News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

- HAEDAL surged 86.68% in 24 hours to $0.1505 on Aug 30, 2025, reversing prior 622.71% and 979.56% declines. - Analysts attribute the spike to isolated trading or speculation, not a sustained trend, amid extreme volatility. - Despite short-term gains, HAEDAL remains down 2415.13% year-to-date, highlighting risks of high-swing assets lacking fundamentals. - A proposed backtesting strategy failed due to missing price history, underscoring challenges in analyzing HAEDAL's unverified market structure.

- Bit Origin secures 180-day Nasdaq compliance extension to address $1.00 bid price requirement, marking its second such deadline extension. - Company authorizes flexible reverse stock split (1-for-2 to 1-for-200) but faces Nasdaq restrictions limiting split effectiveness within 12 months or exceeding 250:1 ratios. - Strategic pivot to Dogecoin treasury (70.5M DOGE) introduces regulatory risks as SEC crypto litigation looms, potentially reclassifying DOGE as a security. - Financial fragility exposed throug

- Toncoin (TON) gains institutional traction via TSC's $558M Nasdaq listing and Verb's $713M supply acquisition, offering 4.86% staking yields and token appreciation potential. - Robinhood's 2025 TON listing boosted retail liquidity, driving 60% trading volume surge to $280M and 5% price increase within days, leveraging its 26.7M U.S. user base. - TON's integration into Telegram's 1.8B-user ecosystem saw 32% weekly transaction growth (3.8M total) and 52% fee spikes, powering decentralized commerce and NFTs

- Seazen Group is tokenizing real estate assets via blockchain to address liquidity crises and pioneer institutional-grade RWA markets in China. - The company leverages Hong Kong's regulatory sandbox, issuing tokenized bonds and NFTs for Wuyue Plaza while complying with e-CNY and CSRC rules. - Tokenization has enabled $300M in bond sales and 894.9M yuan net income, positioning Seazen as a catalyst for China's $4T tokenized real estate market by 2035. - Challenges include regulatory fragmentation and low li

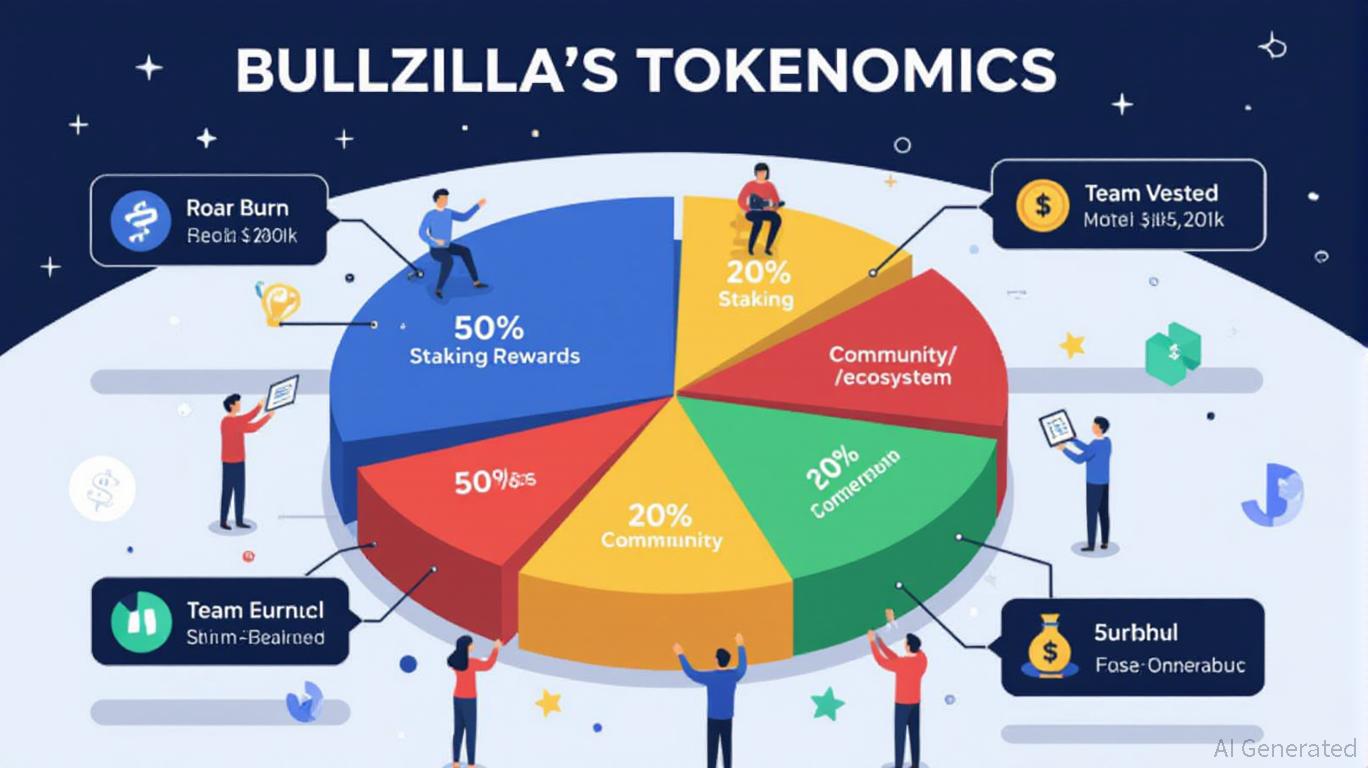

- BullZilla ($BZIL) redefines meme coins with structured tokenomics, progressive pricing, and 5% Roar Burn at each presale stage. - Its 70% APY HODL Furnace and 10% referral rewards outperform Bonk ($BONK) and Dogwifhat ($WIF) in scarcity engineering and community incentives. - Continuous supply reduction and compounding staking create a flywheel effect, contrasting with competitors' sporadic burns and volatile APYs. - Early presale participation could turn $1,500 into $1.3M by 2026, positioning BullZilla

- Aptos (APT) faces critical support at $4.20, a Fibonacci retracement and value area low, with technical and on-chain signals hinting at potential mean reversion or deeper bearish breakdown. - Institutional buying above $4.38 and an ascending channel with higher lows suggest bullish momentum, but volume decline and RSI/MACD weakness caution against premature optimism. - Bullish candlestick patterns (engulfing, hammer) at $4.20 signal possible reversal, yet confirmation via breakout above $4.80 and rising

- 02:08Data: Hyperliquid platform whales currently hold $4.244 billions in positions, with a long-short ratio of 0.87According to ChainCatcher, citing Coinglass data, whales on the Hyperliquid platform currently hold positions totaling $4.244 billions, with long positions at $1.971 billions, accounting for 46.44% of the total, and short positions at $2.273 billions, accounting for 53.56%. The profit and loss for long positions is -$162 millions, while for short positions it is $283 millions. Among them, the whale address 0x9eec..ab has taken a 15x leveraged full-position long on ETH at the price of $3,201.03, with an unrealized profit and loss of -$8.3105 millions.

- 01:40A major AAVE whale enters the market again, buying 80,000 tokens within half a monthAccording to Jinse Finance, analyst Yu Jin has monitored that an AAVE whale was liquidated for 32,000 AAVE at a price of $101 during the market crash, but has re-entered the market since November 24. Within half a month, this investor has spent 14 million USDC to purchase 80,900 AAVE at an average price of $173. Currently, through a looping loan strategy, the whale holds a total of 333,000 AAVE (worth approximately $62.59 million), with an average cost of $167 and a liquidation price at $117.7. Over the past two years, this whale has continuously accumulated AAVE tokens through a looping loan strategy.

- 01:26Aztec TGE could take place as early as February 11, 2026, with 19,476 ETH already raised in the public sale.ChainCatcher news, Aztec officially announced that the AZTEC token public sale has now ended, with a total subscription amount of 19,476 ETH. Of these funds, 50% came from the Aztec community, and a total of 16,741 users participated across the network. Users holding more than 200,000 tokens can start receiving block rewards today. The TGE will be triggered by an on-chain governance vote, which could take place as early as February 11, 2026. At the time of the TGE, all tokens (100%) obtained from the token sale will be freely transferable. Only token sale participants and genesis sequencers are eligible to participate in the TGE vote.