News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec. 5) | 21Shares Launches 2x Leveraged SUI ETF on Nasdaq; U.S. Treasury Debt Surpasses $30 Trillion; JPMorgan: Strategy’s Resilience May Determine Bitcoin’s Short-Term Trend2Bitcoin looks increasingly like it did in 2022: Can BTC price avoid $68K?3The Chainlink ETF Disappoints Despite $41 Million Inflows — Why?

XRP ETF Approval Odds Surge to 99%, but Expert Says ‘ETFs Will Be Irrelevant in 5 Years’

CryptoNewsNet·2025/09/27 10:18

PCE Report Confirms No Surprises, US Demand Remains Strong

Cointribune·2025/09/27 10:15

Moody’s Flags Danger As Stablecoins Spread Globally

Cointribune·2025/09/27 10:15

Worldcoin (WLD) To Soar Higher? Key Breakout Signals Potential Upside Move

CoinsProbe·2025/09/27 10:12

Is Pump.fun (PUMP) Poised for a Bullish Breakout? Key Pattern Formation Suggests So!

CoinsProbe·2025/09/27 10:12

Pudgy Penguins (PENGU) To Bounce Back? Key Breakout Signals Potential Upside Move

CoinsProbe·2025/09/27 10:12

Spot Ether ETFs see five-day outflow streak amid 10% price drop

Coinjournal·2025/09/27 10:09

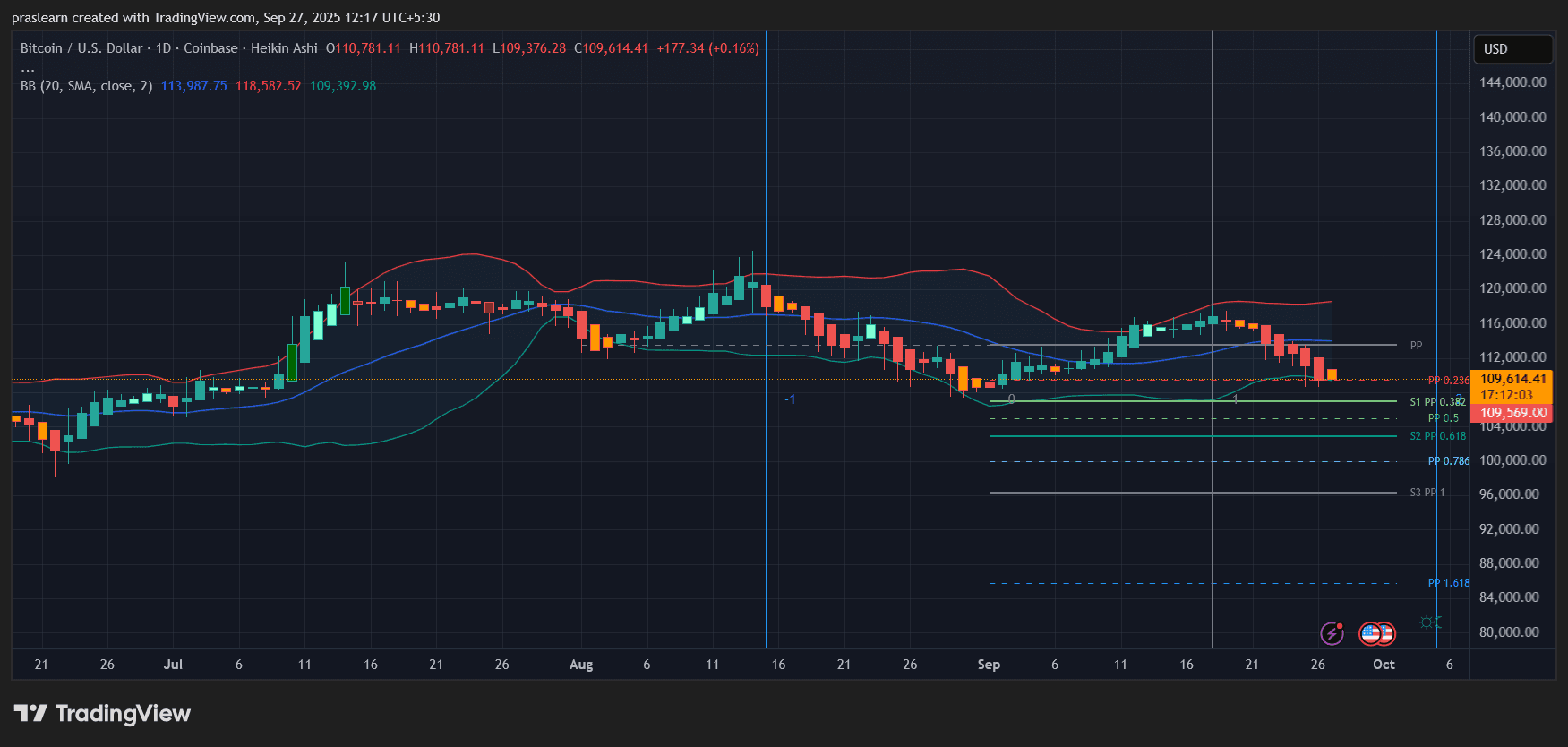

Bitcoin News: Will BTC Price Crash to $81,000?

Cryptoticker·2025/09/27 09:51

Ethereum Crash: ETH Price Might Crash to $3,500 and Here's Why

Cryptoticker·2025/09/27 09:51

Virtuals Protocol Ends Genesis: A New Launch Model Ahead

Cryptoticker·2025/09/27 09:51

Flash

- 03:31Data: In the past 7 days, CEXs have seen a cumulative net outflow of 8,915 BTCChainCatcher news, according to Coinglass data, in the past 7 days, CEXs have seen a cumulative net outflow of 8,915 BTC. The top three CEXs by outflow are as follows: · One exchange, with an outflow of 6,335.56 BTC; · One exchange, with an outflow of 1,193.43 BTC; · One exchange, with an outflow of 1,163.66 BTC. In addition, one exchange saw an inflow of 1,097.26 BTC, ranking first in terms of inflow.

- 03:21Analysis: Rising Bitcoin "vitality" indicator suggests the bull market may continueJinse Finance reported that crypto analyst "TXMC" posted on X, pointing out that although the recent bitcoin price has declined, the liveliness of this cycle continues to rise. This indicates that there is underlying demand for spot bitcoin, which is not reflected in the price trend and may suggest that the bull market cycle is not yet over. The analyst stated that this indicator reflects the long-term moving average of on-chain bitcoin activity, representing the sum of all lifecycle spending and on-chain holding activity. During bull markets, as supply changes hands at higher prices, market "liveliness" usually increases, indicating the inflow of new investment capital.

- 03:12Bankruptcy sector concept tokens continue to surge, USTC up over 78% in 24 hoursBlockBeats News, December 7, according to data from a certain exchange, the bankruptcy sector concept tokens continue to surge, among which: · USTC has risen over 78% in 24 hours, with a market cap rising to $69.35 million; · LUNA has risen over 39% in 24 hours, with a market cap rising to $160 million; · LUNC has risen over 19% in 24 hours, with a market cap rising to $363 million; · FTT has risen over 18% in 24 hours, with a market cap rising to $234 million. BlockBeats reported yesterday that recently, after SBF’s fellow inmate was pardoned, SBF has been making frequent statements, indicating a potential possibility of receiving a pardon. However, on the prediction market Polymarket, the probability of "Will Trump pardon SBF in 2025?" remains at a very low level of about 2%.

News