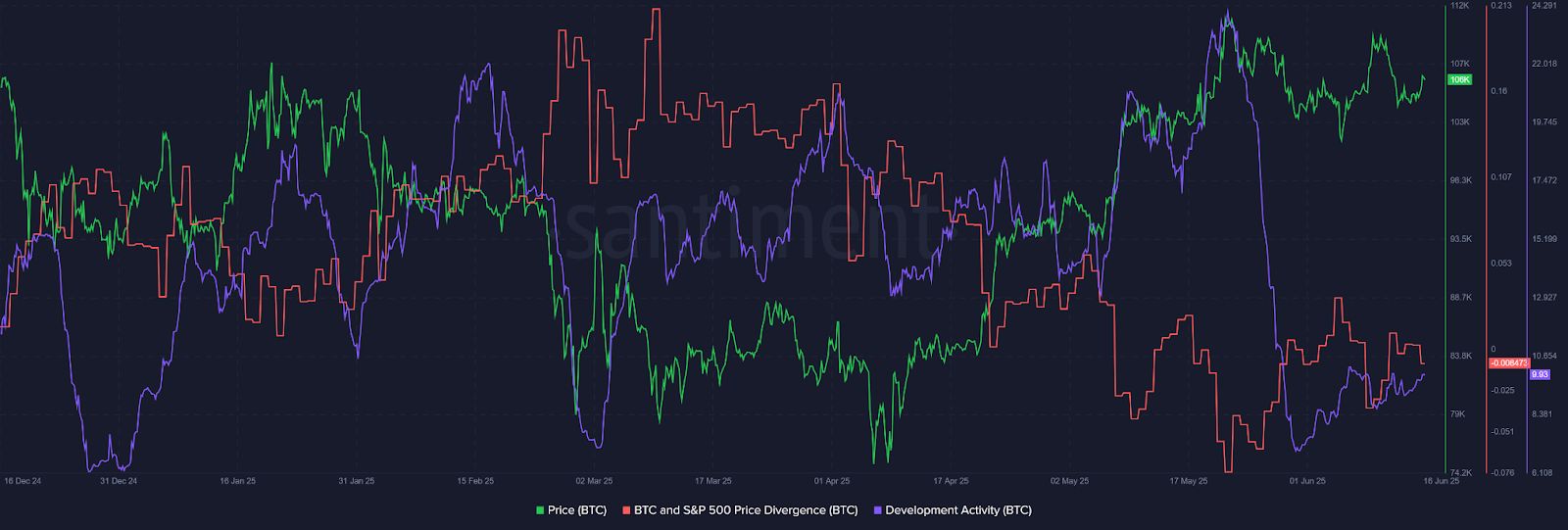

Santiment’s June 16 on-chain data shows Bitcoin diverging from the S&P 500 index, with the spread at -0.00847. This negative divergence reveals BTC’s current underperformance versus equities. Simultaneously, development activity on the Bitcoin network has dropped to 9.93, a notable slide from February’s high of 24.29. The chart visualizes BTC price (green), BTC-to-S&P divergence (purple), and development activity (red).

Source: Santiment

Price moved in a $74K to $112K window between April 2025 and June 2025. Interesting to note is that the correlation tightened with the S&P 500 early in the first quarter, then broke in April. Since then, the BTC has increasingly gone its own way. Declining dev activity, might mean lesser code updates or a delay in protocol work, which may weigh on network confidence in the longer term.

Despite BTC holding the $106K level, dev signals fading and negative equity divergence put a slight chill on the outlook. Bitcoin will require a stronger on-chain recovery to crack through $112K.

The post Bitcoin Eyes $112K as Support Holds and Dev Activity Slows appeared first on Cryptotale.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum News Update: Major Ethereum Holders Resist Market Decline: Leveraged Purchases Indicate Strong Belief in Price Floor

- Ethereum whales accumulate $1.33B ETH via leveraged DeFi tools like Aave amid market uncertainty. - Whale buying absorbs liquidity and reinforces support zones, countering ETF outflows and retail liquidations. - Upcoming Fusaka upgrade (Dec) aims to boost scalability, potentially driving revaluation post-volatility. - Mixed technical indicators show oversold RSI but bearish MACD, with key support at $3,250-$3,131. - Analysts debate whale accumulation's impact: some see bottom signals, others warn of leve

Corporate Sector Relies on Cash Reserves and Strategic Discipline to Steer Through an Unpredictable Financial Environment

- U.S. corporations are leveraging improved liquidity and disciplined strategies to boost growth, with energy, logistics, and tech firms reporting strong earnings and strategic investments. - Natural Gas Services Group raised 2025 EBITDA guidance to $78–$81M due to record fleet growth and Devon Energy collaboration, while Proficient Auto Logistics saw 24.9% Q3 revenue growth from operational efficiency. - Technology firms like TASE and Amdocs demonstrated resilience through 35% revenue growth and dividend

Ethereum News Update: While Ethereum Dominates with $201B in Tokenized Assets, Institutional Investments Grow Amid Price Challenges

- Ethereum leads tokenized assets with $201B, 64% of $314B market, driven by institutional AUM surging 2,000% since 2024. - ETH price struggles under $3,590 as technical indicators flag resistance at $3,880-$4,070 and rising exchange outflows. - Stablecoins ($18T annualized volume) and $12B RWA tokenize real-world assets, expanding Ethereum's utility beyond settlement. - Derivatives show $40.67B open interest but leveraged longs risk cascading liquidations if $4,070 resistance fails.

Bitcoin News Today: Bitcoin at a Turning Point: Is This a Bear Market or Just a Mid-Cycle Pause?

- Bitcoin trades above $105,000 amid debate over bear market confirmation vs. mid-cycle consolidation, with key technical levels at $102,000 and $94,000 critical for near-term direction. - Whale selling (815,000 BTC in 30 days) and ETF outflows ($1.22B in two weeks) contrast with $59.97B net inflows, highlighting fragile market dynamics. - Analysts split: CryptoQuant warns bearish signals (Bull Score 20) while Bitfinex cites 72% of Bitcoin in profit, comparing current correction to prior 22% rebounds. - Ri