Solana jumps almost 10% as VanEck files for first US Solana ETF

Key Takeaways

- Solana's price jump reflects market optimism following VanEck's ETF filing.

- VanEck's initiative could set a precedent for future cryptocurrency ETFs in the US.

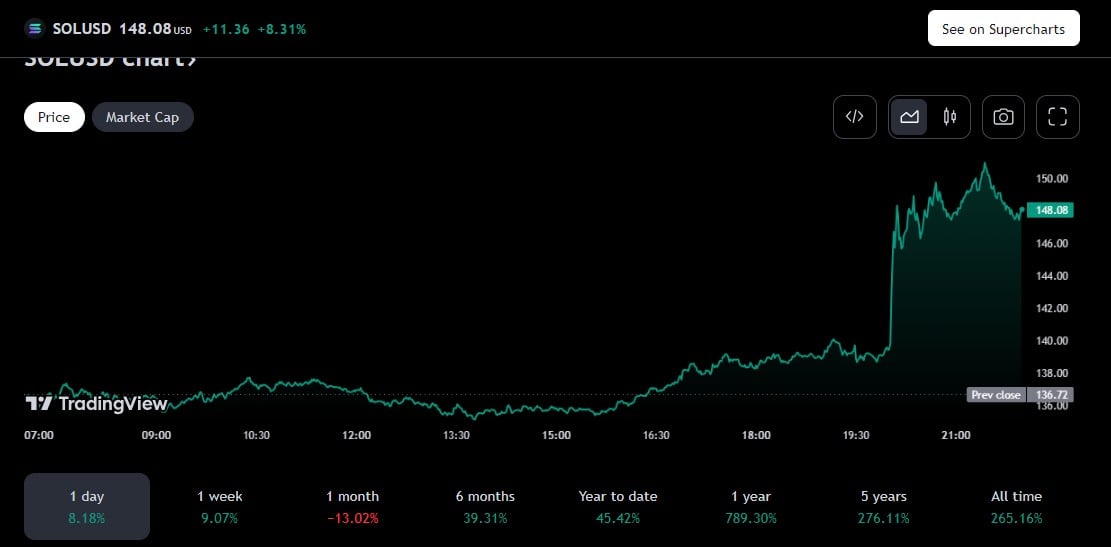

Solana’s (SOL) price surged almost 10%, from around $139 to $151, shortly after VanEck’s application for a spot Solana exchange-traded fund (ETF). According to TradingView, SOL is currently trading at around $148, up 8% in the past 24 hours.

Source:

TradingView

Source:

TradingView

On Thursday, VanEck, the prominent player in the ETF market, submitted an S-1 form to the US Securities and Exchange Commission (SEC) to launch the VanEck Solana Trust . VanEck’s move marks the first attempt to establish a Solana-based ETF in the US.

With the latest filing, VanEck has classified Solana as a commodity rather than a security.

In addition, Matthew Sigel, Head of Digital Assets at VanEck, said Solana stands out as a high-performance blockchain with remarkable attributes like high scalability, speed, and low transaction fees.

VanEck’s new filing comes ahead of the anticipated launch of spot Ethereum funds in the US. In May, the SEC greenlit a batch of Ethereum ETF filings, including one from VanEck. These ETFs are currently pending trading approval from the SEC.

Bloomberg ETF analyst Eric Balchunas predicts the SEC will allow Ethereum ETFs to start trading as soon as next week.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Will Zcash's ZEC return to $500 or higher before 2026?

Bitcoin's ‘bear flag pattern’ targets $67K as BTC spot demand slumps

Bitcoin Hash Ribbons flash ‘buy’ signal at $90K: Will BTC price rebound?

How to achieve an annualized return of 40% through arbitrage on Polymarket?

By demonstrating arbitrage structures with live trading, this provides a clear reference for the increasingly intense arbitrage competition in the current prediction markets.