Artikel untuk saat ini tidak mendukung bahasa yang kamu pilih, artikel ini telah otomatis direkomendasikan ke bahasa Inggris untuk kamu.

Cross-Asset Margin on Bitget Coin-M Futures

[Estimated reading time: 3 mins]

Cross-asset margin is an innovative feature of Bitget Coin-M Futures that allows you to use multiple major cryptocurrencies as margin to trade any Coin-M Futures pair — without needing to hold the base currency of the futures contract. For example, BTC can be used as the margin to trade BTCUSD, ETHUSD, XRPUSD, and more. The system automatically converts the margin based on real-time exchange rates, requiring no manual conversion.

Compared to traditional Coin-M Futures, which require margin in the same currency as the trading pair, cross-asset margin offers greater flexibility and convenience in fund management. Learn more about Bitget Coin-M Futures.

Benefits of cross-asset margin

-

Flexibility and convenience: No need to hold specific coins for different futures trading pairs. A single asset (e.g., BTC or ETH) can be used as margin across multiple trading pairs, streamlining fund management.

-

Diversified options: The feature supports the use of BTC, ETH, XRP, STETH, USDE, USDC, BGB, and more as margin, catering to different investment needs.

-

Lower conversion costs: Use your existing crypto holdings directly as margin without converting between coins, reducing transaction fees and exposure to price volatility.

-

Efficient capital usage: Funds can be allocated flexibly across different futures trading pairs, maximizing capital efficiency.

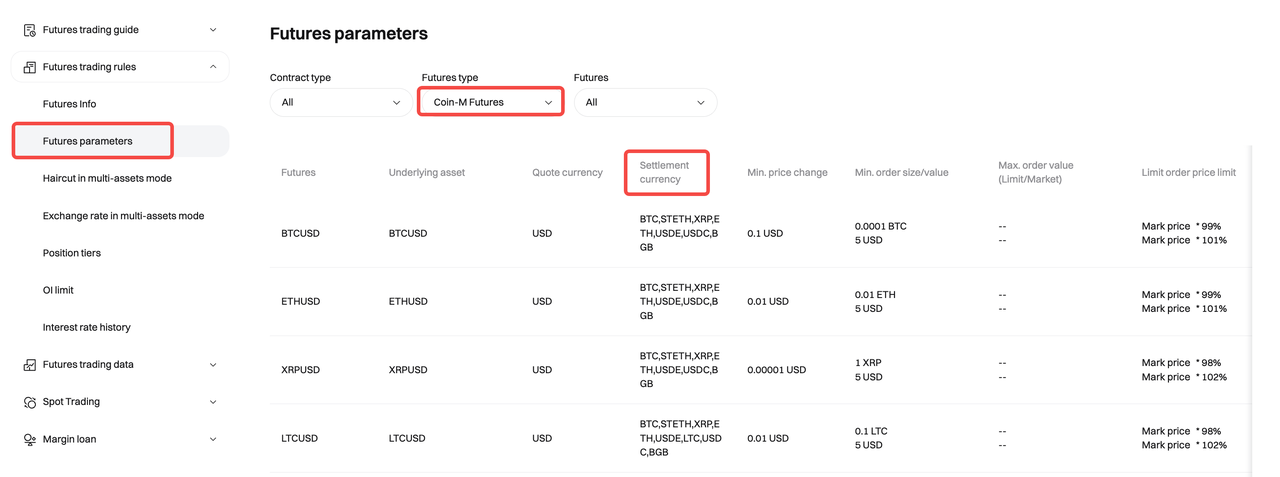

How to view the supported margin assets (settlement currencies)

To learn about which assets are supported as margin for a futures trading pair, follow these steps:

1. Visit the Bitget website and log in to your account.

2. In the top navigation bar, select Coin-M Futures.

3. Find the trading pair you want to trade (e.g., BTCUSD) in the list and click to view the details.

4. In the settlement currencies section, all supported coins will be displayed, such as BTC, ETH, XRP, STETH, USDE, USDC, and BGB.

Risk control rules

To ensure user fund safety and platform stability, Bitget applies the following risk control rules to its cross-asset margin mode for Coin-M Futures.

-

Dynamic conversion and risk monitoring: The system continuously monitors exchange rate fluctuations of supported margin assets and dynamically adjusts the value of margin accordingly. Users must maintain sufficient margin in their account to prevent liquidation due to price swings.

-

Auto-borrowing: If the margin is insufficient to support current positions, the system allows auto-borrowing. Supported assets for adding margin include USDC and BGB.

-

Auto-deleveraging (ADL): During extreme market volatility, or when your margin ratio falls below the maintenance requirement, the system may trigger auto-deleveraging, prioritizing the closure of high-risk positions to reduce overall account exposure.

-

Liquidation: If your margin ratio drops below the liquidation threshold, the system will automatically close all or part of your positions to prevent further losses. You will be reminded via email or site messages to add margin before liquidation is triggered. To avoid unnecessary risks, regularly monitor your margin ratio and set appropriate take-profit and stop-loss targets.

FAQs

1. What is cross-asset margin in Bitget Coin-M Futures?

Cross-asset margin allows you to use multiple major cryptocurrencies as margin to trade any Coin-M Futures pair, without holding the base currency of the contract.

2. How does cross-asset margin differ from traditional Coin-M Futures margin?

Traditional Coin-M Futures require margin in the same currency as the trading pair, whereas cross-asset margin lets you use a single asset across multiple trading pairs, improving flexibility and capital efficiency.

3. What risk control measures apply to cross-asset margin?

Risk controls include dynamic conversion and risk monitoring, auto-borrowing, auto-deleveraging (ADL) during extreme volatility, and liquidation if your margin ratio falls below the required threshold.

4. What should users be aware of when trading with cross-asset margin?

Users must maintain sufficient margin to prevent liquidation, monitor margin ratios regularly, and set appropriate take-profit and stop-loss targets to manage risk effectively.

Disclaimer and Risk Warning

All trading tutorials provided by Bitget are for educational purposes only and should not be considered financial advice. The strategies and examples shared are for illustrative purposes and may not reflect actual market conditions. Cryptocurrency trading involves significant risks, including the potential loss of your funds. Past performance does not guarantee future results. Always conduct thorough research, understand the risks involved. Bitget is not responsible for any trading decisions made by users.

Join Bitget, the World's Leading Crypto Exchange and Web3 Company

Bagikan