- Investor confidence sinks as Bitcoin hits new lows.

- Some analysts are optimistic the bull market is still on despite the weekend crash.

- Macro factors continue to weigh heavily on crypto market uncertainty.

Price volatility is inherent in crypto investing, but investor confidence was shaken over the weekend as Bitcoin plummeted to 25-week lows. This sharp decline has reignited discussions about the state of the Bitcoin bull market, with some speculating that the weekend sell-off marked the beginning of a new bear cycle.

Despite ongoing concerns, some analysts remain optimistic that recessionary fears and the threat of World War III have not derailed the crypto bull market .

Is the Bitcoin Bull Market Still On?

The weekend crypto crash has been attributed to several macro factors , including the unwinding of the yen carry trade and escalating geopolitical tensions. These events have sent shockwaves through legacy and crypto markets, resulting in significant sell-offs across the board and stoking concerns about the end of the bull market.

Sponsored

Kit Juckes, chief foreign exchange strategist at Societe Generale, offered insights into the potential trajectory of the market. According to Juckes, recessionary fears may continue to intensify until mid-September, when the Fed next meets to decide on setting U.S. interest rates.

However, Juckes maintained a cautiously optimistic outlook, suggesting that the current market downturn may not necessarily signal the beginning of a prolonged bear cycle. He predicts a ‘constructive outlook’ for Q4.

Drawing on historical patterns, crypto advisor ‘CryptoJack’ spotlighted the 2020 covid crash, noting that significant market downturns often precede substantial bull runs. In that instance, Bitcoin experienced a 1,400% increase over 13 months following the initial crash to $4,000.

Titan of Crypto echoed CryptoJack’s take, highlighting the importance of the 38.2% Fibonacci level . According to the technical analyst, if Bitcoin can hold above this level, which he set at approximately $56,000, the bull market may still be intact.

Sponsored

Recent price action shows some signs of recovery, with Bitcoin finding support at $49,000 on Monday and gradually climbing to $57,000 by Wednesday.

However, opinions remain divided, with some market participants maintaining that the bear market has returned.

Staked Seed Node

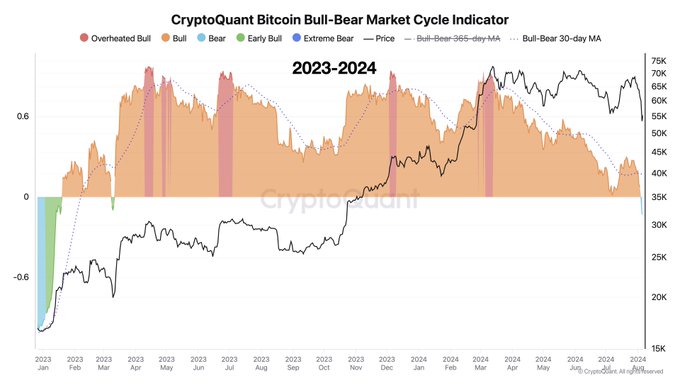

The Bitcoin Bull-Bear Indicator has provided a contrasting perspective on the current market. According to Julio Moreno, CryptoQuant’s head of research, the indicator has shifted into bear market territory following the weekend crash.

The Bitcoin Bull-Bear Indicator, per CryptoQuant

The Bitcoin Bull-Bear Indicator, per CryptoQuant

Moreno noted that this marked the first time since January 2023 that the indicator has signaled a bearish outlook, adding weight to concerns about the market’s direction. The researcher added that the indicator correctly predicted the prior cycle bull market top in November 2021.

Gold bug Peter Schiff added to bear market concerns, stating that this week’s market bounce is driven by expectations of a 50 basis point rate cut by the Fed in September.

However, Schiff argued that a significant rate cut is ‘too little, too late’ to stave off a global recession, especially in light of potentially higher-than-expected inflation data.

On the Flipside

- The Bank of Japan has committed to no more rate raises during market uncertainty.

- The Crypto Fear & Greed Index moved into extreme fear territory on Tuesday.

Why This Matters

The weekend crash has sunk investor confidence; however, it’s too soon to give a definitive answer on whether Bitcoin has entered a new bear cycle or not.

Bitcoin ETF investors get spooked by the weekend crash:

Bitcoin ETFs Bleed $168 Million Amid Market Shakeup

Justin Sun announces initiative to counter future market sell-offs:

Crypto Crash Sparks Justin Sun’s $1B Anti-FUD Initiative