After six years riding the stablecoin wave, he sees the prototype of the future of payments.

Interview: Jack, Kaori

Editor: Sleepy.txt

This year is destined to go down in financial history as the "Year of Stablecoins," and the current buzz may just be the tip of the iceberg. Beneath the surface lies an undercurrent that has been building for six years.

In 2019, when Facebook's stablecoin project Libra shocked the traditional financial world like a depth charge, Raj Parekh was at the eye of the storm at Visa.

As the head of Visa's cryptocurrency division, Raj personally experienced the psychological shift of this traditional financial giant from hesitation to participation. It was a moment without consensus.

At that time, the arrogance of traditional finance coexisted with the immaturity of blockchain. Raj's experience at Visa painfully exposed him to the industry's invisible ceiling. It wasn't that financial institutions didn't want to innovate, but rather that the infrastructure at the time simply couldn't support "global payments."

With this pain point in mind, he founded Portal Finance, attempting to build better middleware for crypto payments. However, after serving a large number of clients, he found that no matter how much the application layer was optimized, the underlying performance bottleneck remained the ceiling.

Eventually, the Portal team was acquired by Monad Foundation, with Raj taking the helm of the payment ecosystem.

In our view, he is uniquely qualified to review this experiment in efficiency, as he understands both the business logic of stablecoin applications and the underlying mechanisms of crypto payments. No one is better suited than him.

Not long ago, we spoke with Raj about the development of stablecoins in recent years. We needed to clarify what is driving the current stablecoin boom—is it regulatory boundaries, the entry of industry giants, or the more practical considerations of profit and efficiency?

More importantly, a new industry consensus is forming—stablecoins are not just assets in the crypto world, but could become the infrastructure for the next generation of settlement and capital flows.

But questions follow: How long will this heat last? Which narratives will be disproved, and which will become long-term structures? Raj's perspective is valuable because he is not a bystander, but someone who has always been in the thick of it.

In Raj's account, he refers to the development of stablecoins as the "email moment" for money—a future where capital flows are as cheap and instantaneous as sending information. But he also candidly admits that he hasn't fully figured out what this will give rise to.

The following is Raj's account, organized and published by Beating:

Problem-First, Not Technology-First

If I had to pinpoint a starting point for all this, I think it would be 2019.

At that time, I was at Visa, and the atmosphere in the entire financial industry was very subtle. Facebook suddenly launched the Libra stablecoin project. Before that, most traditional financial institutions viewed cryptocurrencies either as toys for geeks or as speculative tools. But Libra was different—it made everyone realize that if you didn't take a seat at this table, you might not have a place in the future.

Visa was one of the first publicly listed partners of the Libra project. Libra was very special at the time; it was an early, large-scale, and ambitious attempt that brought many different companies together around blockchain and crypto for the first time.

Although the final result did not materialize as everyone initially expected, it was indeed a very important watershed event. It made many traditional institutions take crypto seriously for the first time, rather than seeing it as a fringe experiment.

Of course, this was followed by tremendous regulatory pressure, and later, Visa, Mastercard, Stripe, and other companies withdrew in October 2019.

But after Libra, not only Visa, but also Mastercard and other Libra members began to formalize their crypto teams more systematically. On one hand, this was to better manage partners and relationship networks; on the other, it was to truly build products and elevate them to a more holistic strategy.

My career actually started at the intersection of cybersecurity and payments. In the first half of my time at Visa, I was mainly building a security platform to help banks understand and respond to data breaches, vulnerability exploitation, and hacker attacks—the core was risk management.

It was during this process that I began to understand blockchain from the perspective of payments and fintech, and I always saw it as an open-source payment system. The most shocking thing was that I had never seen a technology that could move value at such high speed, circulating globally 24/7 without stopping.

At the same time, I also saw very clearly that Visa's underlying system still relied on the banking system, on mainframes, and on relatively old technology stacks like wire transfers.

For me, an open-source system that could also "move value" was very attractive. My intuition was simple: the infrastructure that systems like Visa depend on would likely be gradually rewritten by blockchain systems in the future.

After the Visa Crypto team was established, we didn't rush to promote technology. This team was one of the smartest and most hands-on builders I've ever seen. They understood both traditional finance and payment systems, and had deep respect and understanding for the crypto ecosystem.

After all, the crypto world has a strong "community attribute." If you want to succeed here, you have to understand and integrate into it.

Visa is a payment network, so we had to focus a lot of energy on empowering our partners, such as payment service providers, banks, fintech companies, and on identifying efficiency issues in our cross-border settlement processes.

So our approach wasn't to push a certain technology onto Visa, but rather to identify real internal problems at Visa first, and then see if blockchain could solve them at certain points.

If you look at the settlement chain, you'll see a very intuitive problem: since capital flows are T+1 or T+2, why can't we achieve "second-level settlement"? If we could, what would it bring to treasury and capital teams? For example, banks close at 5 p.m., but what if the treasury team could initiate settlements at night? Or what if settlements could happen seven days a week, instead of not at all on weekends?

This is why Visa later turned to USDC—we decided to use it as a new settlement mechanism within the Visa system, truly integrating it into Visa's existing system. Many people may not understand why Visa would test settlements on Ethereum. In 2020 and 2021, this sounded crazy.

For example, Crypto.com is a major client of Visa. In the traditional settlement process, Crypto.com had to sell its crypto assets every day, convert them to fiat, and then wire the money to Visa via SWIFT or ACH.

This process was extremely painful, starting with time—SWIFT is not real-time, and there is a T+2 or even longer delay. To ensure settlements were not defaulted, Crypto.com had to lock up a large amount of collateral in the bank—this is the so-called "pre-funding."

This money could have been used to generate returns through business, but instead it just sat idle on the books to cope with the slow settlement cycle. We thought, since Crypto.com's business is built on USDC, why not settle directly in USDC?

So we approached Anchorage Digital, a federally licensed digital asset bank. We initiated the first test transaction on Ethereum. When that USDC was transferred from Crypto.com's address to Visa's address at Anchorage, and final settlement was completed within seconds, it was a truly amazing feeling.

The Infrastructure Gap

The experience of doing stablecoin settlements at Visa made me painfully aware of one thing: the industry's infrastructure was far from mature.

I've always understood payments and capital flows as a "completely abstracted experience." For example, when you buy coffee at a café, the user just swipes the card, completes the transaction, and gets the coffee; the merchant gets the money—it's that simple. The user doesn't know how many steps happen underneath: communicating with your bank, interacting with the network, confirming the transaction, completing clearing and settlement... all of this should be completely hidden and invisible to the user.

I see blockchain the same way. It is indeed a great settlement technology, but ultimately it should be abstracted away through infrastructure and application-layer services so that users don't need to understand the complexity of the chain.

This is why I decided to leave Visa and found Portal—to build a developer-facing platform that allows any fintech company to integrate stablecoin payments as easily as connecting to an API.

Honestly, I never envisioned Portal being acquired. For me, it was more of a sense of mission—I saw "building open-source payment systems" as my life's work.

I thought that if I could make on-chain transactions easier to use, and truly bring open-source systems into everyday scenarios, even if I played only a small role, it would still be a huge opportunity.

Our clients included traditional remittance giants like WorldRemit, as well as many emerging neobanks. But as our business deepened, we fell into a strange cycle.

Some might ask, why not build applications at the time, but instead focus on infrastructure? After all, many people now complain that "too much infrastructure has been built, but there aren't enough applications." I think this is actually a cyclical issue.

Generally, better infrastructure comes first, which then gives rise to new applications; as new applications emerge, they in turn drive the next round of new infrastructure. This is the "application-infrastructure" cycle.

At the time, we saw that the infrastructure layer was still immature, so I thought it made more sense to start from infrastructure. Our goal was to run on two tracks: on one hand, to cooperate with large applications that already had distribution, ecosystems, and trading volume; on the other, to make it very easy for early-stage companies and developers to get started.

To pursue performance, Portal supported various chains such as Solana, Polygon, and Tron. But after all the twists and turns, we always came back to the same conclusion: the EVM (Ethereum Virtual Machine) ecosystem has too strong a network effect—developers are here, and liquidity is here.

This creates a paradox: the EVM ecosystem is the strongest, but it's too slow and expensive; other chains are faster, but the ecosystem is fragmented. We thought, if one day there could be a system that is both EVM-compatible and high-performance with sub-second confirmation, that would be the ultimate answer for payments.

So in July this year, we accepted Monad Foundation's acquisition of Portal, and I began to lead the payments business at Monad.

Many people ask me, isn't there already an oversupply of public chains? Why do we need new ones? The question itself may be wrong—it's not "why do we need new chains," but "have existing chains really solved the core problems of payments"?

If you ask those who are actually moving large amounts of capital, they'll tell you that what matters most isn't how new the chain is or how good the story is, but whether the unit economics make sense. What is the cost per transaction? Can confirmation times meet business needs? Is there enough liquidity between different forex corridors? These are all very real issues.

For example, sub-second finality sounds like a technical metric, but it actually translates to real money. If a payment takes 15 minutes to confirm, it's commercially unusable.

But that's not enough—you also need to build a huge ecosystem around the payment system: stablecoin issuers, on/off-ramp service providers, market makers, liquidity providers—none of these roles can be missing.

I often use an analogy: we are at the email moment for money. Remember when email first appeared? It didn't just make letter writing faster; it allowed information to reach the other side of the world in seconds, fundamentally changing human communication.

I see stablecoins and blockchain the same way—this is an unprecedented ability in human civilization to move value at internet speed. We haven't even fully figured out what it will give rise to—it could mean a reshaping of global supply chain finance, or remittance costs dropping to zero.

But the most critical next step is for this technology to be seamlessly integrated into YouTube, into every daily app on your phone. When users can't feel the presence of blockchain but enjoy internet-speed capital flows, that's when we've truly begun.

Generating Yield in Circulation: The Evolution of the Stablecoin Business Model

In July this year, the United States signed the GENIUS Act, and the industry landscape is undergoing subtle changes. The moat that Circle once built is beginning to fade, and the core driver behind this is a fundamental shift in the business model.

In the past, early stablecoin issuers like Tether and Circle had a very simple and direct business logic: users deposited money, the issuers bought US Treasuries with it, and all the interest income went to the issuer. This was the first phase of the game.

But now, if you look at new projects like Paxos and M0, you'll see the rules have changed. These new players are starting to pass the interest income generated by underlying assets directly to users and recipients. This isn't just a change in profit distribution—I think it actually creates a new financial primitive we've never seen before—a new form of money supply.

In traditional finance, money in the bank only earns interest when deposits are idle. Once you start transferring or paying, the money in transit usually doesn't earn interest.

But stablecoins break this limitation. Even when funds are circulating, being paid, or traded at high speed, the underlying assets continue to generate interest. This opens up a whole new possibility—no longer just earning interest while idle, but also while in motion.

Of course, we're still in the very early experimental stage of this new model. I've also seen some teams trying even more radical approaches, managing large-scale US Treasuries behind the scenes, and even planning to pass 100% of the interest to users.

You might ask, so how do they make money? Their logic is to profit from other value-added products and services built around stablecoins, rather than from the interest spread.

So, although this is just the beginning, after the GENIUS Act, the trend is very clear: every major bank and fintech company is seriously considering how to join this game. The future stablecoin business model will definitely not stop at simply earning interest on deposits.

Besides stablecoins, new types of crypto banks have also received a lot of attention this year. Based on my past experience in payments, I think there is a core difference between traditional fintech and crypto fintech.

The first generation of fintech companies, like Nubank in Brazil or Chime in the US, were essentially built on their local banking infrastructure. Their underlying systems depended on the local banking system. This inevitably limited their service scope—they could basically only serve local users.

But when you build products based on stablecoins and blockchain, the situation changes completely.

You are actually building products on a global payment rail—something we've never seen in financial history. The change is disruptive: you no longer need to be a fintech company for a single country. From day one, you can build a global new bank for multi-country or even global users.

This is what I see as the biggest unlock. In the history of fintech, we've almost never seen this level of global-first from the start. This model is giving rise to a new generation of founders, builders, and products who are no longer limited by geographic boundaries. From the first line of code, their target is the global market.

Agentic Payments and the Future of High-Frequency Finance

If you ask me what excites me most about the next three to five years, it's definitely the combination of AI Agent (Agentic Payments) and High Frequency Finance.

A few weeks ago, we held a hackathon in San Francisco themed around the integration of AI and cryptocurrency. There were a lot of developers on site. For example, one project combined the US food delivery platform DoorDash with on-chain payments. We're already seeing the signs—Agents are no longer limited by human processing speed.

On high-throughput systems, Agents move funds and complete transactions so fast that the human brain may not be able to comprehend it in real time. It's not just about being faster—it's a fundamental shift in workflow: we're upgrading from "human efficiency" to "algorithmic efficiency," and ultimately to "Agent efficiency."

To support this leap from millisecond to microsecond efficiency, the underlying blockchain performance must be strong enough.

At the same time, user account types are merging. In the past, your investment account and payment account were separate, but now the boundaries are blurring.

This is actually a natural product choice, and it's exactly what giants like Coinbase want to do. They want to be your "Everything App"—saving, buying coins, buying stocks, even participating in prediction markets—all in the same account. This way, they can lock users into their ecosystem and not hand over deposits and behavioral data to others.

This is also why infrastructure still matters. Only by truly abstracting away the crypto underpinnings can DeFi trading, payments, and yield generation all be stacked into a unified experience, with users barely feeling the underlying complexity.

Some of my colleagues have deep high-frequency trading backgrounds and are used to doing large-scale trades on CME or stock exchanges with ultra-low latency systems. But what excites me is not continuing to trade, but transferring this rigorous engineering capability and algorithm-driven decision-making into everyday financial workflows in the real world.

Imagine a finance manager handling multinational funds, dealing with large sums scattered across different banks and involving multiple forex pairs. In the past, this required a lot of manual scheduling, but in the future, with LLMs and high-performance public chains, the system can automatically conduct large-scale algorithmic trading and fund allocation behind the scenes, allowing the entire capital management operation to earn more returns.

Abstracting the capabilities of "high-frequency trading" and transferring them to more real-world workflows—this is no longer the exclusive domain of Wall Street, but allows algorithms to optimize every cent of a business at high speed and scale. This is the truly exciting new category for the future.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

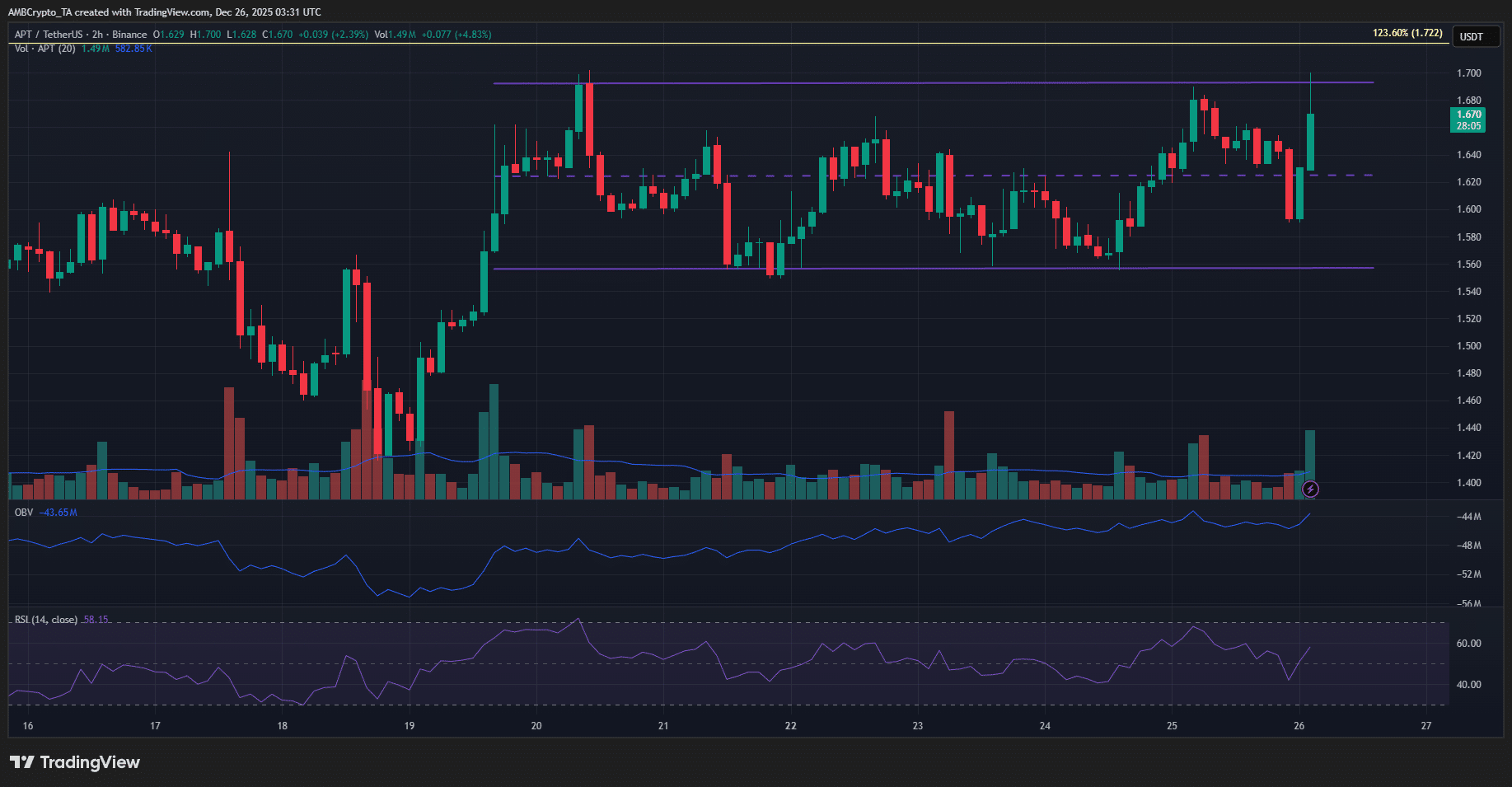

Can Bitcoin’s momentum push Aptos towards the $2-level?

Dialogue with Xie Jiayin: I have ambition, and Bitget has ambition too

3 days until TGE, what other cards does Lighter have up its sleeve?

Trust Wallet Faces Major Security Breach with Chrome Extension Update