News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec. 8)|The median stock price of DAT companies listed in the U.S. and Canada has fallen 43% this year; Trump proposes replacing the current personal income tax system with tariff revenue2Bitcoin price dips below 88K as analysis blames FOMC nerves3Stablecoin : Western Union plans to launch anti-inflation "stable cards"

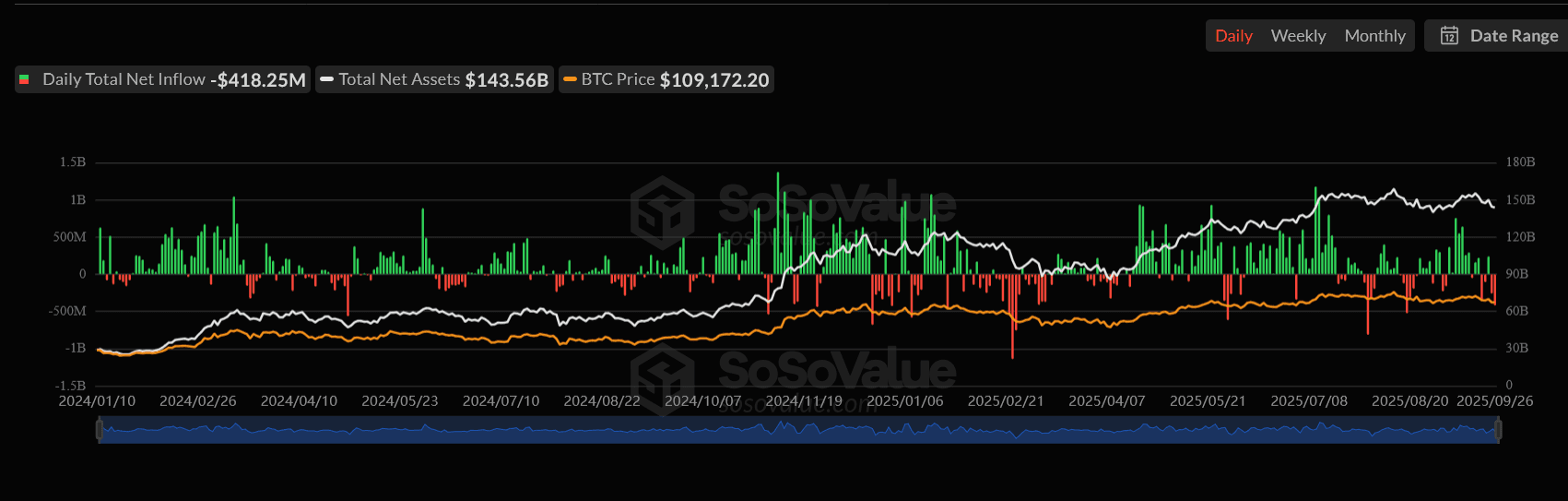

Ethereum and Bitcoin ETFs just had their worst week ever.

Record outflows have raised significant doubts about institutional confidence in Bitcoin and Ethereum.

Cryptoticker·2025/09/28 14:50

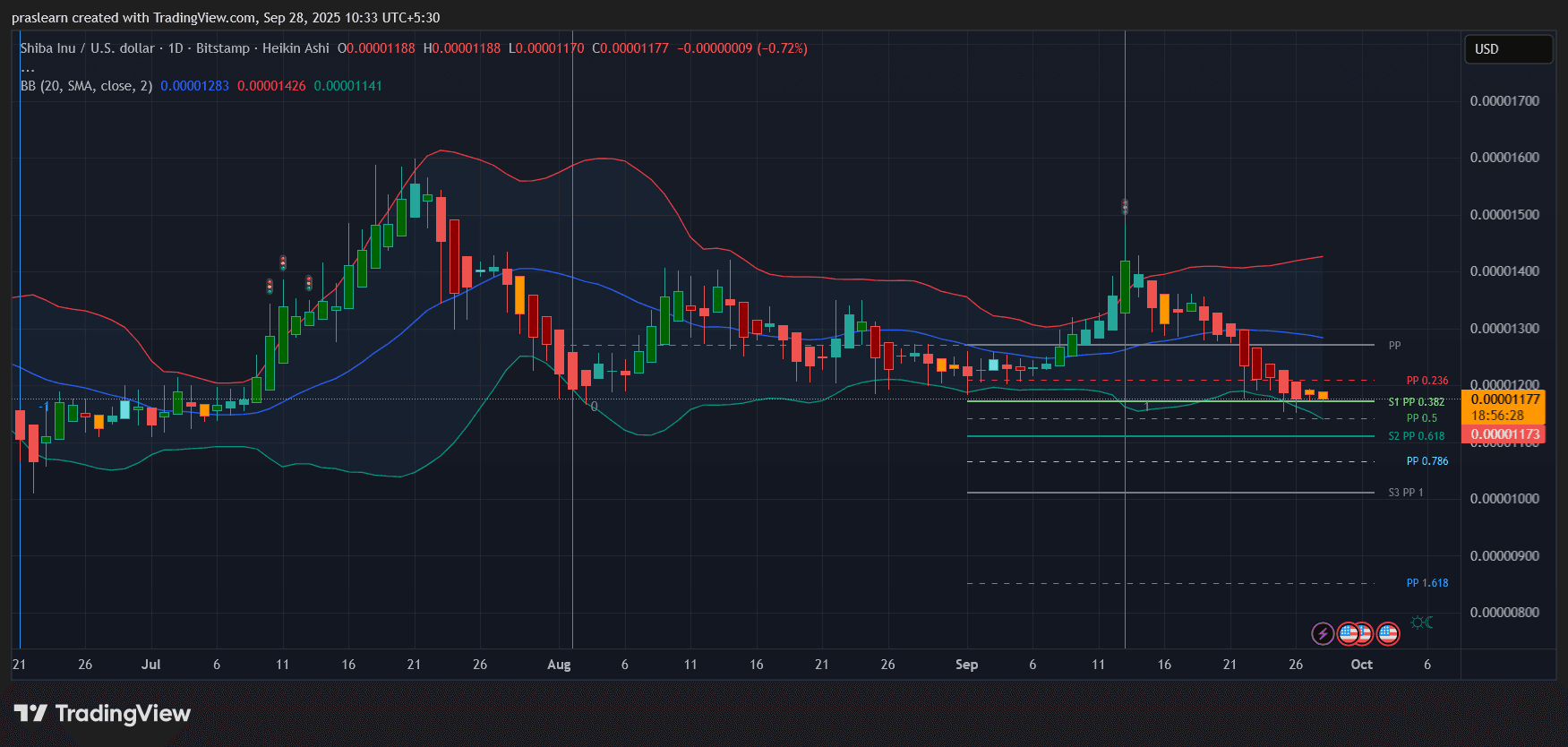

SHIB price plummets: Has the worst yet to come?

Declining savings, rising inflation, and bearish charts all point to one issue: SHIB's problems may have only just begun.

Cryptoticker·2025/09/28 14:49

The hidden force behind Bitcoin and Ether price swings: Options expiry

Cointelegraph·2025/09/28 14:27

Three Reasons ASTER Price Is Sliding Despite CZ’s Backing

Aster’s token has fallen sharply from recent highs, with analysts pointing to product doubts, investor exits, and unclear signals from CZ. Despite strong fundamentals, user trust and Hyperliquid competition raise questions about the exchange’s staying power.

BeInCrypto·2025/09/28 12:06

Everyone’s shorting the dollar and markets could be in for a ride

CryptoSlate·2025/09/28 12:00

Cathie Wood likens Hyperliquid to early Solana, says Bitcoin may remain ARK’s core

Coinotag·2025/09/28 11:00

SHIB Stabilizes at Crucial Support Amid Rising Whale Activity

Cryptonewsland·2025/09/28 10:51

Flash

- 01:48PayPal stablecoin market cap to reach $4 billion, driven by DeFi protocolsAccording to ChainCatcher, citing DL News, the circulating supply of PayPal's stablecoin PYUSD has surged by 224% since September, surpassing $3.8 billion and becoming the sixth largest stablecoin. The DeFi protocol Ethena has become the largest holder of PYUSD, holding $1.2 billion through the custodian Copper. PayPal, in cooperation with liquidity management company Sentora, provides incentives on the decentralized exchange Curve Finance and subsidizes yields for DeFi protocol users. The Solana lending protocol Kamino currently offers nearly 6% annualized yield for lending PYUSD, with part of the yield subsidized by PayPal. Over the past three months, the scale of PYUSD on Solana has increased from $250 million to over $1 billion. U.S. Treasury Secretary Scott Besant expects the stablecoin market to reach $3 trillion by 2030.

- 01:48Fitch Ratings warns of US banks' cryptocurrency exposure risks and may reassess the ratings of related banksChainCatcher news, according to Cointelegraph, international credit rating agency Fitch Ratings has issued a report warning that it may negatively reassess US banks with "significant" cryptocurrency exposure. Fitch Ratings stated that while cryptocurrency integration can enhance fees, yields, and efficiency, it also brings "reputational, liquidity, operational, and compliance" risks to banks. The report pointed out that stablecoin issuance, deposit tokenization, and blockchain technology applications provide banks with opportunities to improve customer service, but banks need to fully address challenges such as cryptocurrency value volatility, the pseudonymity of digital asset owners, and the protection of digital assets against theft. The report also emphasized that if the stablecoin market grows to a scale large enough to impact the Treasury market, it could pose systemic risks. Major banks such as JPMorgan, Bank of America, Citigroup, and Wells Fargo are all involved in the cryptocurrency sector.

- 01:48MegaETH: Frontier to Open to Application Developers Next WeekChainCatcher reported that MegaETH announced on X that Frontier will be open to application developers next week. The infrastructure team has completed deployment on the mainnet, and more teams will join in the coming days. In the following weeks, they will support applications in completing deployment and testing before users join. Previously, in November, MegaETH announced the launch of the mainnet Beta "Frontier", which was expected to run for one month starting from early December.

News