News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Bullish divergence in altcoin dominance points to early stages of a major rally with more upside potential.Early Stages of Altseason?What to Watch Next

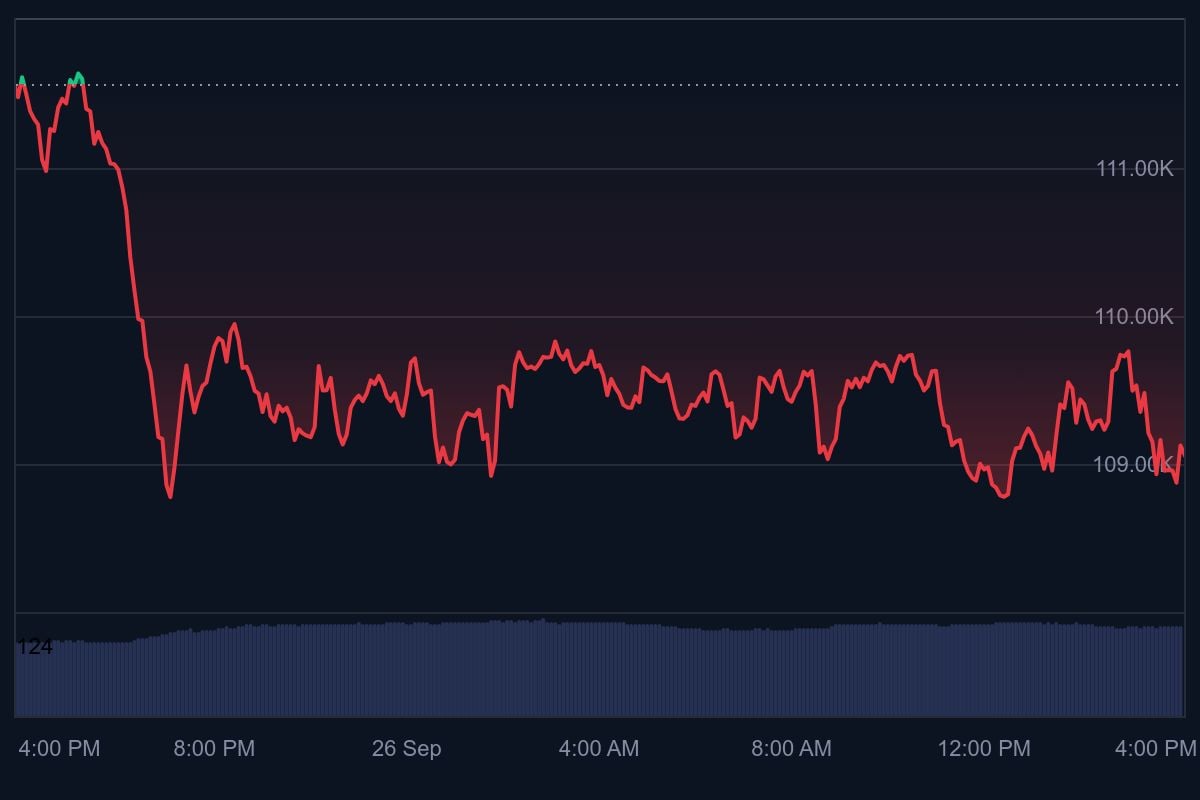

Bitcoin holds near $109K while US stock futures react to inflation data and new tariffs.Stock Markets React to Tariff NewsWhat This Means for Bitcoin

Cronos ($CRO) sets sights on $0.8868, signaling over 350% potential upside as bullish sentiment grows.What’s Fueling the $CRO Price Surge?Can Cronos Reach $0.8868?

SWIFT is testing stablecoins and blockchain-based messaging using Consensys' Linea network.Why Stablecoins and Linea?The Bigger Picture for Crypto Integration

Bitcoin often dips in September but rallies hard in Q4. Will 2025 follow the same bullish pattern?Bitcoin Q4 Performance: A Bullish TurnaroundWhat to Watch This Q4

- 09:02Kalshi releases new SDK, covering API functions for trading, market data, and portfolio managementForesight News: Prediction market Kalshi has officially released a new SDK. Its features include comprehensive API functions covering trading, market data, and portfolio management, authentication using RSA-PSS signatures, as well as automatic request signing and timestamp processing.

- 07:56Data: 2,000 bitcoins from a Casascius physical coin dormant for 13 years have been transferred, worth approximately $180 millions.According to ChainCatcher, citing CoinDesk, two wallets associated with Casascius physical bitcoins recently transferred a total of 2,000 bitcoins, valued at approximately $180 million, after lying dormant for over a decade. These bitcoins had not been moved since 2011 and 2012, when the price of bitcoin was less than $15, compared to nearly $90,000 today. Casascius physical coins were created by Utah entrepreneur Mike Caldwell in 2011 as tangible collectibles containing embedded private keys, with denominations ranging from 1 to 1,000 BTC. Each coin came with a tamper-evident holographic seal to protect the private key underneath. Caldwell ceased production of pre-funded coins at the end of 2013 after the U.S. Financial Crimes Enforcement Network (FinCEN) identified him as an unregistered money transmitter. The specific purpose of the recent transfers remains unclear; it could be for sale, internal restructuring, or as a precaution to preserve access. It may also be related to the physical components degrading, similar to an incident earlier this year where a user claiming to own a 100 BTC Casascius bar reported difficulty importing the key into a modern wallet after peeling off the hologram.

- 07:56Data: The average cash cost to mine one bitcoin has reached $74,600According to ChainCatcher, citing the latest data from CryptoRank.io, the average cash cost to mine one bitcoin has reached $74,600. When including depreciation and stock-based compensation (SBC), the total cost soars to $137,800. As network hashrate surpasses the symbolic milestone of 1 ZH/s, industry competition is intensifying and mining profit margins are plummeting. This shift is prompting many public miners to reallocate computing power to artificial intelligence (AI) and high-performance computing (HPC) workloads, as these sectors offer significantly higher profit margins compared to traditional bitcoin mining. The industry is splitting into two distinctly different business models: Infrastructure providers—transforming mining data centers for high-profit computing tasks; and traditional miners—continuing operations in a more competitive, near-zero profit environment. Analysts point out that the high mining costs also reflect the scarcity of bitcoin, which may be one of the factors driving the current price increase.