Ethereum ETF Inflows Hit 2025 Peak — How Will ETH Price React?

Ethereum surged past $2,500 in May, driving record inflows into spot ETFs and forming a bullish chart pattern. A breakout could push ETH toward $3,000 or higher.

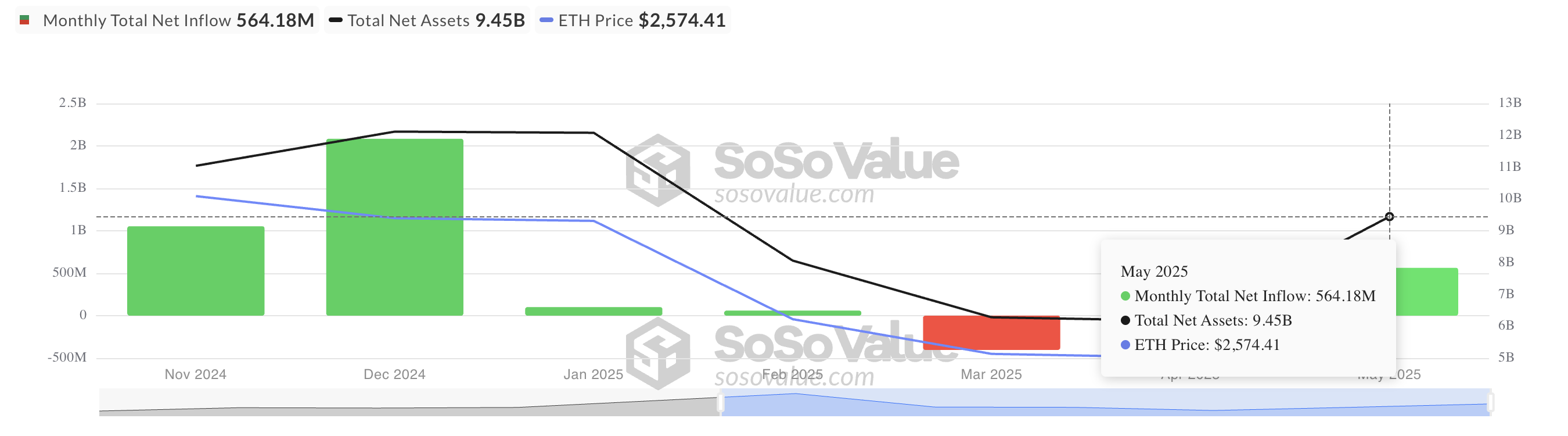

Ethereum’s price rally in May reignited investor interest in ETH-backed exchange-traded funds (ETFs). During the 31-day period, capital inflows into these investmemt products exceeded $550 million, marking the highest monthly netflow into ETH ETFs since the year began.

While the coin’s price has witnessed a pullback over the past week, technical indicators hint at a possible near-term rebound.

ETH ETFs Log Highest Monthly Inflows of 2025

According to data from SosoValue, ETH spot ETFs recorded a combined inflow of $564.18 million in May, surpassing all previous monthly totals this year.

Total Ethereum Spot ETF Net Inflow. Source:

SosoValue

Total Ethereum Spot ETF Net Inflow. Source:

SosoValue

The influx of capital was largely driven by ETH’s strong performance, with the leading altcoin breaking above the critical $2,000 level and attempting to consolidate gains above $2,500 during the month. This renewed bullish sentiment encouraged institutional investors to increase their exposure through spot ETFs and position ahead of a sustained rally in the coin’s price.

Ethereum Prepares for Next Leg Up

Readings from the daily chart show that ETH witnessed a 49% surge between May 8 and May 13, before settling into a consolidation phase that has now formed a bullish pennant pattern.

Ethereum Bullish Pennant. Source:

TradingView

Ethereum Bullish Pennant. Source:

TradingView

A bullish pennant pattern is formed when a strong upward price movement (flagpole) is followed by a period of consolidation that resembles a small symmetrical triangle (the pennant). This pattern suggests that buyers are temporarily pausing before continuing the uptrend.

If ETH breaks out of the pennant to the upside, it could trigger a renewed rally that mirrors the initial 49% surge. Such a breakout would confirm continued bullish momentum and attract additional capital inflows.

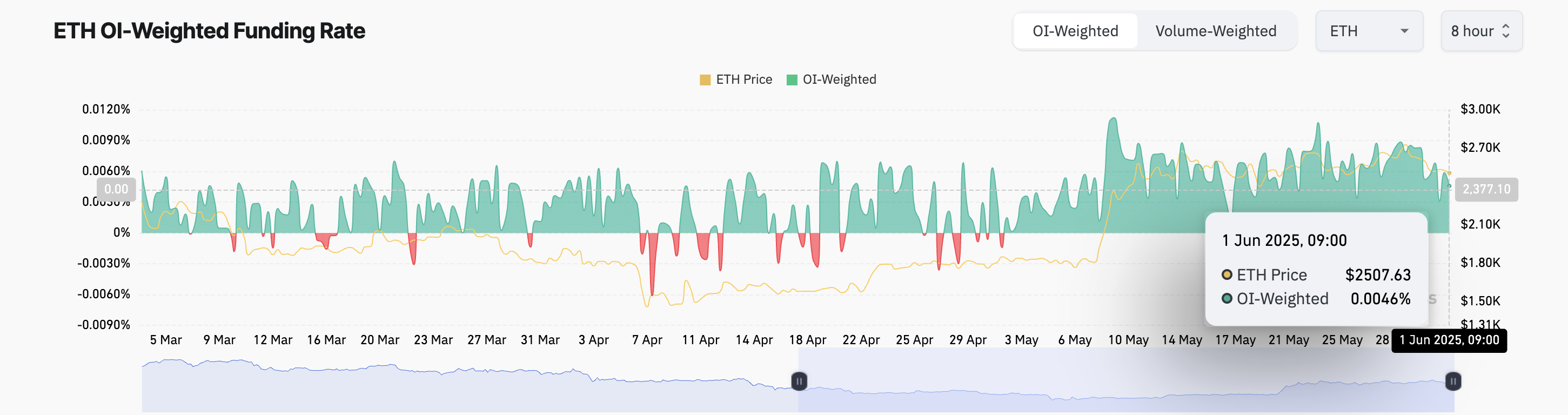

Moreover, the coin’s funding rate continues to print values above zero, indicating a preference for long positions even amid the ongoing consolidation phase. As of this writing, ETH’s funding rate stands at 0.0046%.

Ethereum Funding Rate. Source:

Coinglass

Ethereum Funding Rate. Source:

Coinglass

A positive funding rate like this means that long-position holders are paying short-position holders, indicating bullish sentiment and that more traders are betting on price increases.

Ethereum’s Next Move: Can Bulls Push ETH 49% Higher From Here?

ETH currently trades at $2,489, sitting above the lower line of its pennant, which forms support at $2,479. If a bullish breakout occurs, ETH’s price could rally by the flagpole’s length (49%) to trade at $3,907.

Ethereum Price Analysis. Source:

TradingView

Ethereum Price Analysis. Source:

TradingView

However, if selloffs resume, the coin’s price could break below the pennant and trade at $2,419.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin ‘Wave 3’ expansion targets $200K as sell-side pressure fades: Analyst

Market sentiment in the crypto space remains fragile; even the positive news of the "U.S. government shutdown" ending failed to trigger a meaningful rebound in bitcoin.

After last month's sharp drop, Bitcoin's rebound has been weak. Despite traditional risk assets rising due to the US government reopening, Bitcoin has failed to break through a key resistance level, and ETF inflows have nearly dried up, highlighting a lack of market momentum.

How Bedrock Strengthens BTCFi Security With Chainlink Proof of Reserve and Secure Mint